World Bank December 2024 Report Suggests Cambodian Reforms In Diversifying Trade and Improving Productivity

The latest World Bank Cambodia Economic Update: From Recovery to Resilience: Harnessing Tourism and Trade as Drivers of Growth, was released on December 12, 2024, and although it highlighted steady economic growth, it recommends that diversification of trade and improved productivity are needed. The comprehensive report covers a range of industries and sectors with recommendations for each.

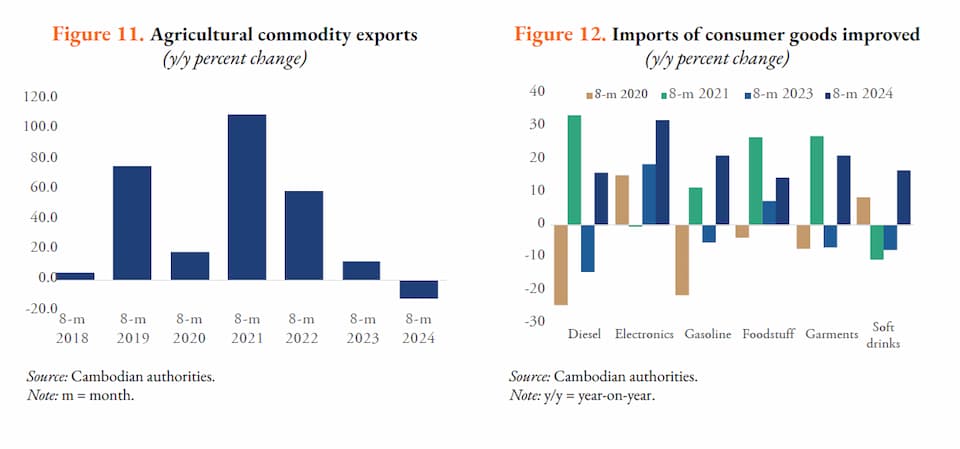

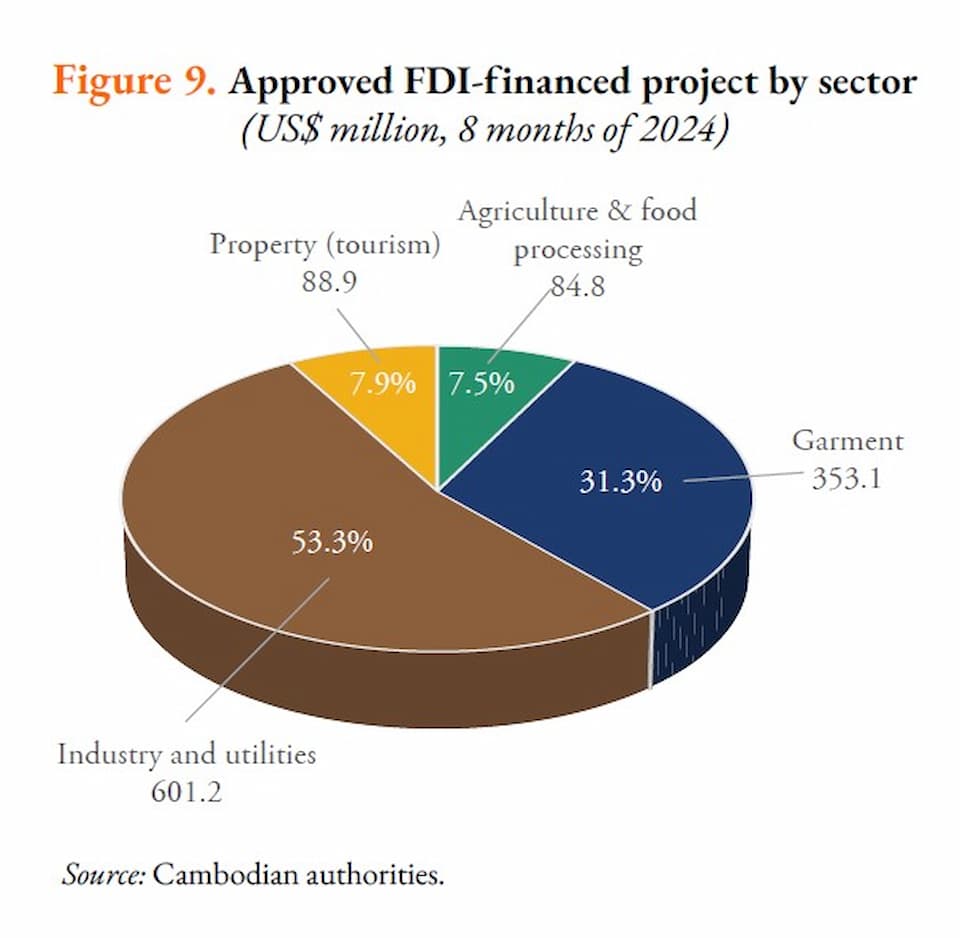

According to the World Bank, Cambodia in 2024 saw a revival in exports, but there were uneven performances across sectors and economic growth is projected to reach 5.3 percent in 2024. The main economic catalysts have been an increase in manufacturing exports, as well as a partial recovery in tourism and continued foreign investment.

They predict only marginal growth in the coming years with real GDP growth projected to reach 5.5 per cent in 2025 and 2026.

World Bank Country Manager for Cambodia, Tania Meyer said "Cambodia can further boost its growth by diversifying trade and improving productivity. Investing in human capital, in particular education, and deepening reforms to improve the business environment will be key to enable the private sector to create more and better jobs”.

World Bank also argues that domestic consumption is hindered by credit growth and high household debt - and certainly, when we hear from SMEs in Cambodia, 2024 does seem to have been a challenging year. On the positive side, exports have increased and Cambodia has experienced improvements in goods exports to all major markets.

Tourism is Recovering But Not to The 2019 Levels

The World Bank report added that in terms of tourism, which remains one of the four core pillars of the Kingdom's economy, international tourist arrivals have reached pre-COVID-19 levels but the average tourist spending remains much lower than it was in 2019. One of the reasons is the fewer arrivals from high-spending countries but Siem Reap still lags far behind the 2019 levels too.

We have seen this reporting of data for 2024 expected to surpass 2019 levels over recent weeks but even the data from VINCI Airports suggests that although 2024 levels are up compared to 2023, year to date, they still lag 2019 numbers by as much as 38 per cent according to their records.

The World Bank report says of tourism in Siem Reap: "During the first eight months of 2024, total international tourist arrivals to Siem Reap were significantly lower than in 2019, reaching only 23.2 per cent of the 2019 level. International arrivals to Siem Reap reached 0.4 million, accounting for 9.0 percent of the total during the first eight months of 2024, compared to 1.67 million or 38.5 per cent of the total during the same period in 2019."

What Does the World Bank Recomend for Cambodia

The World Bank says there is a need to “build on ongoing improvements in fiscal management, with reforms that boost domestic revenue mobilisation a top priority to support social spending and public investment.”

It also suggests:

- Diversify Exports - Cambodia needs to diversify its exports of both goods, especially manufactured and processed agricultural products, and services, particularly travel and hospitality, in order to reduce vulnerability to external shocks.

- Improving Productivity - Cambodia can improve productivity to sustain economic growth and achieve its vision of becoming a high-income country by 2050. Investment in education and workforce training will improve productivity and competitiveness.

- Tourism Diversification - The Kingdom should offer new offerings to attract visitors from high-spending markets and enhance tourist spending (We feel this is also strongly linked to offering direct routes to new destinations such as in Europe, Australia, and the US)

- Business Development - There is a need to accelerate structural transformation, promote modernization and digitalisation, and address critical business environment challenges.

The ongoing infrastructure developments are seen as a positive, with World Bank stating, “The travel, transport, and logistics industry should benefit from strong private investment in several key infrastructure projects, such as a newly built expressway linking Phnom Penh to Sihanoukville, where a deep-sea port is located; new logistics complex and multimodal port development projects in Kampot and Phnom Penh; and a new expressway project linking Phnom Penh to Bavet, on the Cambodia-Vietnam border, among others.”

Fiscal Changes Proposed for Cambodia

On the fiscal side, there are still challenges. The report adds that due to slow revenue collection there will be less impact social spending and basic education and health services unless fiscal space is restored in the short term.

Suggestions include:

- Pandemic-induced fiscal interventions and tax incentives should be discontinued.

- Stricter governance of tax incentives should minimise the unnecessary revenue losses they may cause. Being able to track, manage, and control tax expenditures within medium-term fiscal and budgetary decision-making is particularly important. this maybe why digitalisation is so key.

- Taxes on goods and services should be strengthened by reviewing the VAT rate, exemptions, and zero rating. Introducing ambitious excise tax increases on alcohol and tobacco, benchmarking against good practices in middle-income countries. Introducing a personal income tax should be suggested as a medium-term objective.

- Strengthening spending efficiency or value for money is essential.

There is also a remark on the sheer number of financial institutions in Cambodia, something B2B Cambodia has highlighted previously. World Bank suggests that a period of “consolidation of the financial sector through mergers and acquisitions should help preserve profit margins by improving their efficiency and increasing market share.”

There is a lot of useful data and overviews across a range of sectors in the report – which is available to download for free.