Why Wing Bank Digital Installments (Buy Now Pay Later) Is A Beneficial Financial Tool

Wing Bank has an expanding customer base in Cambodia of nearly nine million, and its assets now exceed USD 2.1 billion. The bank’s services cater to an increasingly digital savvy base, with ‘Buy Now Pay Later Digital Installments’ being one of the many convenient tools available to its loyal customer base.

As Wing Bank strives to innovate and expand, the company is delivering services and products that help build a more prosperous future for Cambodia. Wing Bank provides 11,000+ Wing Cash Xpress agents, 140,000+ merchants, and has partnerships with global financial payment leaders with the goal of transforming banking for every Cambodian.

Buy Now, Pay Later (BNPL) plans are increasingly popular in Cambodia and the percentage of Cambodians who have said they have used a BNPL plan is above the regional average. Customers appreciate the tool as it is a means to support those who might be facing adversity with short-term financing.

This Digital Installments tool from Wing Bank is beneficial for its customers as it allows them to use alternative forms of credit and also helps them build their credit history. There is greater financial stability as the BNPL offers a controlled and transparent repayment plan.

Buy Now, Pay Later In Cambodia – Wing Bank Digital Installments

Wings Bank Digital Installments is a convenient financial tool that lets customers repay in parts over weeks or months, making it an excellent method for handling money movement and preventing debt.

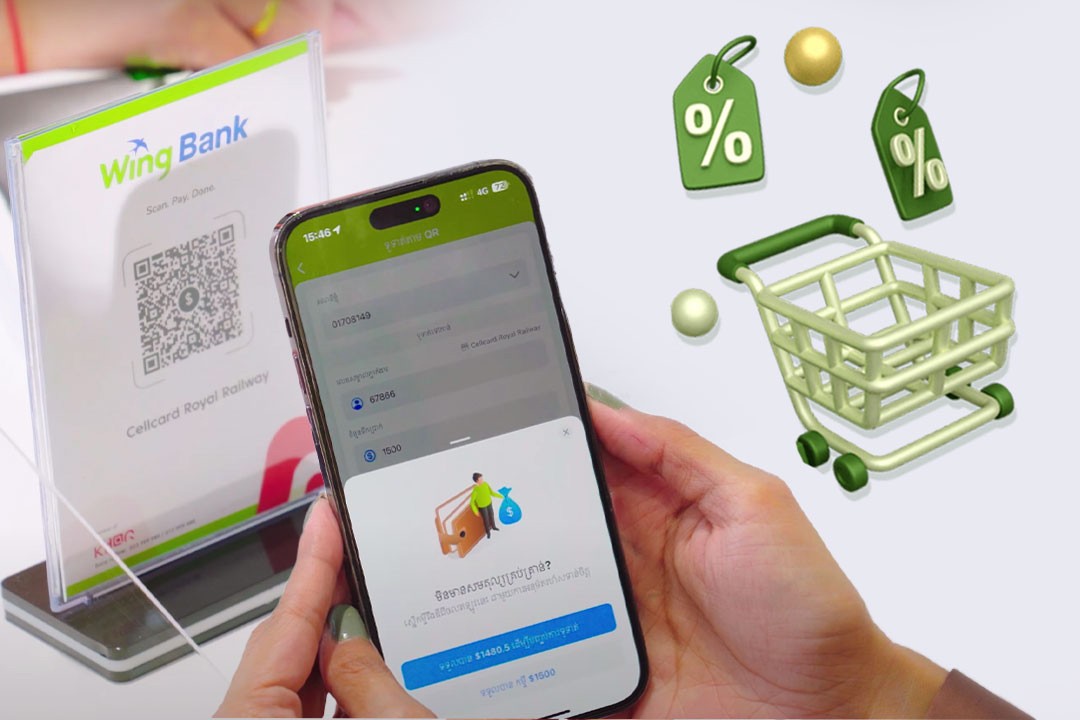

The increasing use of smartphones and convenient banking apps like the Wing Bank app means it is easy to access these services, and an increasing number of Cambodians are now utilising credit to pay for things. This could be used to buy the latest tech gadgets or essential home appliances, and Wing Bank's Digital Instalment provides a hassle-free solution that empowers its customers to shop confidently.

The Digital Installments application process and payments can be easily managed through the Wing Bank app. In addition to the benefits listed below, the service is also tailored to fit each customer’s financial needs and lifestyle.

- There is instant approval via the Wing Bank app.

- There are no upfront deposits required for Wing Bank customers.

- Flexible payment plans are available – clear and straightforward terms with no hidden fees.

- Real-time notifications about your payment status.

Who is Eligible For Wing Bank Digital Installments?

The Wing Bank app will indicate if a customer is eligible for the Digital Installments services. If, for some reason, a customer is not eligible, Wing Bank suggests the following:

- Use the Wing Bank App regularly – frequent use helps build a profile.

- Increase digital payments via the Wing App – use KHQR payments, online bill payments and top-ups, which also provide extra benefits.

- Maintain a higher balance – keeping more funds in a Wing Bank account helps improve eligibility.

- Open a Term Deposit – as well as helping customers save, term deposits also help to increase their chances of becoming eligible for Digital Installments.

This service is part of Wing Bank's goal of pursuing its vision of leveraging digital solutions to enhance the daily lives of every Cambodian, while embracing its "phygital" approach in banking – offering a seamless physical presence, digital innovation and convenient banking solutions that are accessible to every Cambodian, regardless of location.