Tariff Fears Weigh on Cambodia’s $13.6B Garment Sector, but Factories Hold Firm on Outlook

Cambodia’s export-led garment, footwear and travel goods (GFT) sector is facing mounting risks from tariff uncertainty and shifting buyer behaviour, according to a new survey by Better Factories Cambodia (BFC).

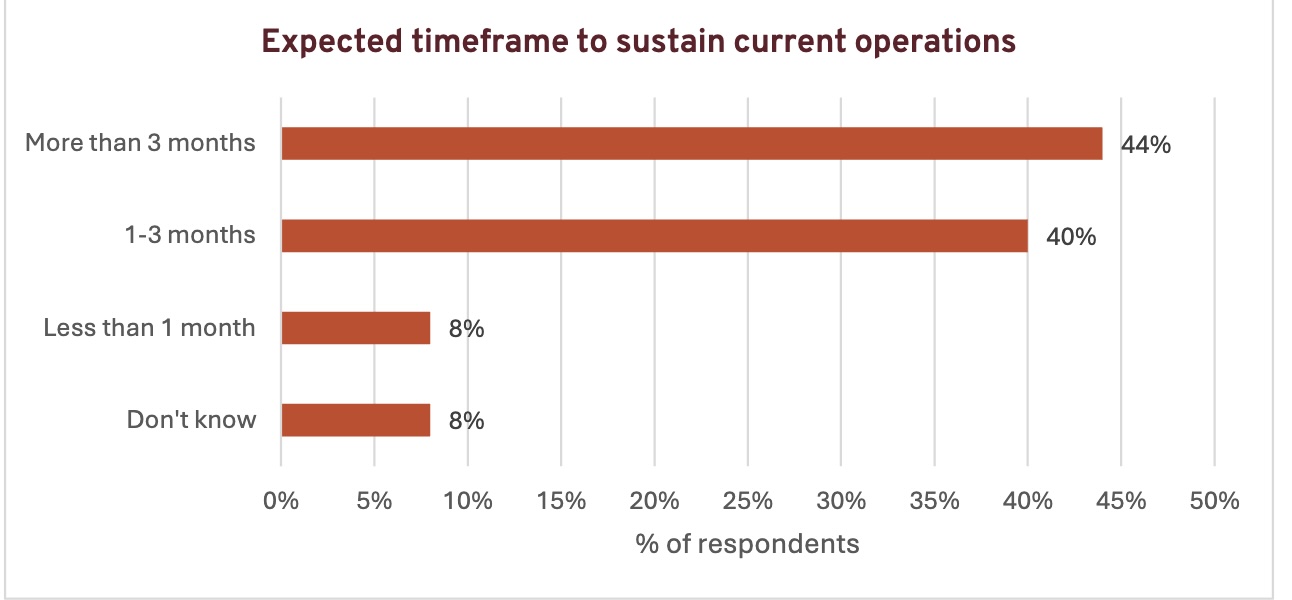

Nearly half of the factories that participated in the survey reported they may not be able to sustain operations beyond the next three months under current order conditions, highlighting the sector’s exposure to external shocks. Despite these challenges, 65 per cent of factories remain optimistic about their short-term outlook.

Key Economic Pillar Under Strain

The GFT sector generated USD 13.6 billion in exports in 2024, providing 918,000 formal jobs, and serving as a critical engine of Cambodia’s economic growth. The sector’s success depends heavily on preferential trade arrangements, particularly with the United States (U.S.) and the European Union (EU)

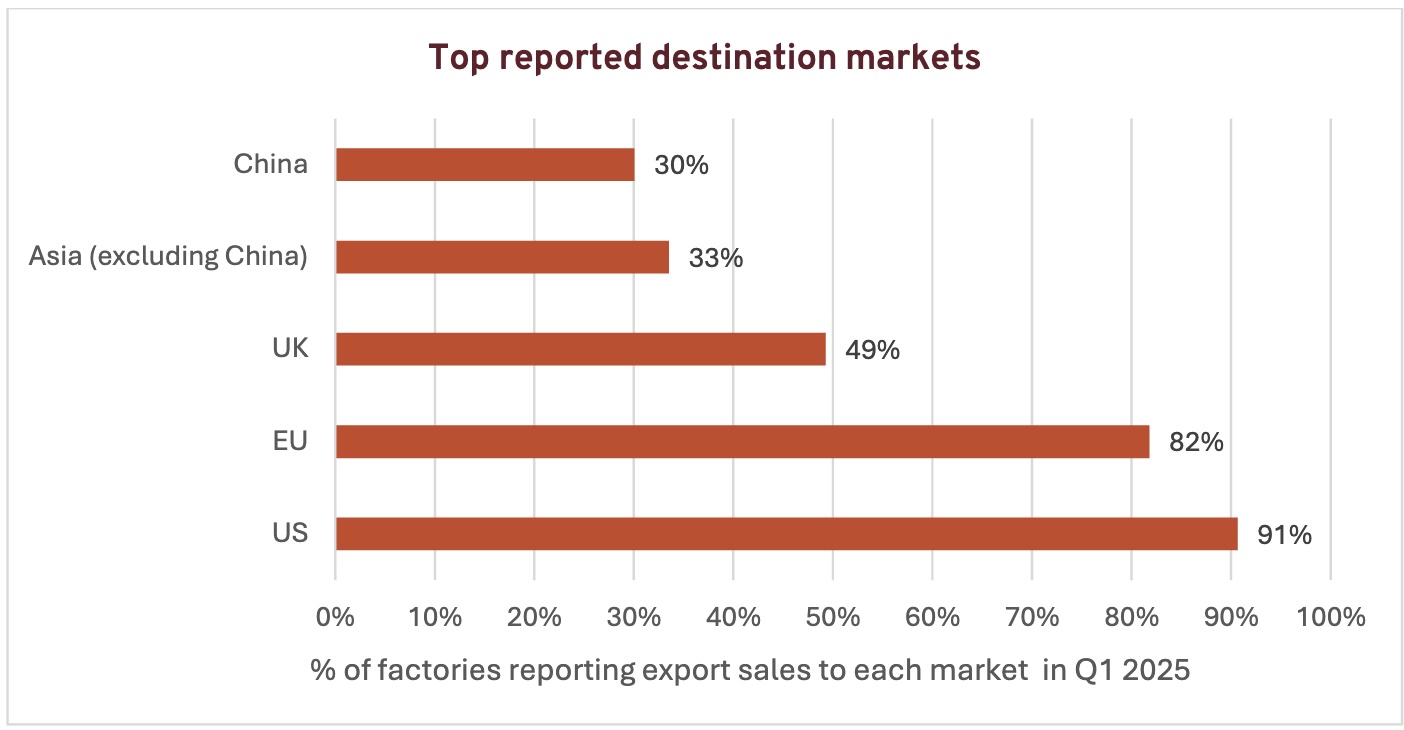

Cambodia is especially reliant on the U.S. market, where 39 per cent of GFT exports go. Among factories exporting to the U.S., over half of their production—51 per cent on average—is tied to this single market.

Factories also rely significantly on the EU, which accounts for 31 per cent of production among relevant exporters.

The report cautioned that any removal of trade preferences, introduction of tariffs, or a downturn in the global economy could threaten the strong export performance seen in recent years.

Orders and Sustainability at Risk

The BFC survey, conducted in late May 2025 with the involvement of 756 registered factories, found that 44 per cent of respondents could only maintain operations for up to three months, based on current orders and access to raw materials. Within this pool, 8 per cent indicated they could operate for less than one month.

While 55 per cent of factories had confirmed orders for the next three to six months, and thirty per cent had orders beyond six months, 15 per cent reported either no confirmed orders, or orders only for the immediate weeks ahead.

Production trends were mixed in the first quarter of 2025 compared to a year earlier. Twenty-six per cent of factories reported increased output, 22 per cent saw a decline, and 42 per cent experienced no significant change.

Rising Buyer Volatility and Price Pressures

Factories also reported increasing pressure from buyers to reduce prices, with 27 per cent of respondents saying customers had requested discounts on 2025 orders. Buyer relationships showed signs of fragility, as over 20 per cent of factories experienced discontinued orders from at least one customer in the first quarter of 2025, while 10 per cent lost multiple buyers.

The report highlighted that tariff fears have contributed to production volatility, with factories reporting cancelled or delayed orders, expedited shipments to avoid potential tariffs, and shifts in manufacturing to other countries.

Labour Shortages Compound Industry Struggles

Labour shortages are another pressing concern. Many factories are struggling to recruit and retain skilled workers, particularly sewers and technicians. Respondents cited growing competition from new factories in provincial areas and a reluctance among relocated workers to return.

These issues have led to high turnover and reduced productivity. Factory managers pointed to the need for better vocational training, improved workplace conditions and more coordinated recruitment strategies to stabilise the workforce.

Coping Strategies and a Glimpse of Optimism

In response to the challenging environment, many factories are adapting by expanding recruitment efforts, offering better benefits, investing in automation and diversifying their customer base. Twenty-six per cent of respondents said they had secured new buyers or business opportunities so far in 2025.

Despite the array of risks—ranging from trade policy shifts to labour shortages—65 per cent of factories expressed optimism about their business prospects over the next three months. BFC attributed this to the sector’s experience in navigating past disruptions, including during the COVID-19 pandemic.

BFC plans to conduct a follow-up survey in the third quarter of 2025 to assess how factories are responding to ongoing trade uncertainty, and to provide fresh insights for industry stakeholders.