Key Takeaways - Cambodia Real Estate Highlights Knight Frank H2 2024 Report

The Cambodian-based Knight Frank property company released its Cambodia Real Estate H2 2024 Highlights report in February, which provides deeper insights across the key property sectors in the Kingdom, covering; Office, Retail, Hotel, Services Apartments, Condos, and Industrial property with a look back at shifting trends from 2024 but also offering insights into expectations until 2028.

As Cambodia is set to continue to benefit from an influx of foreign investment with numerous new companies having entered the market during 2024, certain segments are looking like they are showing signs of recovery while the industrial property sector shows the most positive signs for growth with that trend set to continue into 2025.

Phnom Penh Office Property Sector 2024 Review

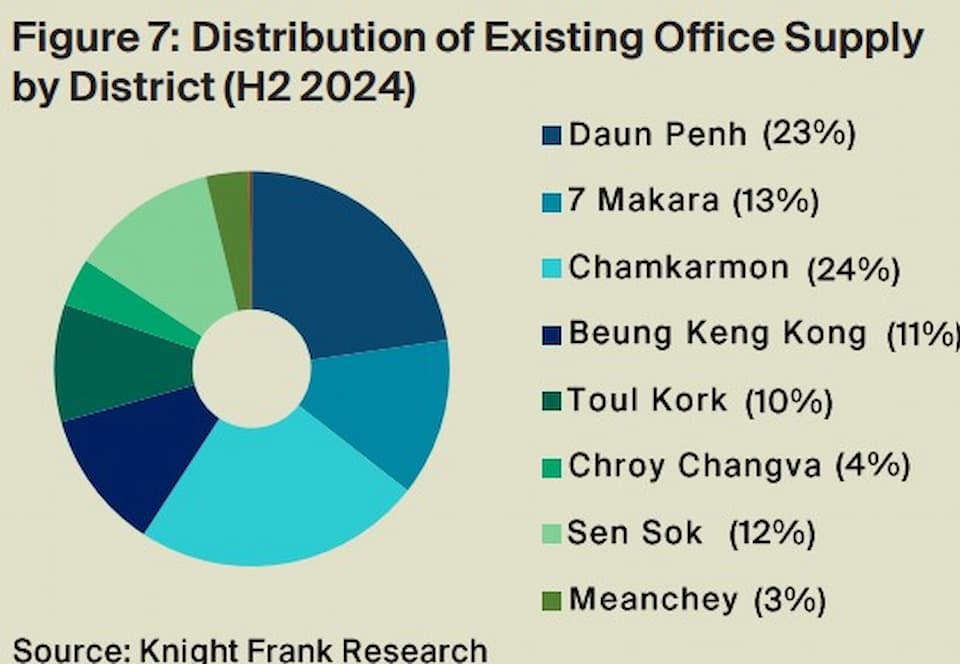

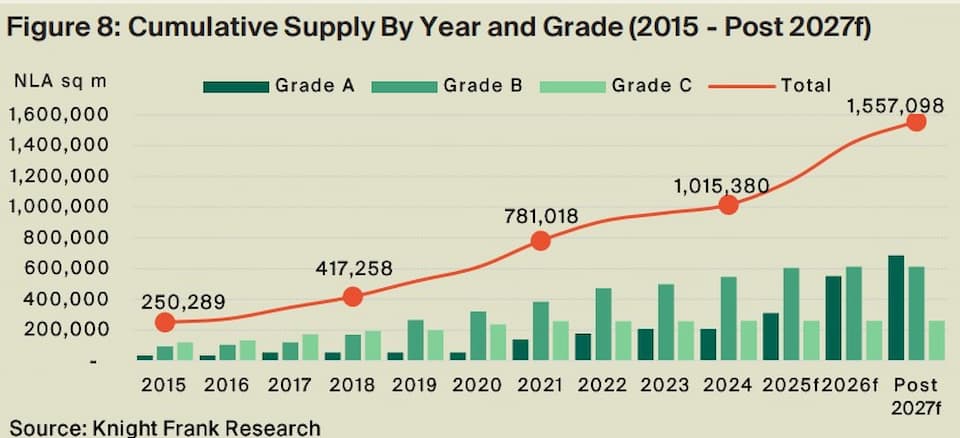

New office completions slowed in 2024 and over the past two years, annual supply growth was recorded at 5.9 per cent in 2023 and 5.5 per cent in 2024 - these are the lowest figures in a decade. The cumulative Phnom Penh office supply at the start of 2025 was 1,015,380 sqm of Net Lettable Area (NLA).

The report indicated the slight increase in new supply meant landlords focussed on retaining existing tenants whilst offering attractive incentives to attract new tenants to boost occupancy rates in 2024.

Overall, the net take-up rate improved during H2 2024 and the overall average Phnom Penh occupancy rate increased by two percentage points y-o-y (year-on-year) compared to 2023.

For H2 2024, three projects added 51,441 square metres of NLA to the existing supply - these were Maline Office Park, Hattha Tower and KLK Tower.

- The office supply in Phnom Penh is 73 per cent centrally owned and 27 per cent stratified offices.

- Phnom Penh's Grade A office stock stood at 234,483 sqm NLA by the end of 2024 - an increase of 42 per cent from 2021.

- Centrally-owned and stratified offices are divided into Grade B (47%), Grade C (29%), Grade A (24%)

- The capital’s CBD still has a dominant market share and a ratio to Suburban supply of 80:20.

The average rent fell in the office property segment with Grade A offices ranging from US $15 to US $25 sqm per month, Grade B from US $10 to US $17 and Grade C starting from US $6 (excluding service charges and taxes).

Predictions 2025-2028

According to the report, the office market is poised for stabilisation in 2025. Knight Frank anticipates that by 2028 the supply is projected to increase to 1,557,098 sqm of net lettable area (NLA), representing a 53 per cent increase from the existing stock at the start of 2025.

In 2025 alone, an additional 158,406 sqm of NLA is expected to be delivered in the office supply, with 249,626 sqm of NLA in 2026 and 133,686 sqm in 2028, combined adding 541,717 sqm to the existing supply.

- Grade-A office supply will dominate the total supply by 2028 with 88 per cent expected to be Grade A, 12% will be Grade B and no plans for additional Grade C office projects in Phnom Penh.

- Construction of several commercial bank HQ buildings in the capital are contributing to this; such as Sathapana Tower, Wing Tower, Hattha Tower with J-Trust Bank (2025) and FTB (2026) coming soon.

Phnom Penh Retail Property Sector 2024 Review

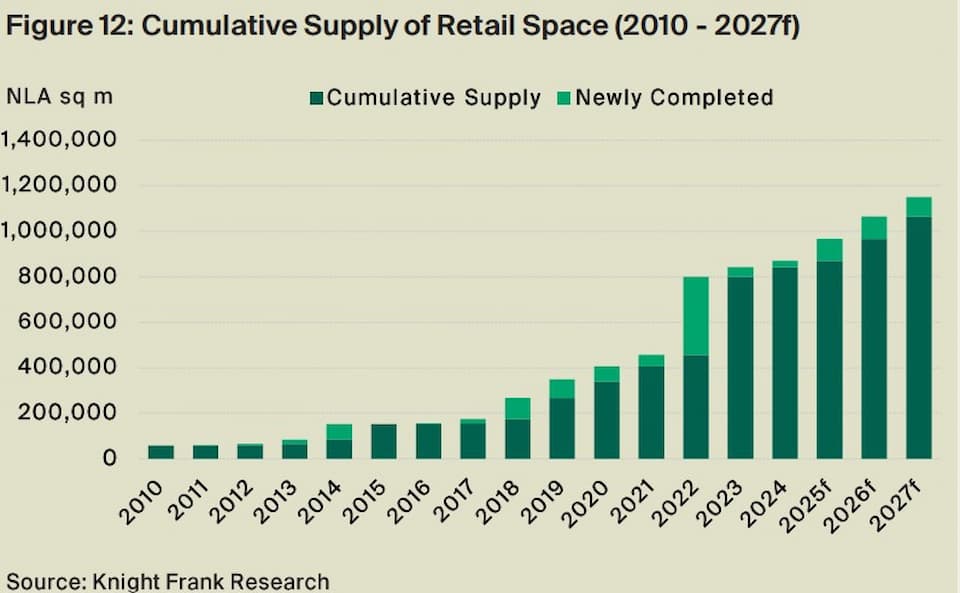

The retail sector in Phnom Penh continued to face challenges in 2024 and landlords were forced to be more flexible as well as diversifying their tenant mix. Notably, no major additional retail developments entered supply in 2024.

- Phnom Penh’s retail supply was 870,520 sqm of net leasable area, distributed across 60 retail malls by the end of 2024.

- Only Riverlight entered supply in H2 2024 in Koh Norea, adding approximately 5,880 sqm NLA.

- Suburban districts accounted for 61 per cent of retail property in the capital - Aeon 2, Aeon 3 and Chip Mong Mega Mall 271 being major contributors.

- The CBD accounts for 39 per cent of the retail space - mainly small-scale neighbourhood centres.

- The overall occupancy rate fell to 64.5 per cent which was, down 3.5 per cent y-o-y.

- Average rents in prime shopping centres ranged from US $18-28.00 per sqm per month of NLA, and rents in secondary-grade retail malls were US $10-22 per sqm per month of NLA.

The existing supply consists of:

- Purpose-built shopping malls (67%)

- Community malls (20%)

- Retail podiums (9%)

- Cash & carry wholesale and strata retail - 2 per cent each.

Predictions 2025-2028

The retail space is estimated to reach approximately 1.2 million sqm of NLA by 2027. Cambodia continues to attract new brands and is emerging as a good opportunity for major F&B retail brands.

However, there is a shift to increased e-commerce due to changing consumer habits which will impact retail occupancy.

Phnom Penh Hotel Property Sector 2024 Review

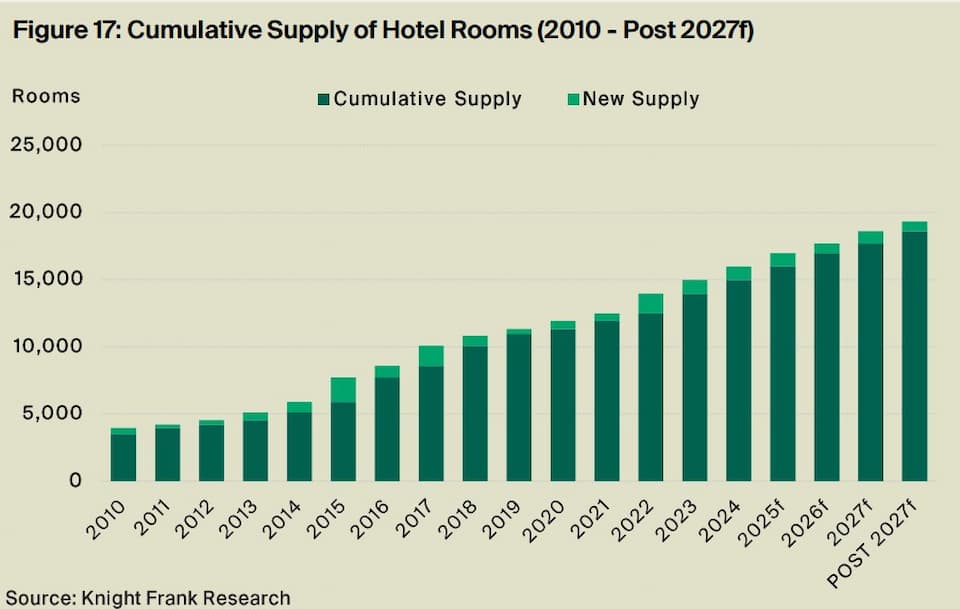

Hotel operators in Phnom Penh are looking to the future potential of the Cambodian tourism sector as numbers are on the rise and new hotels are in the pipeline. 2024 saw the addition of several newly operated hotels which increased the hotel supply by 7 per cent y-o-y and the total keys by the end of 2024 was 15,972.

The mix of hotel supply consists of Midscale and Economy (43%), Upscale (32%), Upper Midscale & Luxury and Upper Upscale (25%).

The report does state that its figures for occupancy rates in 2024 do not match those released by the Ministry of Tourism, which stated that the average hotel occupancy rate increased to 77.8 per cent during 2024.

New additions included:

- The Shangri-La features 303 luxurious 5-star rooms.

- Caravan Hotel by EHM offers 94 rooms.

- WH Hotel with 52 rooms.

- Mahasakor Inn offers 92 rooms.

Predictions 2025-2028

The luxury market in Phnom Penh is experiencing growth, according to the report, and more international brands continue to enter the Kingdom. Phnom Penh will reach 19,300 keys by 2028.

The future hotel supply sees a majority (58%) being Luxury and Upper Upscale, while Midscale and Economy hotels will contribute 22 per cent of the total, and Upscale and Upper Midscale hotels account for 20 per cent.

Upcoming hotel openings include:

- Wyndham Hotels & Resorts is due in 2025 and offers 312 keys.

Phnom Penh Serviced Apartment Property Sector 2024 Review

The report cited an uptick in demand for serviced apartments in the Cambodian capital in 2024. The total existing supply of serviced apartments increased to 8,400 by the end of 2024, reflecting a 2 per cent year-on-year growth.

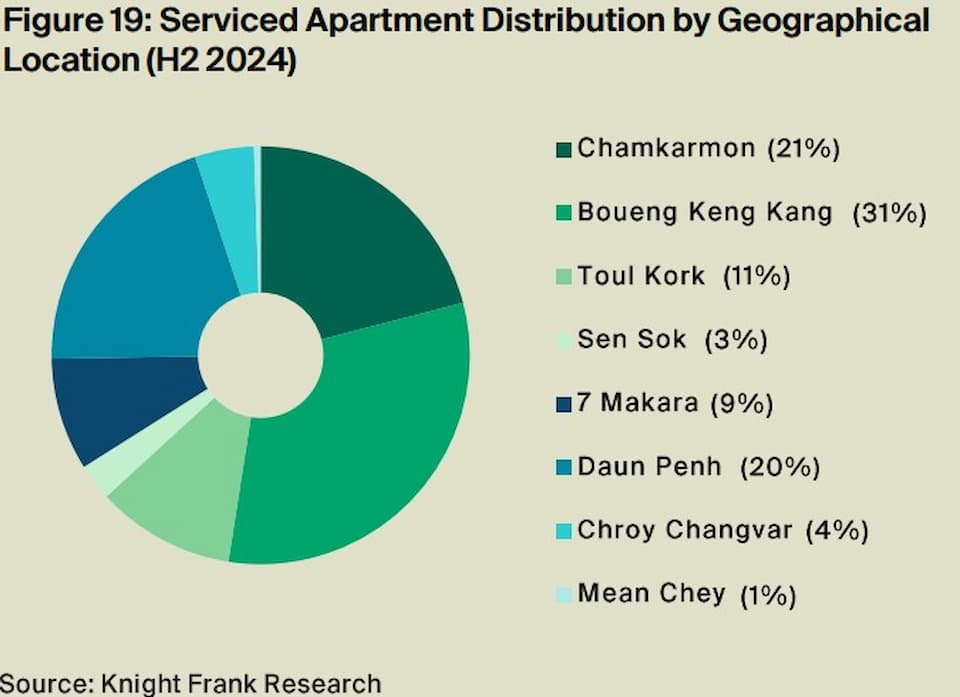

- A majority of serviced apartments (92%) were located in the CBD districts of Phnom Penh with Boueng Keng Kang District having the highest supply at approximately 31 per cent, followed by Chamkarmon District and Daun Penh District, which accounted for 21 per cent and 20 per cent.

- The average overall occupancy rate remained low, at 54 per cent.

Predictions 2025-2028

Future projects include Citadines Vue Aston and Somerset Diamond Bay Gardens among others and the projected future supply is expected to be approximately 1,800 units.

Some of the reasons provided for continued growth are “rising tourism, business travel and a preference for flexible living arrangements among professionals and expatriates.”

- The supply of serviced apartments is projected to reach 10,259 units, indicating a 22 per cent growth by 2027.

- The future supply will predominantly be located in Daun Penh District, accounting for a third of the total.

Phnom Penh Condo Property Sector 2024 Review

Maybe surprisingly, the report suggests there were indications that 2024 showed signs of early stages of a rebound in the condominium market, even if they were considerably lower prices.

A total of 4,606 new units were completed in H2 2024, up from 3,118 units in H1 2024. Most of these were at the Royal Platinum, Wealth Mansion, Anata Residence, Seven Residence and The Pinnacle Residence developments.

There were also several projects due for completion by 2024 which did not and have rolled over into 2025. “Despite the delayed completion, construction progress gathered pace in line with increasing sales performance and many international investors returning to the market.”

The positive performance was due to reputable and mature developers tapping into the domestic market more effectively, while domestic buyers showed increased confidence in the sector and were attracted to the competitive pricing and strategic locations.

- Chamkarmon continued to dominate market share and even increased its dominance in 2024 to 22 per cent.

- New launches in 2024 included; Time Square 8 and Picasso 2 (Picasso Sky Gemme).

- There were 57,772 units across 132 projects by the end of 2024.

- Key factors driving effective market positioning include fair pricing, strategic site selection, a clear target customer focus and thoughtfully designed properties.

Predictions 2025-2028

- Following Chamkarmon District, Mean Chey District and Chroy Changvar District are projected to rank among the top three key contributors to the future supply pipeline.

- Project completions in H1 2025 are projected to add approximately 6,090 units; LIXIN CEO Center, Vue Aston, City View, Urban Village (H Building) etc.

Phnom Penh Landed Housing Property Sector 2024 Review

There was a widespread slowdown in landed housing construction (only 2,063 units were added) but some developers continued to make progress. Projects have started integrating “a stronger sense of community and incorporating well-being themes into their existing nature-inspired infrastructure.”

The total supply of landed housing in Phnom Penh was 93,573 units across 314 projects as of H2 2024. This reflected a 8.2 per cent YoY increase from H2 2023.

Landed property units priced at US $200,000 or below continued to attract the highest level of inquiries and showed improved sales performance.

- Sen Sok led in supply share for landed property and accounted for 20 per cent, followed by Dangkao at 17 per cent and Kamboul at 11 per cent.

- The mid-tier segment experienced the most growth.

- Projects which were completed included; Mekong City (Phase 1), The Prestige Shophouse in Orkide The Botanic City, Dragon Land 598, Prince One Tropica Residence, Golden Park The Natural (Phase 1), B&V Mansion in OCIC Chroy Changvar, Samraong Village (Phase 1), Lay Kong Emerald Residence, Phnom Penh Thmey Radiant Park and a few others.

- Competitive financing options such as a 5% down payment and an interest-free payment schedule extending up to 36 months helped sales.

Predictions 2025-2028

- The completion of landed housing supply in Phnom Penh is projected to increase in 2025 (1,120) and 2026 (930 units).

- From 2026 onward, an estimated 7,600 units are projected to enter the market.

Phnom Penh Industrial Property Sector 2024 Review

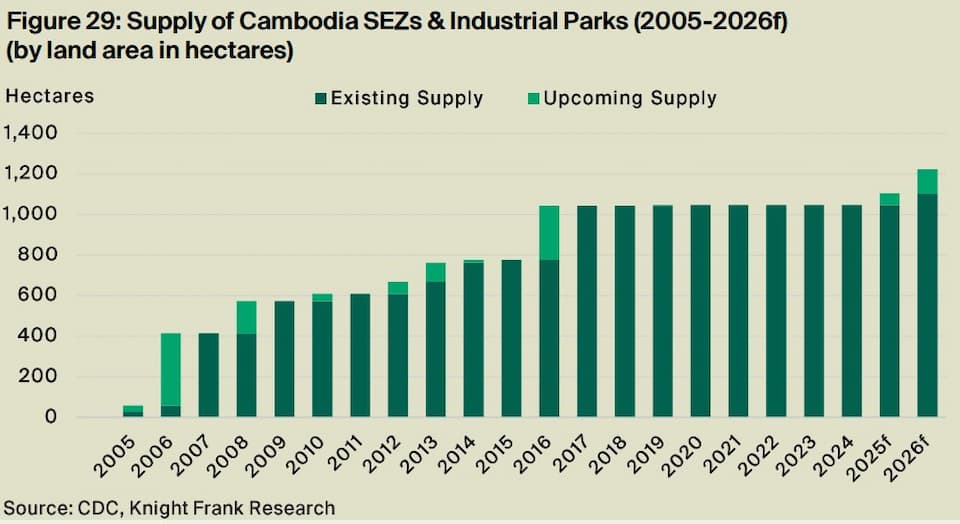

The sector was the strongest performer, and fixed-asset investment was valued at US $6.9 billion, representing a 40 per cent increase compared to 2023, according to data released by the Council for the Development of Cambodia (CDC). The Special Economic Zones (SEZs) in Phnom Penh and surrounding areas continued to attract significant Foreign Direct Investment (FDI).

The average factory rental ranged between US $2.5-3.5 per sqm in Phnom Penh and US $2-3.5 per sqm in Kandal province. The price premium for long-term leasehold land was between US $80-120 per sqm within a leasing period of 50 years.

Predictions 2025-2028

Improvement in Cambodia’s industrial sector is expected to continue into 2025, supported by the surge in manufacturing exports.

According to the World Bank estimation, Cambodia’s industry is expected to grow by 8.6 per cent in 2025, supported by better trends of global demand and higher confidence of investors.