EuroCham Cambodia’s Transport & Logistics (T&L) Committee hosted the Transport and Logistics Forum 2025 on February 12 at the Raffles Hotel Le Royal, providing a platform for private companies in the logistics sector to gain insights from the Ministry of Public Works and Transport (MPWT), and further explore strategies to strengthen Cambodia’s position as a key logistics hub in the sub-Mekong region.

This year’s forum was presided over by H.E. Huot Lyda, Under-Secretary of State at the Ministry of Public Works and Transport (MPWT), and took on a more macroeconomic point of view to exploring how logistics in Cambodia needs to adapt to the current economic challenges the country is facing

“Indeed, logistics remains one of, if not the, major challenges of doing business in Cambodia, in terms of cost, paperwork, relevance to trade in and out of Cambodia, regional connectivity and cross-border trade,” said Tassilo Brinzer, Chairman of EuroCham Cambodia, in his opening remarks.

Brinzer stressed that the Cambodian government is currently working towards transforming the country into an international standard logistics hub in the greater Mekong sub-region. Most recently, on November 29, 2024 the government issued a directive on the determination of Priority Sectors for Public-Private Partnerships Projects (2025-2035), highlighting transport and logistics as one of the top three.

As Cambodia moves out of the list of least developed countries (LDCs), the country must transform its transport and logistics system from what it is today to what it should be in the not-so-distant future.

Improvements In Cambodia’s Transport And Logistics Infrastructure

Suy Bunthan, Chairman of EuroCham Cambodia's T&L Committee and Head of Operations at DHL Express Cambodia, shared some of the main points of progress made in Cambodia regarding its transport and logistics infrastructure, which spans road network development, port upgrades and major investments into mega projects.

Road Network Developments

- Upgrades of National Roads No. 5, No. 6 and No. 3

- Development of multiple expressways, including the launch of the Phnom Penh-Sihanoukville Expressway in 2022, ongoing construction of the Phnom Penh-Bavet Expressway and Phnom Penh-Siem Riep-Poi Pet Expressway, as well as the feasibility study for the Ho Chi Minh City-Moc Bai Expressway connecting Cambodia and Vietnam

Sihanoukville Seaport Upgrade

The Sihanoukville Autonomous Port (PAS) is in the process of upgrade, expansion and modernisation, with the goal of transforming it into a major hub port across three phases by 2029. At completion, PAS will have a 17.5-metre depth container terminal that can allow large cargo ships from the United States and Europe to dock directly without transit elsewhere.

Mega Projects – International Airport And Canal

- The Techo International Airport (TIA), slated to begin its first phase of operations in July 2025, covers 2,600 hectares across Kandal and Takeo provinces and is located approximately 20 km south of Phnom Penh. TIA will accommodate long-haul flights from aircraft such as the Airbus A380-800 and Boeing 747-800. Set to be the ninth largest airport in the world, TIA has significant implications for Cambodia’s pursuit of becoming a regional logistics hub.

- The Funan Techo Canal is a major inland waterway transport project that will connect the Bassac river in Phnom Penh to the sea in Kep province. The 180 km canal is expected to cut shipping costs by potentially 70 per cent and facilitate smoother trade routes, thereby reducing Cambodia’s reliance on neighbouring country ports.

Digital Infrastructure Improvements For Trade Facilitation

Bunthan also mentioned new developments made in improving Cambodia’s digital customs systems for greater trade facilitation, particularly the adoption of ASYHUB for electronic pre-arrival cargo declaration, as mandated under Prakas No. 1447 and No. 788 from the Ministry of Economy and Finance (MEF).

He also mentioned the implementation of the third phase of the Cambodian National Single Window (CNSW) by the General Department of Customs and Excise (GDCE), which has worked towards facilitating trade activities by having a standardised digital system of information and documents under a single entry point for all import, export, and transit-related regulatory requirements in Cambodia.

Watch Suy Bunthan discuss how Cambodia can reduce logistics costs:

Transport And Logistics Challenges In Cambodia

While many developments have been made, Bunthan stressed that there are still challenges that remain concerning the operational efficiencies of cross-border processes, particularly in platform utilisation and paperwork handling.

“Addressing these complexities, especially in moving from physical paperwork to digital, is a real challenge for us in the industry, in both the private sector and the public sector,” said Bunthan. “The main challenge that we see is it creates high operational costs for operators, and also constraints in the infrastructure.”

If we talk about the expressway, it takes us only two hours from Phnom Penh to get to the seaport, but a bottleneck still remains at the seaport because the ecosystem is not yet ready… So what we are talking about is needing the whole ecosystem to support the logistics process to overcome such challenges.

High Cost Of Logistics In Cambodia

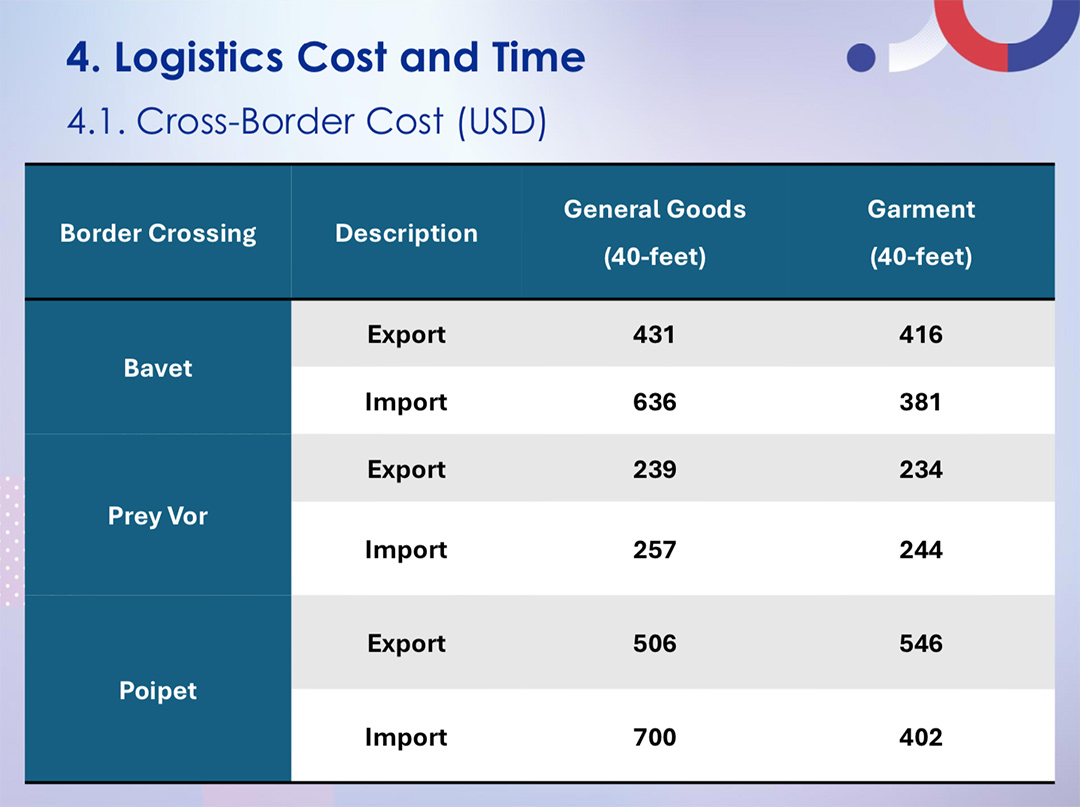

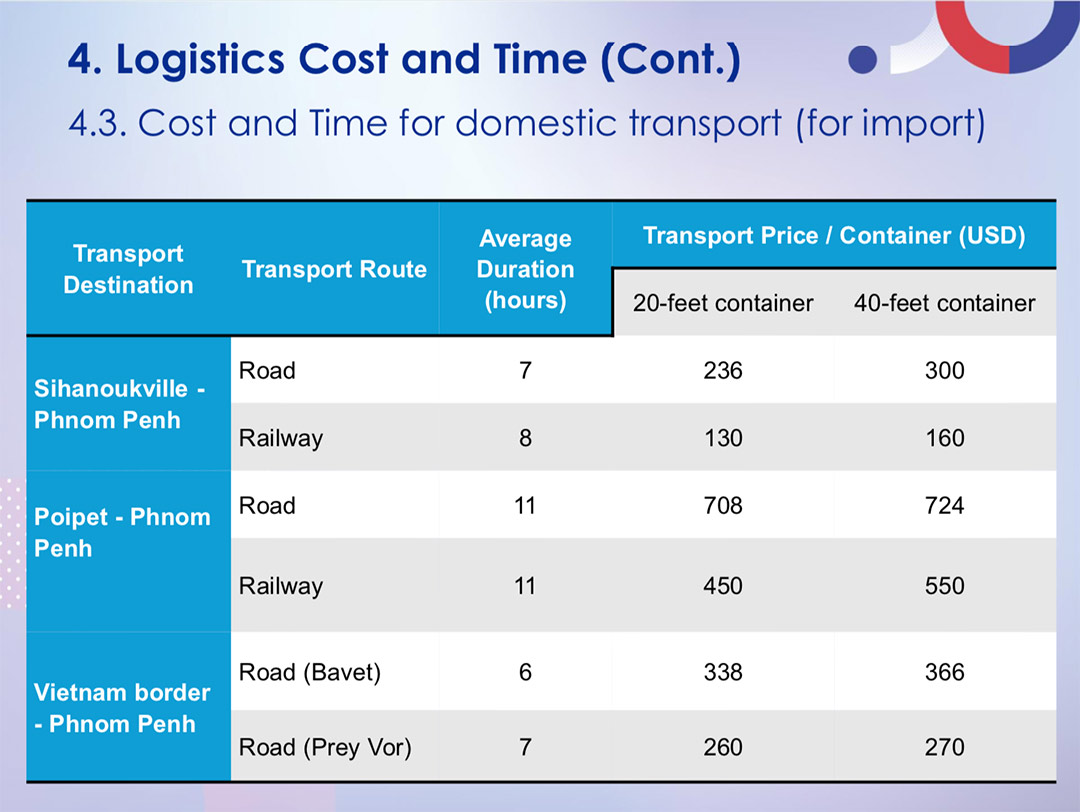

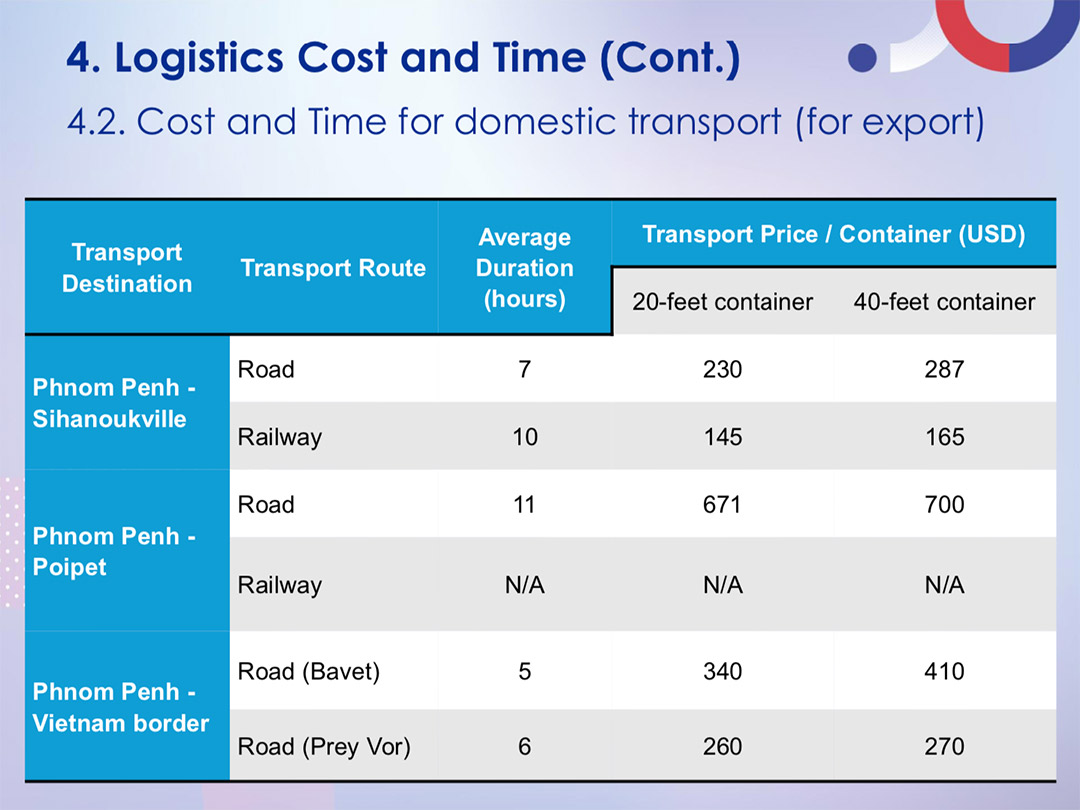

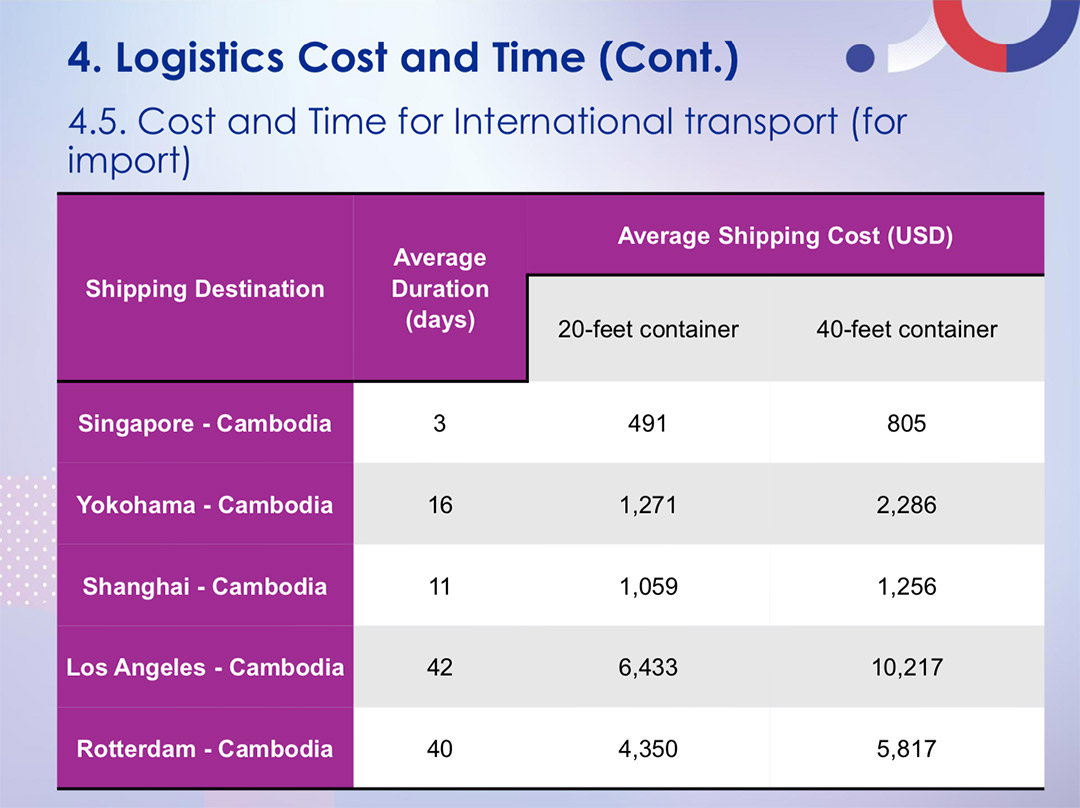

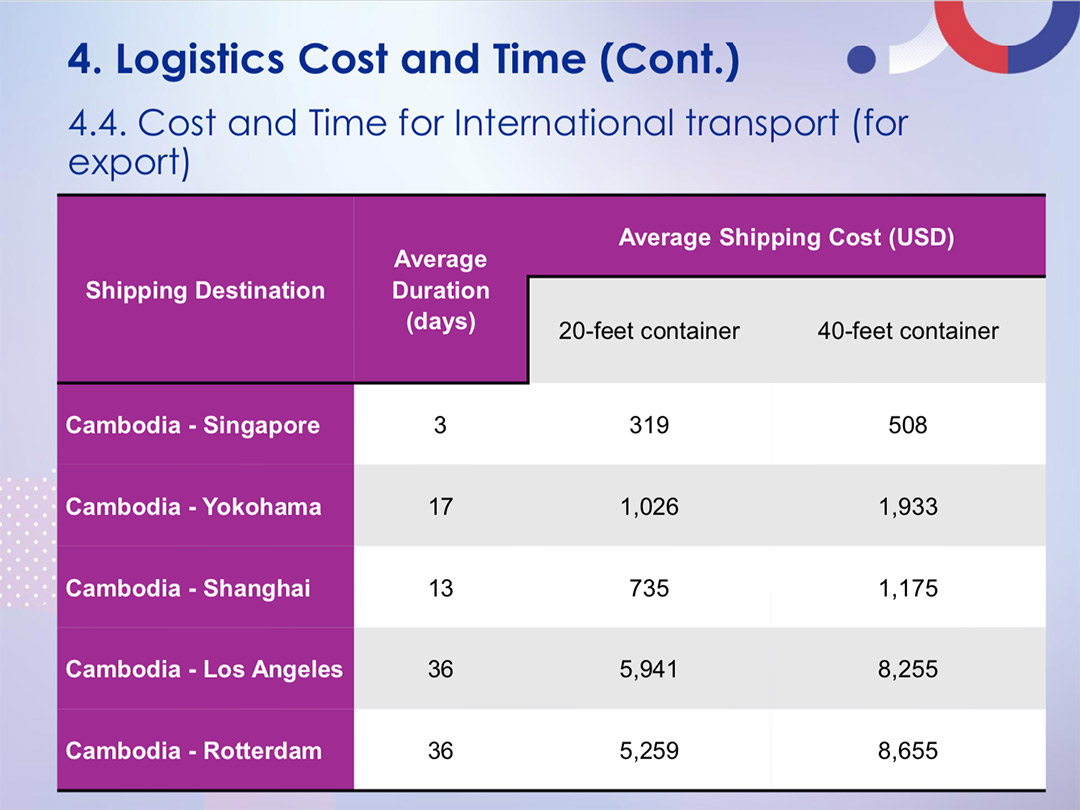

The high cost of logistics was a major challenge repeatedly underlined at the forum. Sor Yilin, Director of the Department of Logistics Monitoring and Evaluation at the MPWT delivered a presentation on the results of a corporate survey conducted by his department in 2023, focused on the cost, time and reliability of logistics services in Cambodia.

“If we review from the first version of our corporate survey until now, there are a lot of significant improvements, particularly in logistics services," said Yilin. “But somehow, compared to the logistics cost of our neighbouring countries, it is still still very high [in Cambodia]. So that is something that the government is trying to figure out while working closely with the private sector.”

The survey broke down the average costs of importing and exporting across different border crossings, as well as the average costs and times for domestic and international transport (see graphs above and below for more details).

However, other speakers at the forum were vocal in pointing out that the numbers presented in the survey do not represent a full picture of the logistics costs in Cambodia and rather only cover the cost of trucking.

“What I saw [in the survey results] is only trucking costs, not logistic costs,” reflected Kaing Monika, Deputy Secretary General at TAFTAC Cambodia, while speaking on a later panel discussion focused on logistics stakes.

I think it's time to call a spade a spade. This is not the full picture of Cambodia’s logistics cost…. the [survey] mentions that trucking costs account for 60 per cent of total [logistics] cost, which I believe is the global average… but I can share with you that in Cambodia, it’s probably just 30 to 35 per cent, not 60 per cent… We have to be transparent and put all these costs in discussion so a solution can be found to seriously address these issues in Cambodia.

Is Cambodia Ready To Become A Major Regional Logistics Hub?

While major infrastructural developments are in progress, other aspects of manufacturing capacity and labour also come into question when considering whether Cambodia is logistically ready to take on a higher volume of import-export activity. External trade forces and shifting global politics have also put Southeast Asia, and Cambodia, in the spotlight for potential manufacturing operation relocations, so now is the time for the country to step up and be ready to receive new market entrants.

“Last year, in 2024, we saw a growth of 23 per cent compared to 2023 [at TAFTAC], and we registered 120 new factories who set up operations in Cambodia, of which about 80 are in the garment sector, while the rest are in footwear, travel good as well as non-garment items,” shared Kaing, adding that some of these new registrations are a result of factories relocating to Cambodia from places like China, Myanmar and Bangladesh due to recent tariffs and political uncertainty in those countries.

“In mainland China right now there is big chaos in manufacturing, especially for those doing business with the U.S., because the current U.S. government has raised tariffs,” Dr. Ben Li, Chairman of the Cambodia Chinese Commerce Association (CCCA), also contributed.

Most manufacturers in China, he added, believe the U.S. won’t stop at just a 10 per cent increase, and that more tariff increases will continue in the coming four years of Donald Trump’s presidency.

Now, most Chinese investors are focusing on Vietnam and Cambodia, and looking at the Cambodian market, tariffs to Europe and the U.S. are even lower than those in Vietnam… When making decisions, [manufacturers] usually think first of tariffs, second about labour costs, and then third about logistics… So what I see in the coming two to four years, while Donald Trump is still president, the [trade] war will keep going, and manufacturers will keep moving from mainland China to Cambodia.

_B2B Cambodia_20250221_144346.jpg)

In terms of workforce and labour supply, Kaing stated that he believes Cambodia should be well-equipped at least up until 2030 due to the country’s young population. On the subject of skills-development, improvements are still needed but the government has been working actively to facilitate skills upgrading through such mechanisms as the Skills Development Fund.

“There's the challenge, as well, of rising labour costs. We know that [Cambodia] has higher labour costs compared to neighbouring countries… like Vietnam, and if you look at just the minimum wage alone, it's equal to more expensive regions… But I think [such costs] can be offset by other factors… like our [favourable] tariffs to destination markets,” said Kaing.

Susanne De Haas, Mekong Head of Supply Chain at Maersk – overseeing logistics supply chains in Vietnam, Thailand, Cambodia, Myanmar, Laos – shared that since the start of 2025, the majority of discussions she’s had with customers have revolved around sourcing shifts from China, with many companies looking to countries in the Mekong region like Cambodia, Vietnam and Thailand.

“But actually, I would say, most of the appetite and most of the conversations today are happening around Cambodia,” she said. “A lot of the questions that we are receiving from our customers are: is Cambodia ready? Can you tell us about the infrastructure? Can you explain to us how the labour force is?”

From what she has observed so far, De Haas believes Cambodia is ready and must now focus on building trust among customers overseas and ensuring smooth cooperation between the public and private sector to streamline logistics procedures and increase the ease of doing business as much as possible.

Is Cambodia ready from a labour point of view? I believe [at Maersk] we hear, yes, and from an asset factory point of view, also yes, as a lot of investments have been made. Actually being able to create goods is not so much an issue, it is much more about: How can we instill trust in customers overseas that Cambodia is ready? How are we making sure that we talk to the public sector to help simplify customs operations and reduce costs?

“Of course, Cambodia still has a little bit more to prove [than its neighbours], because it is very much still in development, but I think it’s all about how we can get those proof points forward,” she concluded.