IMF Article IV 2025 Report on Cambodia - Economic Recovery Is Uneven But Positive

The IMF (International Monetary Fund) Article IV 2025 Report on Cambodia released on January 28 anticipates GDP growth of 5.8 per cent for Cambodia in 2025 but has outlined a positive future outlook which could see the Kingdom maintain its position as one of the highest growth economies.

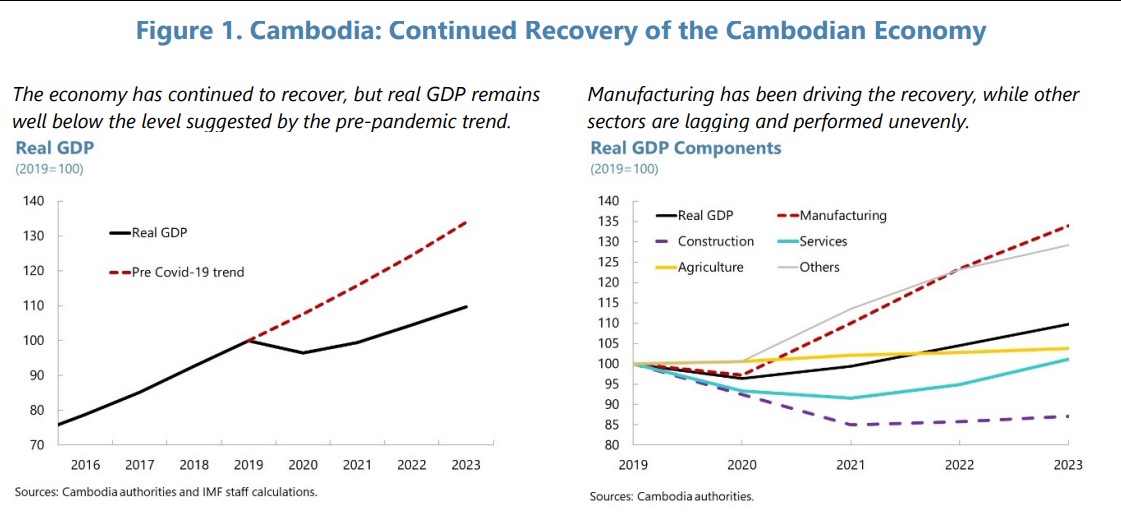

The 107-page document is based on bilateral discussions and consultation with Cambodia is accompanied by a press release from the IMF which says "Cambodia’s economy has continued to recover, albeit at a modest pace. We project real GDP to grow from 5.5 per cent in 2024 to 5.8 per cent in 2025 and inflation to pick up from 0.5 per cent in 2024 to 2 per cent in 2025 and remain contained.

However, risks to the outlook are tilted to the downside from both external factors and domestic vulnerabilities, including from policy changes by major trading partners, geoeconomic fragmentation, and continued weakness in the construction and real estate sectors."

The Cambodian government foresees an optimistic growth rate of approximately 6.3 per cent in 2025 according to the Budget in Brief report for the Fiscal Year 2025 released by the Ministry of Economy and Finance (MEF). The World Bank's forecast for Cambodia in 2025 is 5.5 per cent and the Asian Development Bank’s projection is 5.8 per cent.

Revamped GDP Calculations Shed Light On Key Industries Driving Economic Growth

The report also highlights that "the revamped calculations of GDP using 2014 as the new base year (which shows a thirty-per cent increase in GDP per capita) better reflects the current structure of the economy and entails a more realistic assessment of economic activity.

The rebasing means that the growth in industry and services was previously underestimated and was the primary driver of economic growth in Cambodia.

- Agriculture now is down to 17 per cent in 2020-22 under the new GDP - decreasing 33 per cent two decades ago in the previous GDP.

- Industry and services account for larger shares of GDP over 2020-22, reaching 39.5 per cent and 37.3 per cent of GDP, respectively.

- Textile manufacturing has been consistently the largest growth driver - 21 per cent of GDP growth on average over the 2010-2019 period.

- Construction’s contribution to GDP increased significantly in the pre-pandemic decade, to an average of 17 per cent of overall growth

- Tourism-related services, a traditional export sector in Cambodia, has seen its growth contribution slowly decline over time but remains an important growth driver.

Stephen Higgins, Managing Partner at Mekeong Strategic Capital said online, “Like us, they see risks weighted to the downside. They see longer-term growth averaging around 6 per cent, which should see Cambodia remain one of the highest-growth economies globally. Also plenty of interesting little snippets within, including: personal income tax due to come in 2026, where Chinese tourists are going (not Cambodia or the Philippines), and Agri falling from 32.5 per cent of the economy 20 years ago to just 17 per cent now.”

The IMF Article IV report on Cambodia reports:

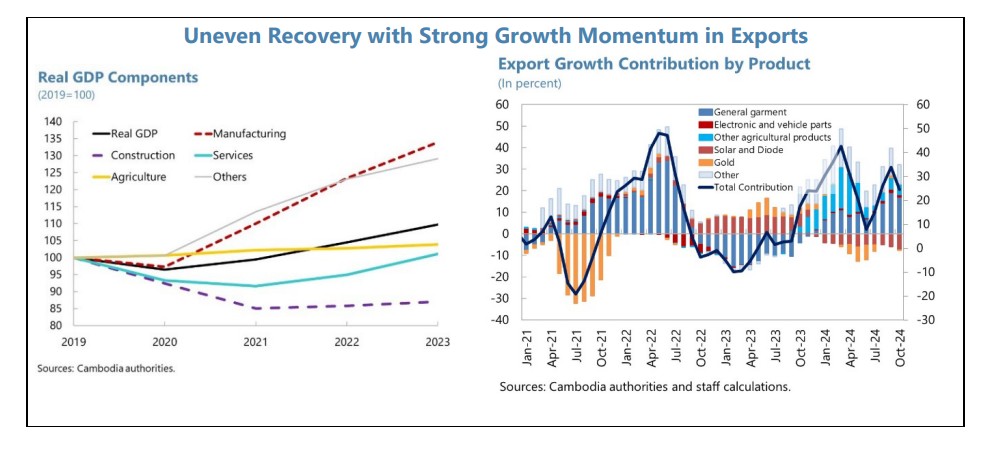

- There was a strong rebound in garment exports and high growth in agricultural exports in 2024

- Tourism experienced a structural shift in its composition which has resulted in a lagged recovery in tourism receipts.

- Growth in non-tradable sectors remains weak.

- Fiscal deficit is estimated at 2.4 per cent of GDP in 2025, which is down from 3 per cent in 2024. There is gradual fiscal consolidation envisaged in the medium-term fiscal framework in Cambodia

- Public debt remains well-contained, staying below 30 per cent of GDP over the next decade. The deficit is projected to increase somewhat in 2025, reaching 2.5 per cent of GDP, with export growth expected to moderate.

What Business Challenges Are There When Operating in Cambodia?

IMF indicates that some of the challenges of doing business in Cambodia include:

- The high cost of electricity is frequently cited by foreign investors as “one of the most significant obstacles to doing business." The energy rates in Cambodia are twice that of Vietnam, suggests the report.

- Enforcement and interpretation of laws, as well as governance-related issues

The IMF recommends targeted reforms as they could enhance governance frameworks, improve transparency, and strengthen investor confidence.

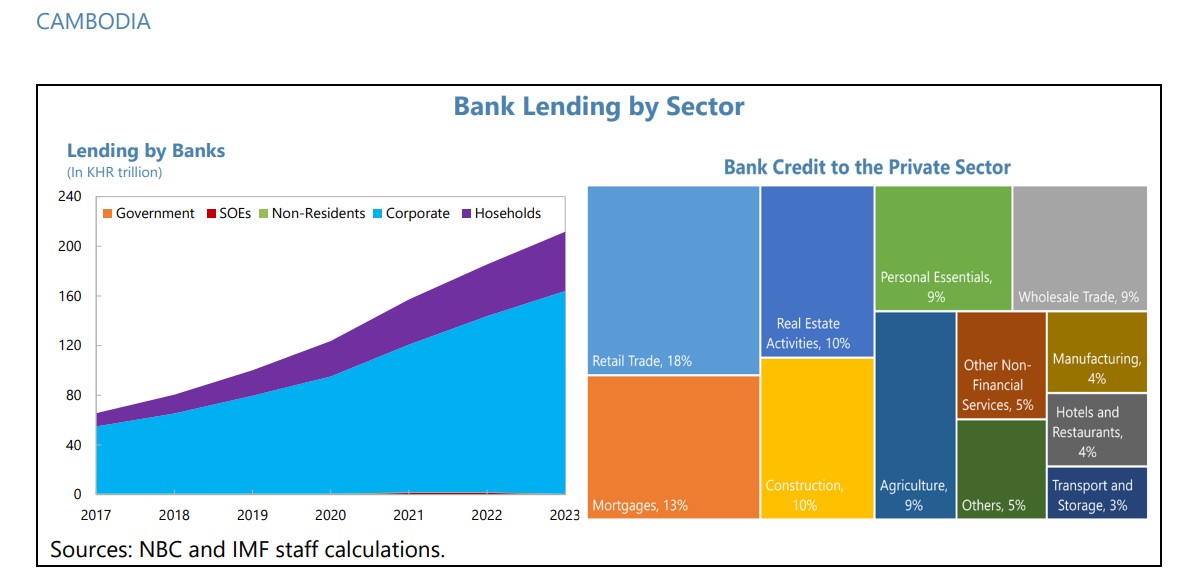

Credit Growth Remains a Risk In Cambodia - Impacting Construction and Real Estate Sector

The IMF report said, “After a sustained credit expansion that lifted the credit-to-GDP ratio from 24 per cent in 2010 to 135 per cent in 2023, credit growth has come to a near halt. The construction and real estate sectors are undergoing a correction, with rising non-performing loans and emerging signs of private-sector debt overhang.”

It highlights that credit growth in Cambodia reached a decade-low in 2023 after a prolonged period of rapid credit expansion and overall credit growth remained low in 2024.

- The National Bank of Cambodia (NBC) lowered the USD reserve requirement rate (RRR) on deposits and non-resident borrowing for banks in Q4 2023 Q4 back to the pandemic-support level of 7 per cent to support credit activity.

- Rates on negotiable certificate deposits (NCDs), used by the NBC to absorb short-term liquidity, were lowered in early 2023 from 3.4 and 1.3 per cent for USD and KHR, respectively, and have since remained broadly unchanged at average rates of 0.7 and 0.9 per cent, respectively, in H1 2024.

Long-Term Analyses & New IMF Evaluation Technique

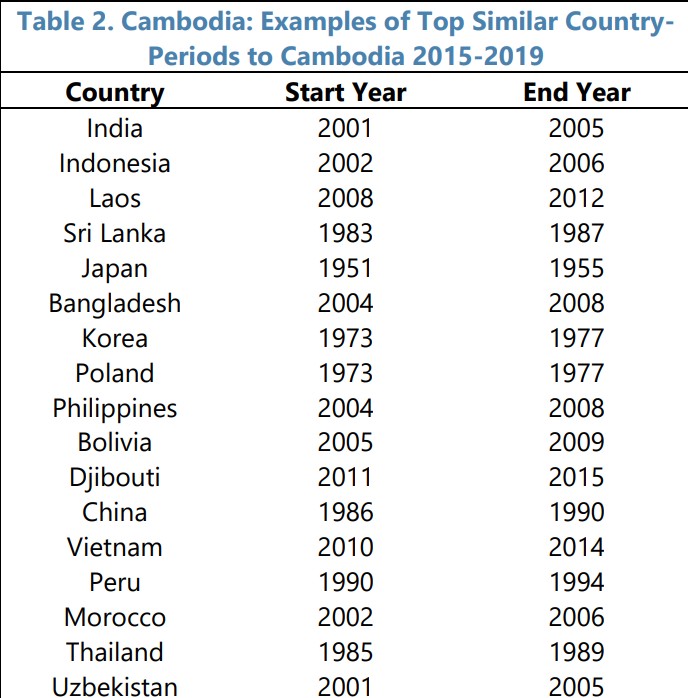

The IMF employs a new machine-learning technique that utilises historical growth trajectories of other countries with comparable economic conditions - known as Dynamic Time Warping (DTW) - this identifies periods in other countries where economic indicators closely mirror those of the target country.

IM says of the approach, that it "offers a novel approach to forecast a target country’s future growth from the historical growth paths of its peers. This approach provides a data-driven and non-parametric way to anticipate potential growth trajectories based on similar historical experiences. It employs a machine-learning technique that compares multivariable sequences of economic data between Cambodia and other countries. This technique makes it possible to identify historical periods in other countries that closely mirror Cambodia’s current economic conditions. The observed growth paths of these historical episodes are then used as a basis for forecasting the future growth trajectory of Cambodia’s economy.

The DTW method is particularly useful because it can adapt to differences in the speed or the timing of changes in underlining variables, allowing for more flexible and nuanced comparisons."

The IMF report does suggest that Cambodia can achieve annual growth of approximately 6 per cent by 2030 – rising to potentially 8 per cent if it follows historical examples set by China, Japan, and South Korea.

When averaging the episodes in this context for Cambodia in 2030 - the average forecast is 5.8 per cent and the median forecast is 6.3 per cent. If Cambodia’s economy outperforms the forecasts could reach 7.5 per cent to 7.9 per cent for 2030.

“Policy formulation must ensure a durable and inclusive recovery in the near term and achieving development goals over the medium term. The path forward will require a refocus on more resilient and diversified growth drivers, with the graduation from Least Developed Country (LDC) status expected by 2030.

Key Takeaways IMF Article IV 2025 Report on Cambodia

- Economic Recovery: Cambodia's economy is recovering, with projected real GDP growth increasing from 5.5 per cent in 2024 to 5.8 per cent in 2025, driven primarily by garment and agricultural exports. However, the recovery is uneven, particularly in non-tradable sectors and tourism, which has seen a structural shift in composition.

- Inflation and Fiscal Outlook: Inflation is expected to rise from 0.5 per cent in 2024 to 2 per cent in 2025, while the fiscal deficit is projected to decrease from 3 per cent of GDP in 2024 to 2.4per cent in 2025. Public debt remains manageable, staying below 30 per cent of GDP over the next decade.

- Risks to Growth: The outlook for Cambodia's economy faces several risks, including external factors such as policy changes by major trading partners and domestic vulnerabilities like weaknesses in the construction and real estate sectors. The current account balance is projected to swing back into a deficit due to strong import demand outpacing export recovery.

- Policy Recommendations:

- Fiscal Policy: A neutral fiscal stance is recommended for the near term, with a focus on gradual consolidation to build fiscal buffers and ensure debt sustainability. This includes improving revenue mobilization and enhancing public investment management.

- Monetary Policy: Resuming monetary policy normalisation at a measured pace is crucial for maintaining financial stability and supporting de-dollarization efforts. Strengthening oversight of the financial sector is also emphasised.

- Structural Reforms: Emphasis on diversifying growth drivers through human capital development, infrastructure investment, and improved governance frameworks is essential for attracting higher-value FDI and addressing climate vulnerabilities.