EDENA-BEK Group Launches the Middle East’s First 24/7 Digital Securities Exchange in Historic Cairo Deal

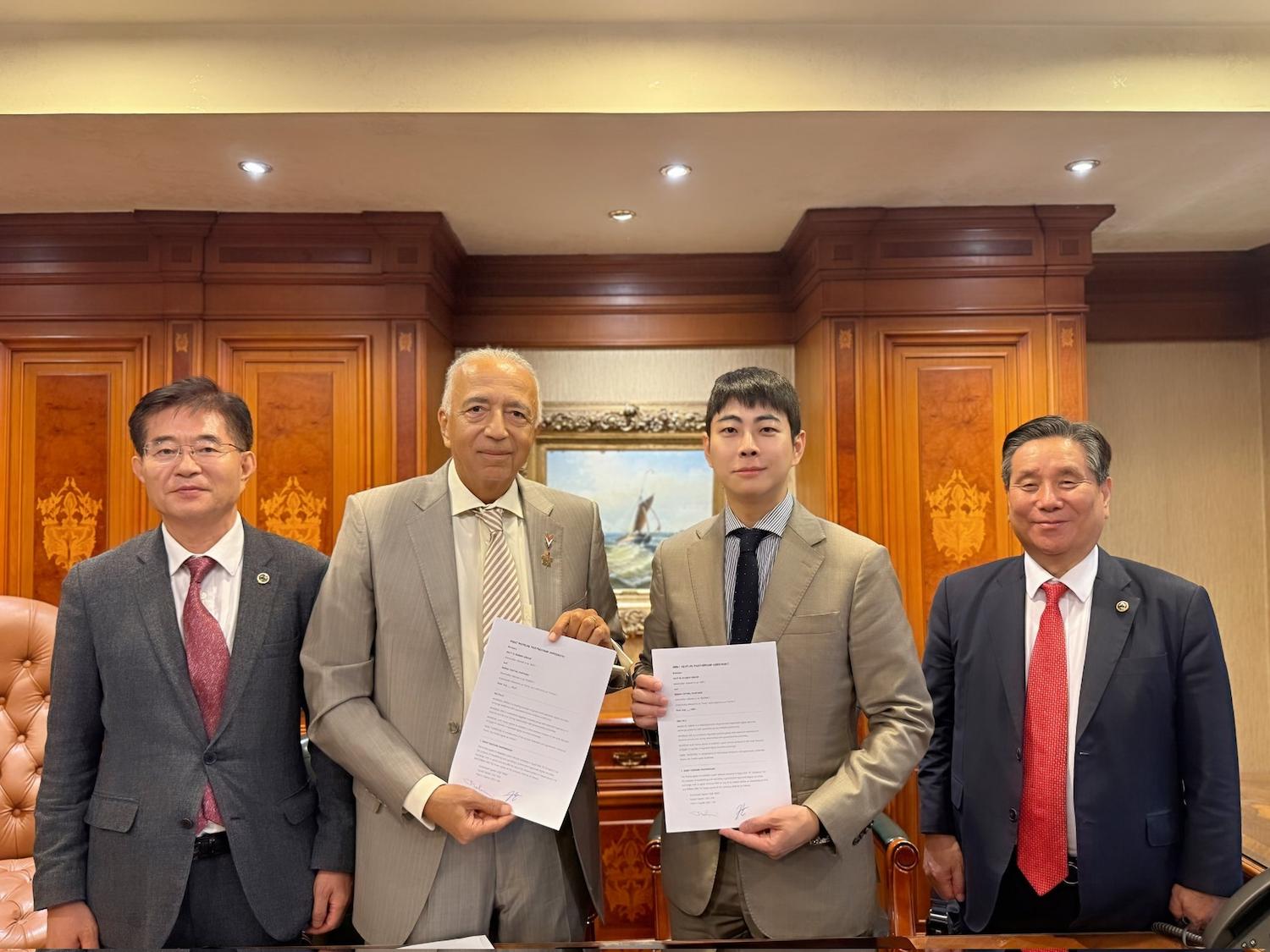

CAIRO/SEOUL, 23 July 2025 – ASEAN’s digital finance pioneer EDENA, and Egypt’s influential BEK Group, have signed a definitive joint venture agreement to establish the Middle East’s first 24/7 digital securities exchange in Egypt, launching with a USD 250 million Cairo real estate tokenisation project.

The partnership, sealed in an unprecedented 48-hour negotiation led by Eng. Khaled Abdullah, BEK Chairman, and former Egyptian Prime Minister Ibrahim Mahlab, positions Cairo as the digital finance capital for 70 countries and 2 billion people across the Middle East and Africa.

Game-Changing Alliance Reshapes Regional Finance

The EDENA-BEK Group joint venture represents a seismic shift in Middle Eastern finance, combining Korean technological innovation with Egypt’s most powerful financial network. BEK Group, founded in 1949 and guided by former PM Mahlab as Managing Director, brings unmatched market expertise and regional influence.

Ibrahim Mahlab, who served as Egypt’s 35th Prime Minister and previously led Arab Contractors through mega-projects including the Suez Canal expansion, personally orchestrated the partnership. His continued role as strategic adviser to President El-Sisi on national projects underscores the venture’s alignment with Egypt’s digital transformation agenda.

“The EDENA-BEK Group partnership isn’t just a business deal – it’s the beginning of a financial revolution that will open up access to premium assets across MENA,” stated Wook Lee, EDENA CEO and joint venture co-chair.

Revolutionary Platform Breaks Traditional Barriers

The EDENA-BEK Group platform will dismantle conventional investment barriers:

- Minimum Investment: USD 10 (vs. traditional millions)

- Trading Hours: 24/7/365 (vs. limited market hours)

- Transaction Costs: 90 per cent lower than traditional systems

- Settlement Time: Minutes (vs. days)

- Geographic Reach: 70 countries from day one

The inaugural USD 250 million tokenisation of a mixed-use development in Cairo will serve as a proof of concept, showcasing how blockchain technology can transform illiquid real estate into freely tradable digital securities, accessible to global retail investors.

Strategic Monopoly Across the MENA Region

The EDENA-BEK Group agreement includes exclusive regional rights, effectively creating a dominant position across the Middle East and Africa’s digital securities market. This strategic partnership positions the venture to capture what analysts estimate to be a USD 2 trillion tokenisation opportunity.

“EDENA-BEK Group will transform Cairo into the region’s undisputed digital finance hub,” declared Eng. Khaled Abdullah, BEK Chairman and joint venture co-chair. “With our combined capabilities and deep market understanding, we’re not just entering the market – we’re creating it.”

First-Mover Advantage in a Trillion-Dollar Market

While Dubai and Riyadh have announced fintech ambitions, EDENA-BEK Group’s partnership with BEK’s seven-decade market presence provides immediate operational capabilities and established regulatory pathways. The venture leverages:

- EDENA’s Proven Technology: Active across several ASEAN markets, with Indonesia launching in September 2025

- BEK’s 75-Year Legacy: Deep relationships spanning multiple Egyptian administrations

- Egypt’s Strategic Location: 12 per cent of global trade flows through the Suez Canal

- Demographic Dividend: 60 per cent of the MENA population is under 30 – a mobile-first generation

The platform is targeting a Q4 2025 launch, with a robust pipeline that includes infrastructure bonds, renewable energy assets, and commercial properties valued at over USD 5 billion across the region.

Carbon Credits: The Hidden Goldmine

Beyond real estate, EDENA-BEK Group plans to revolutionise the carbon credit market by connecting Egyptian carbon assets to global markets, where they command significantly higher premiums—while supporting Egypt’s green transition.

“We’re not just tokenising assets; we’re unlocking trapped value across entire economies,” added Lee. “What gold rushes were to the 19th century, tokenisation will be to the 21st.”

Connecting Continents Through Digital Finance

EDENA-BEK Group’s vision extends beyond regional boundaries. By linking EDENA’s ASEAN network through its Indonesian hub with MENA’s 2 billion people, the platform creates the world’s largest emerging market digital finance corridor.

The joint venture has already attracted interest from global investors, with early discussions indicating significant attention from major international funds.

Immediate Impact and Future Projections

Year 1 Targets:

- USD 1 billion in tokenised assets

- 1 million registered users

- 100+ listed projects

By 2027:

- USD 10 billion transaction volume

- Expansion to 20 African nations

- IPO considerations in multiple markets

The venture’s success could spark a domino effect across MENA, with other nations racing to establish similar platforms. However, EDENA-BEK Group’s first-mover advantage, exclusive partnerships, and BEK’s market dominance create formidable barriers to entry.

The Bigger Picture

This partnership represents more than financial innovation – it’s a blueprint for South-South cooperation in the digital age. As traditional financial powers hesitate, emerging markets are leapfrogging legacy systems altogether.

For Egypt, this places the nation at the forefront of the Fourth Industrial Revolution. For Korea, it affirms the global competitiveness of K-Fintech. For the millions of retail investors previously excluded from premium assets, it opens doors long kept shut.

The message is clear: the future of finance isn’t being written in New York or London – it's being coded in Seoul and Cairo.

About EDENA-BEK Group

EDENA-BEK Group is a strategic joint venture established in July 2025 between EDENA, ASEAN’s leading digital securities exchange operator, and Egypt’s BEK Group, the nation’s premier financial services conglomerate, founded in 1949. The partnership aims to build the Middle East and Africa’s first comprehensive digital securities ecosystem.

This press release was supplied.