CSX Expects To List 6 Companies In 2025

The Cambodia Securities Exchange (CSX) has stated that 2025 is expected to be a golden opportunity for investors, despite the 2024 data seeing a downturn in share prices and daily trading. CSX anticipates at least three companies will list equities, and four companies debt securities, in 2025, while they aim to double the daily trading volume to USD 300,000, as well as launch the first-ever Exchange-Traded Funds (ETFs) on the market.

In a recently released CSX report providing a review of the 2024 market and outlook for 2025, the exchange expressed optimism that this year will have high potential while acknowledging that the 2024 market situation was not very favourable for investors.

“Due to a drop in the price of shares at quality companies, there is an opportunity for investors to buy shares below market value, positioning them to sell during the market recovery,” the report stated.

CSX has committed to doubling the daily trading value from 2024 to 2025, adding 15,000 new trading accounts, and increasing the number of listed companies by at least six. Additionally, the exchange plans for new innovations in the market, such as an update to the trading platform, margin trading, and improvements in market mechanisms.

The exchange previously stated that it targets an average daily trade volume goal of USD 100 million by 2030. Daily trade volume on the CSX rose from about USD 20,000 per day in 2018 to nearly USD 300,000 per day in 2023 – a goal the CSX hopes to achieve again in 2025 after a lacklustre 2024.

The exchange had also set an ambitious growth target of 100,000 trading accounts in 2024, up from the approximately 49,000 recorded at the end of 2023, however, fell short of this goal and recorded only 58,394 active trading accounts by the end of the year.

Cambodia Securities Exchange 2024 Market Overview

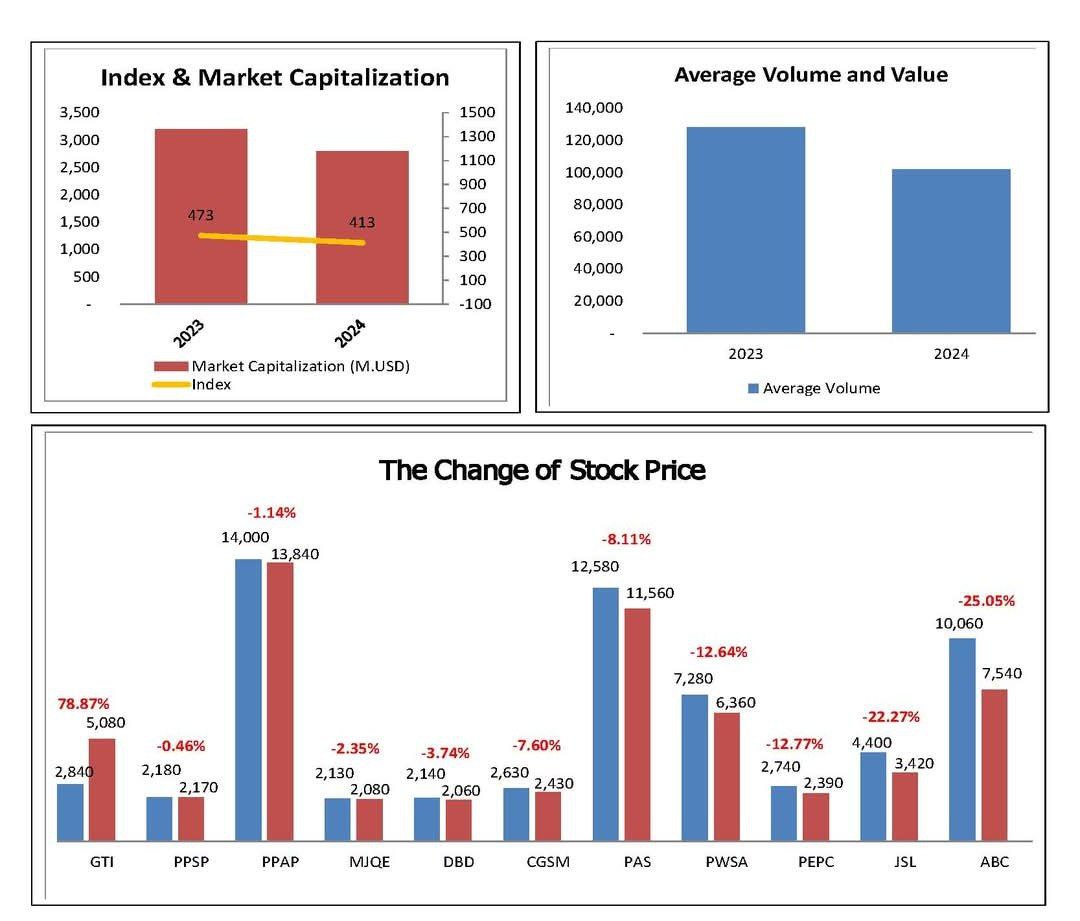

In 2024, the CSX index fell by 12.68 per cent, which they claim was influenced by global geopolitical conflicts, an economic downturn, and a lack of cash flow entering the market. The average daily trading value in 2024 was more than KHR 535 million (approximately USD 133,963), reflecting a 35 per cent decline from 2023. However, there has been a noticeable gradual increase in local investor participation, the CSX report noted.

The average daily trading volume was 101,843 shares, with 93 per cent of shares traded by local investors. Daily buy and sell orders averaged 3,627 in 2024, which was an increase of 20 per cent compared to 2023.

In addition to Negotiated Trading Methods (NTM) in 2024, CSX recorded 10 additional transactions involving shares of the Sihanoukville Autonomous Port, Grand Twins International, and Phnom Penh Water Supply Authority.

“The total trading volume for these transactions amounted to 1,213,554 shares, equivalent to KHR 6.266 billion, with 60 per cent of trades conducted by foreign investors and 40 per cent by locals,” the report stated.

Investors from different countries also contributed to the market in 2024, led by Taiwan (39.50 per cent), Japan (21.31 per cent), China (14.18 per cent), and Thailand (5.36 per cent).

Only two new bond-listed companies joined CSX: Royal Group Phnom Penh SEZ, which went public in 2016, and Telcotech, a fibre optic cable company.

Why Did the CSX Index Drop In 2024?

CSX has been implementing various training programs aimed at enhancing investor confidence and knowledge about stock trading which they say is crucial for attracting more participants to the market.

Currently, only 11 stocks are listed on the CSX main board and growth boards combined. Ten of those stocks declined in 2024, while the only Taiwanese manufacturer listed, Grand Twins International, saw an increase of 78.87 per cent. ACLEDA Bank suffered the biggest loss of the year, dropping over 25 per cent, followed by JS Land, which was down over 22 per cent.

The combined drop in share prices, however, was not entirely due to business factors, according to CSX. The report explained that externally, prolonged global conflicts have impacted the value of the U.S. dollar, while internally, uncertainty surrounding domestic economic conditions caused by a downturn in the real estate sector and an overall decline in domestic consumption were factors.

“These issues have led many investors to hold onto cash instead of investing, along with a rise in reports of fraud using the term 'investment.'”

A lack of cash flow entering the market, minimal fluctuations in most company stocks making the market less attractive, and low volatility, were also other internal factors cited by the CSX.

“Furthermore, some investors have rushed to sell shares, pulling down the prices of certain stocks, even though the listed companies continue to make regular progress and development,” the report added.

The Securities Market’s Role In Cambodia's Pursuit Of Upper-Middle-Income Country Status

As Cambodia pursues its transition to upper-middle-income country status, the CSX will continue to play a role in facilitating capital mobilisation and promoting sustainable investment to drive national economic growth.

With the recovery of various sectors and the reduction of interest rates, there will be an improvement in the state of the securities market. At the same time, the listing of new equity securities in 2025 will serve as a catalyst to boost trading and attract more investors. 2025 is expected to be a golden opportunity for our investors.

“Investors have been showing a new perception of stocks as a highly liquid asset, and more active investors are joining the market as they have faith in possibly making returns from the current stock prices,” said CSX.