CBC Publishes First Edition Of Small Business Credit Index Report Showing Trends And Indicators On Small Business Loans In Cambodia

The Credit Bureau of Cambodia (CBC) has published the first edition of its ‘Small Business Credit Index Report’ showing trends and indicators on small business loans in Cambodia.

Small business loans – referring to business loans given to consumers rather than institutional entities – comprise one of the most important loan segments in Cambodia. The CBC's newly launched ‘Small Business Credit Index Report’ will be released quarterly and is intended to improve understanding and monitoring of the small business credit segment in Cambodia.

The first publication of this report details data and trends from Q1 2024.

Key Highlights Of The CBC's Small Business Credit Index Q1 2024 Report

Small Business Credit Performance was found to have expanded in both the number of loan accounts, as well as loan balance, recording positive growth across the country. Small Business Credit Applications also grew compared to the previous quarter. Loan quality, on the other hand (as measured by 30+ Days Past Due (DPD), indicating a loan payment that has been defaulted for 30 days), slightly decreased from the previous quarter as the overall balance of 30+ DPD increased.

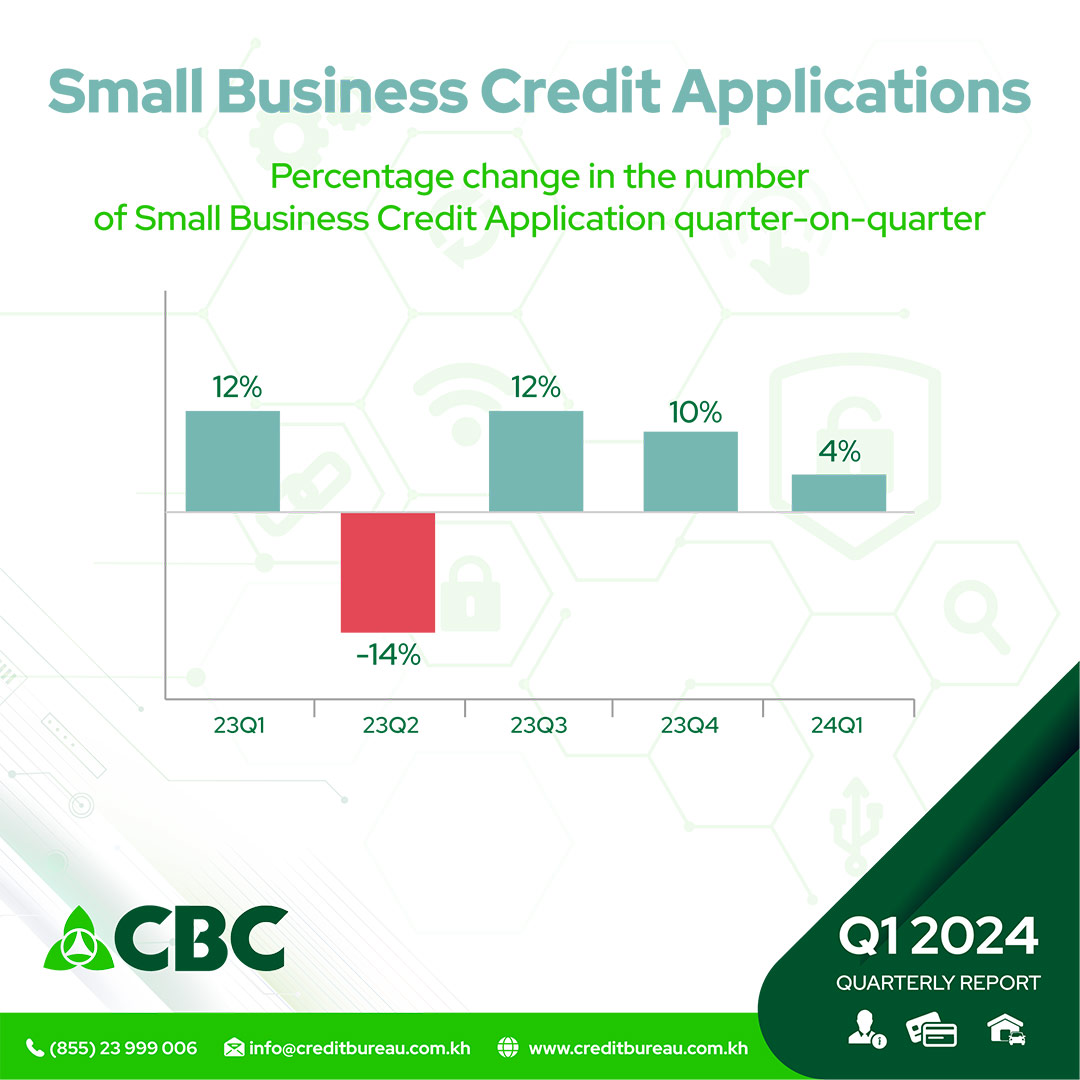

- Small Business Credit Applications

- Overall, Small Business Credit applications rose by 3.87 per cent.

- This increase was due to: expanded Working Capital Applications by 4 per cent quarter on quarter (QOQ), Agriculture Application +9 per cent, Construction Application +2 per cent, and Other Applications +1 per cent.

- Asset Finance Applications, meanwhile, dropped by 12 per cent from the previous quarter.

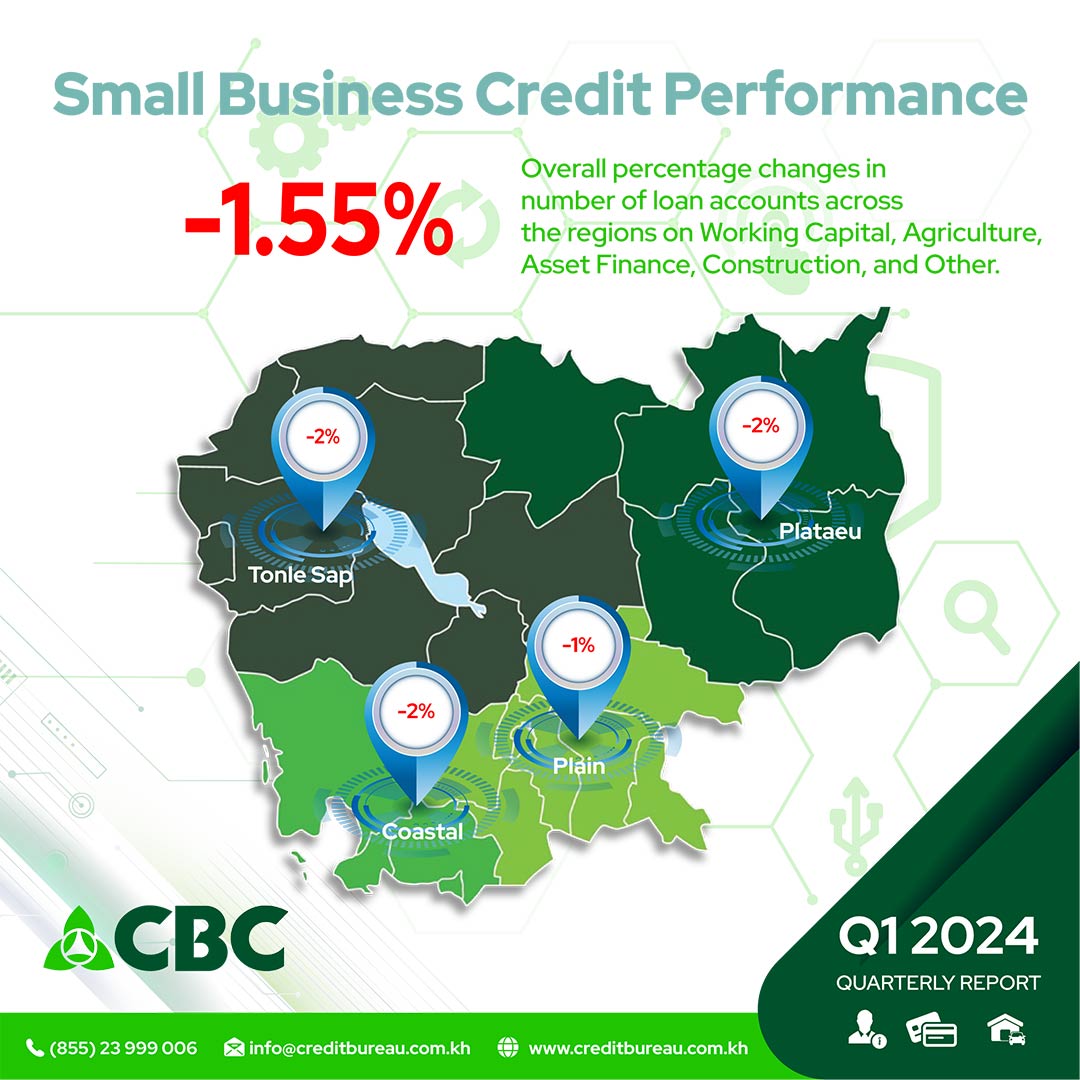

- Small Business Credit Performance

- The total number of loan accounts saw a drop by 1.55 per cent, bringing it to around 1.89 million accounts.

- Outstanding balance grew by 0.9 per cent to reach USD $34.2 billion by the end of the first quarter in 2024.

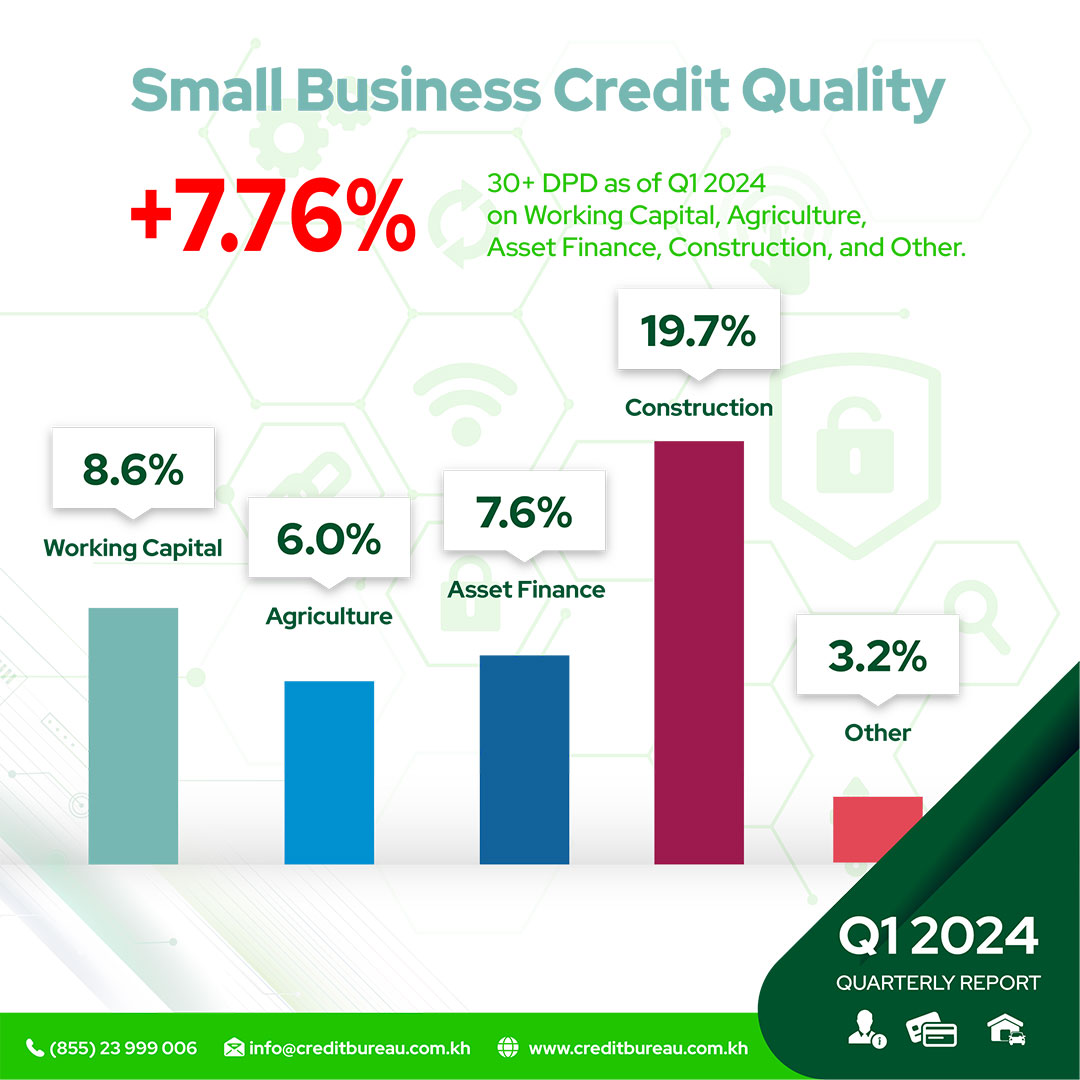

- Small Business Credit Quality

- 30+DPD as a ratio of the total balance increased to 7.76 per cent.

- The majority of customer credit (53 per cent) remained committed to a single financial institution, and 37.8 per cent of customers were found to be holding only a single account.

Reflecting on the findings of the report, Oeur Sothearoath, CEO of the CBC, remarked:

The demand for Small Business Credit increased in terms of the number and amount of applications; however, Small Business Credit performance was negative in number of loan accounts, -1.55 per cent, while loan balance increased +1.36 per cent in this quarter.

He added that loan quality dropped with an increase in 30+ DPD ratio of 6.59 per cent in the fourth quarter of 2024 to 7.76 per cent in this quarter.

Small Business Credit Applications, Performance And Quality In Q1 2024

Small Business Credit Applications

This metric represents intention of consumers to acquire credit in the form of Working Capital, Agriculture, Asset Finance, Construction, and other applications.

In the first quarter of 2024, the number of consumers attempting to acquire credit in these five different areas rose overall at a rate of 3.87 per cent. Working Capital Applications increased +4 per cent, with the largest increase noted in Cambodia's coastal region (+9 per cent).

Agriculture Applications grew to +9 per cent, with the largest increase noted in Cambodia's plateau (+63 per cent). Meanwhile, there was a 12 per cent drop in Asset Finance Applications, with the largest decrease of 17 per cent noted in the coastal region.

Construction Applications increased by 2 per cent, with the largest increase of 50 per cent recorded in the plateau region, while Other Applications rose by 1 per cent, with the largest increase of 28 per cent recorded in the plateau.

The percentage change in loan amounts sought for the five aforementioned categories expanded by 4.3 per cent. This expansion was due to Working Capital Application amounts increasing by 10.1 per cent, and Construction Applications increasing by 4.5 per cent, while there was a decrease in Agriculture Applications by 7.7 per cent, Asset Finance by 14.9 per cent, and Other Applications by 14.3 per cent.

Small Business Credit Performance

This metric indicates the volume of consumer loans as of the reporting quarter, reflecting an active credit market.

As of March 2024, the number of consumer loan accounts for Small Business Credit decreased by 1.55 per cent from the previous quarter, resulting in a total of 1.89 million Small Business loan accounts throughout the country. From this total, 54 per cent comprised of Working Capital loan accounts while a much smaller share was recorded for Agriculture loans (32 per cent), Asset Finance (6 per cent), Construction loans (1 per cent), and Other loans (7 per cent).

This decrease was observed in all regions of the Kingdom (down 2 per cent in the Plateau, Coastal and Tonle Sap regions, and down 1 per cent in the Plain region).

Consumer loan balance continued to rise, increasing 0.9 per cent as of March 2024. By the end of the quarter, there was a total outstanding consumer loan balance of USD $34.2 billion.

Working Capital loan shares made up 54 per cent of total loan accounts, or 68 per cent of the total consumer outstanding loan balance. Agriculture loans accounted for 32 per cent of total loan accounts and 11 per cent of the total outstanding loan balance, while Finance Asset loans accounted for 7 of the total outstanding loan balance and Construction loans accounted for the total a low 2 per cent of the total outstanding balance.

Overall, there was positive growth recorded in balance across all four regions of Cambodia (Plateau +0.1 per cent, Plain +1 per cent, Coastal 0.01 per cent, and Tonle Sap 0.2 per cent.

Small Business Credit Quality

This metric is measured by taking the ratio of loan accounts with late repayments 30 days past their due date, indicated as 30+ DPD. It indicates the creditworthiness and risk of default within the reporting quarter.

The instance of 30+DPD increased to 7.76 per cent in Q1 of 2024, up from 6.59 per cent recorded in Q4 of 2023. Construction has the highest 30+DPD with a ratio of 19.7 per cent. The largest increase in 30+ DPD was seen in the Coastal region (+11 per cent), followed by the Tonle Sap (+8 per cent) and the Plateau and Plain regions (+7 per cent).

Fifty three per cent of the credit customer base were found to hold credit accounts at only one financial institution. The remaining 37.8 per cent hold accounts at multiple financial institutions.

Customers holding only one loan account stood at 37.8 per cent; those holding two accounts made up 35.8 per cent; those holding three accounts made up 18.6 per cent; and those with more than three accounts were only 7.9 per cent of the entire credit customer base.

This article is adapted from a supplied press release.