Cambodia Business Climate 2024 And Future Of US-Cambodia Investment In Light Of Trump’s Presidency – Invest Cambodia 2025

At ‘Invest Cambodia 2025: The Asian Tiger of the 21st Century’ – a half-day seminar organised by B2B Cambodia and Moores Rowland Cambodia on November 26, 2024 at the Novotel Phnom Penh – Casey Barnett, President of CamEd Business School and President of the American Chamber of Commerce (AmCham) in Cambodia, delivered a presentation sharing the findings from a recent AmCham business climate survey exploring the current business and investment landscape in the country.

His presentation also touched on the future of US-Cambodia investment in 2025 and beyond, following the reelection of Donald Trump and his widely-known plans to increase tariffs worldwide, and especially on China.

According to Barnett, the 2024 AmCham Business Climate Survey received 800 responses, including 542 from unique companies. Responses came from companies owned by a wide variety of nationalities, including Cambodian, American, Chinese, Vietnamese, Dutch, French, Australian, British, and more.

“Our survey found that over 70 per cent of businesses in Cambodia are reporting 2024 to be a better year than 2023, reporting a growth in income, growth in investment, and growth in hiring,” shared Barnett.

Those businesses that are smaller, doing more innovation (improving products, services, operations or introducing new ones), run by younger CEOs and run by Cambodians, were found to be experiencing faster growth than companies that are larger, doing less innovation, run by older CEOs and run by foreigners. The study, however, noted there might be a trade-off in terms of risk and reward – older CEOs and foreign-run businesses may be more risk-averse compared to their younger and local counterparts.

_20241203_162007.jpg)

Some of the industries that saw high growth in 2024 were mining, healthcare, transportation, education, agriculture and manufacturing. On the other hand, businesses reporting slow growth or challenges included the financial insurance industry, retail, trade, accommodation and food services i.e. the tourism sector.

In terms of what is attracting investment into Cambodia, Barnett shared that survey respondents reported factors including, but not limited to:

- Political stability

- Growing market

- Dollarised banking and payments

- Foreigners having the ability to own 100 per cent of a business

- No restriction on international money transfers

- Low cost of labour

On the other hand, some of the negative aspects about investing in Cambodia include:

- Uncertainty about the application of laws and regulations

- Cost of electricity (which Barnett added is about double the cost of electricity in Vietnam)

- High cost of transportation infrastructure and shipping

- An inadequately educated workforce

A point of note was that ‘crime, theft and disorder’ was one of the very least rated issues about doing investment in Cambodia, indicating that investors generally regard Cambodia as a safe place to do business.

Watch a snippet of Casey Barnett's presentation on the 2024 AmCham Business Climate Survey:

Analysing Cambodia’s Economic Growth

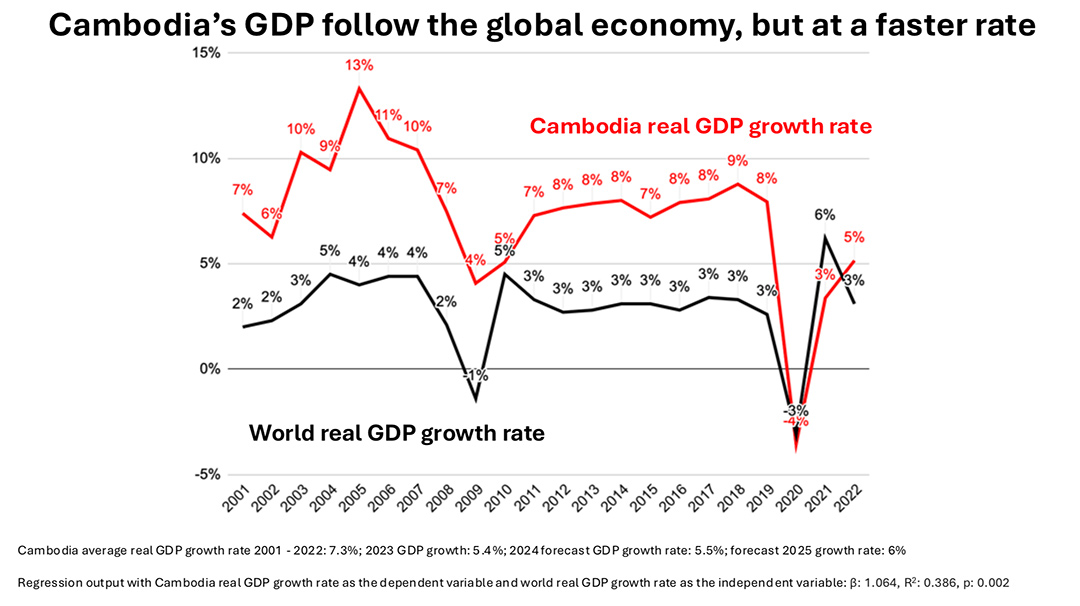

Further analysing Cambodia’s investment landscape, Barnett shared a graph showing how Cambodia’s economic growth has been faster and above global economic growth for over two decades, growing at an average of 7.3 per cent between 2001 and 2022.

The relationship between Cambodia’s economic growth and global economic growth is evidently growing closer, trending up and down together over time.

“The more Cambodia develops, the more integrated it becomes with the world economy, and the more affected it is by growth in the global economy,” said Barnett.

When doing a regression analysis with the Cambodian GDP as the dependent variable and world economic growth as the independent variable, Barnett said it was found that world economic growth only explains around 39 per cent of Cambodia's economic growth.

That means there's a lot of economic growth in Cambodia that is not explained by the world economy, and it also means that investing in Cambodia can be a good diversification of an investment portfolio.

Survey Limitations

Barnett disclosed two limitations to the business climate survey, the first being that data was only collected from companies that have already invested in Cambodia, and not those who chose not to invest.

“In the future, we would like to reach out to investors that chose not to invest in Cambodia, and ask them why didn't you? Why did you choose not to invest in Cambodia? That would be very useful. There's going to be some bias here in the survey, because we're only surveying people that have invested in Cambodia,” he said.

Another limitation, not necessarily of the survey itself but of the report presented to the public, was that information collected about specific government institutions and corruption were not included in the report, which Barnett explained was because AmCham wishes to continue maintaining its good relationship with the government to improve the business environment in Cambodia.

What Will Donald Trump’s Presidency Mean For US-Cambodia Business Relations And Investment?

Cambodia receives the largest amount of foreign direct investment (FDI) from China in manufacturing, with a significant amount of goods being manufactured and exported to the United States.

With president-elect Donald Trump set to take office again in 2025, his administration has not shied away from declaring its commitment to increasing tariffs worldwide, especially on China.

Watch a snippet of Barnett's remarks on what Trump's impending presidency could mean for US-Cambodia business and investment:

In Barnett’s view, he believes Cambodia will largely be able to continue exporting goods to the US without any major issues, and may even see some manufacturing benefits. He recalled that back in 2018, the Trump administration increased tariffs on Chinese exports of solar panels by 25 per cent, which led to many Chinese solar panel companies moving their operations to Cambodia. In 2023 Cambodia had USD 2.8 billion in exports of solar panels assembled in the country.

Furthermore, Cambodia recently received approximately USD 600 million of investment in Chinese tire manufacturers who export a large amount to the US and Canada.

“As these tariffs increase, we can see other areas, other industries and areas of production, move to Cambodia to avoid the US tariffs on Chinese goods,” said Barnett.

The US is very much fixated on competition with China, and the experience during COVID made the US aware that it cannot rely on Chinese-made goods… So what does the US and also the EU want? They want to have a more diverse supply chain, a diverse group of manufacturers, away from China. So we believe there are a lot of opportunities for Cambodia.

Something that makes Cambodia special for receiving investment from China, and also exporting back to China, is that Cambodia has a bilateral free trade agreement (FTA) with the country. The only other country in ASEAN that has a bilateral FTA with China is Singapore, meaning Cambodia is the only low labour cost country that has a bilateral FTA with China in Southeast Asia.

“Cambodia's bilateral free trade agreement can have a lot of opportunities for European and American manufacturers exporting to China, and also the Chinese manufacturers exporting to the US because… it will be easier for them to bring goods into Cambodia for the purpose of manufacturing, so bringing equipment, supplies, raw materials, should be easier,” Barnett added.

_20241203_162317.jpg)

Will Trump’s Administration Renew GSP?

Barnett described how the Generalised System of Preferences (GSP) – a US trade program designed to promote economic growth in developing countries by providing preferential duty-free entry for various products – contributed to Cambodia’s GDP growth, as it did for many other developing countries who were able to export goods to the US tariff-free.

GSP, however, expired in 2020, and since then, developing countries around the world have been waiting to see if the program would be renewed. With Trump’s return to office imminent, Barnett said it seems very unlikely that the president-elect would approve or support such tariff-free access. But he still believes that all hope is not lost, pointing out how the GSP law was passed in the US house of representatives.

The new GSP law in the US passed the (Ways and Means) committee in the US House of Representatives… which is responsible for approving Budget Matters… and the GSP law was passed unanimously by the Republican members of that committee, so there is a lot of Republican support for GSP.

The draft GSP law that was approved is publicly available, and Barnett described it as “basically an anti-China law”, designed to support and increase diversification of the manufacturing base away from China.

In summary, while it is still unknown just how much Trump’s presidency might negatively or positively impact US-Cambodia business relations, Barnett sees many opportunities for increased investment in Cambodia’s manufacturing sector, which can have a potentially positive impact on the country’s GDP and help the Kingdom with its process of economic diversification.