Cambodian Retail and Small Business Credit Application Dropped In 2024; Credit Quality Improved

Cambodia's 2024 retail and small business credit index showed that credit applications dropped significantly; however, outstanding loan balances grew, and credit quality improved, according to recent reports from Credit Bureau Cambodia (CBC).

By the end of Q4 2024, the Kingdom’s retail credit index recorded an overall decrease in applications of 16 per cent, while the small business credit index also saw a drop of 13.2 per cent. Both retail and small business credit quality, measured as 30+ days past due (DPD) as a ratio of the total balance, was lower at 6.24 per cent and 8.3 per cent, respectively, indicating improvement compared to the previous quarter.

The CBC report recorded growing loan balances as follows:

- Retail Credit Loan Balance reached USD 15.53 billion (+0.46 per cent).

- Small Business Credit Loan Balance reached USD 35.14 billion (+1.3 per cent).

Cambodian Retail Credit Index Q4 2024

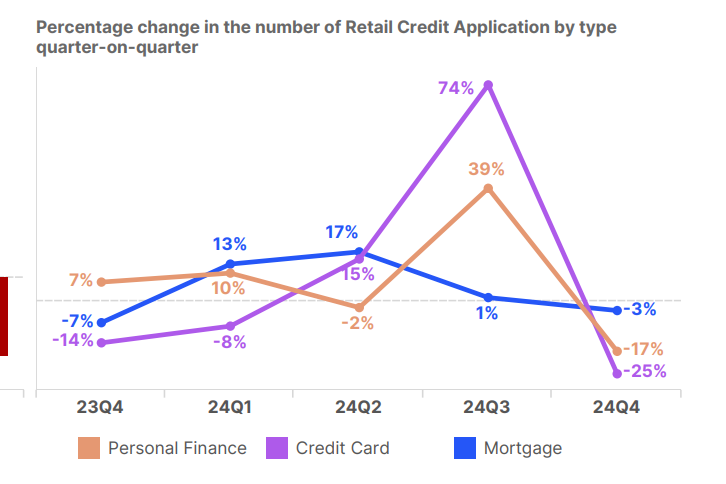

The CBC report indicated that overall retail credit applications decreased due to a drop in personal finance applications by 17 per cent, credit card applications by 25 per cent, and mortgage applications by 3 per cent compared to Q3 2024.

The report noted that the growth in personal finance applications was down 17 per cent (with the largest contraction of -19 per cent in the Plain region). There was also a decrease in credit card applications of -25 per cent (with the largest decrease of -27 per cent in the Plain region). Mortgage applications dropped by -3 per cent (with the largest decrease of -10 per cent in the Plateau region).

However, in terms of retail credit performance, the total number of loan accounts increased slightly by 0.83 per cent, bringing the total to approximately 2.04 million accounts. Outstanding balances grew by 0.46 per cent, reaching USD 15.53 billion by the end of 2024.

Additionally, the country’s credit quality has improved, with the 30+ DPD ratio of the total balance decreasing to 6.24 per cent, down from 6.35 per cent in Q3 2024. Among the three products, credit cards have the highest 30+ DPD ratio at 7.90 per cent.

The CBC reported that the majority of customers (70.30 per cent) remained committed to a single financial institution, while 29.70 per cent had relationships with multiple institutions.

The distribution of customers by the number of loan accounts is as follows:

- Those holding only one loan account: 59.92 per cent

- Those holding two accounts: 27.59 per cent

- Those holding three accounts: 9.16 per cent

- Those with more than three accounts: 3.33 per cent

“The demand for retail credit decreased in terms of the number and amount of applications, but retail credit performance was also positive in both the number of loan accounts and loan balances in this quarter,” said Mr. Oeur Sothearoath, CEO of CBC.

Cambodian Small Business Credit Index Q4 2024

Mr. Oeur Sothearoath, CEO of CBC, noted that while the number of small business loans declined, loan quality showed signs of improvement.

The Credit Bureau Cambodia reported that small business credit performance dropped in the number of loan accounts, while loan balances recorded positive growth. Compared to Q3 2024, small business credit applications decreased, but the amount requested increased. Loan quality improved with a lower share of 30+ days past due (DPD) balances across key regions of the country.

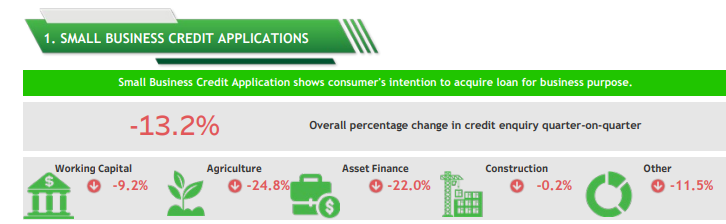

During Q4 2024, small business credit applications decreased by 13.2 per cent compared to Q3 2024. The decline was due to contractions in:

- Working Capital Applications by 9.2 per cent quarter on quarter

- Asset Finance Applications by 22.0 per cent

- Agriculture Applications by 24.8 per cent

- Construction Applications by 0.2 per cent

- Other Applications by 11.5 per cent

The number of loan accounts fell by 1.1 per cent to approximately 1.83 million, while outstanding balances increased by 1.3 per cent to USD 35.14 billion. According to the report, Cambodia’s small business credit quality saw the 30+ DPD ratio improve to 8.3 per cent from 9.0 per cent in the previous quarter. The highest 30+ DPD ratio was in Construction at 12.7 per cent. A significant portion of customers (65.0 per cent) remained committed to a single financial institution.

In terms of loan accounts and balances, working capital loans comprised 52.8 per cent of accounts and 66.7 per cent of the outstanding balance, while agriculture accounted for 30.8 per cent of accounts but only 10.8 per cent of the balance.

Despite the decrease in applications, the amount requested increased by 8.9 per cent, with notable growth in Construction (+40.2 per cent).

Read More About Business & Finance News

- CBC Publishes First Edition Of Small Business Credit Index Report Showing Trends And Indicators On Small Business Loans In Cambodia.

- Taiwan Bank SinoPac Ltd. Concludes 80% Acquisition of Cambodian Amret MFI in a Deal Worth $550 Million.

- Cambodia Microfinance Association Partners With NBC and UN To Safeguard Vulnerable Populations.