Cambodian Insurance Sector Recorded Marginal Growth in 2024 - NSSF Sees Greater Adoption

The Cambodian insurance sector recorded US $356 million in gross premiums in 2024, reported the Insurance Regulator of Cambodia (IRC) - this represents a marginal 3.5 per cent increase compared to 2023. There is also great adoption of the National Social Security Fund (NSSF), which has just under 3 million members.

Heading into 2025, the Cambodian insurance sector included 18 general insurance and 14 life insurance providers as well as 7 microinsurance companies, 1 re-insurance company, 20 insurance brokers, 39 insurance agents, three loss adjustors, two claim managers and one actuarial company. The IRC also says that the sector has over US $1 billion in total assets - but a similar number was reported 12 months ago.

The total insurance claims incurred in 2024 was approximately US $79.7 million, which was an increase of 18.9 per cent from US $67 million in 2023.

By the end of December 2024:

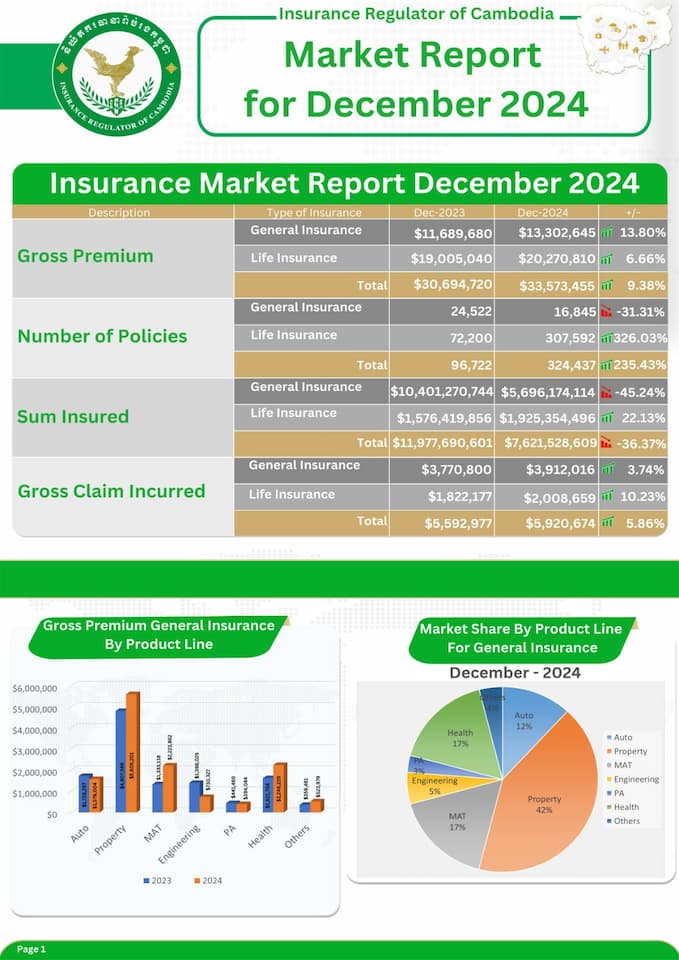

- Gross premium insurance alone increased by 9.4 per cent year-on-year (YoY) to US $33.6m.

- The Cambodian life industry increased by 6.7 per cent YoY to US $20.3 million - the number of policies increased by 326 per cent YoY to reach 307,592.

- The value of the general insurance sector in the Kingdom increased by 13.8 per cent YoY to US $13.3 million but the number of policies decreased by nearly one-third YoY (31.3 per cent) to 16,845.\

- Property is still the biggest segment of the insurance sector, followed by health.

IRC Director General Bou Chanphirou said of the results in 2024, “The insurance penetration and insurance density numbers illustrate that the Cambodian insurance market has potential room for further growth. There is also a need for public outreach and education on the benefits and advantages of insurance,”

This same messaging has been said for several years now in Cambodia - Looking at the past few years data for Cambodia:

- 2020 - Total gross insurance premiums reached US $271.5 million.

- 2021 - The gross premiums were US $299.8 million and the sector achieved a penetration rate of 1.11 per cent of GDP and an insurance density of US $18.75 per capita

- 2022 - Total gross premiums were US $331.8 million, and the penetration rate of insurance in Cambodia was 1.14 per cent of GDP.

- 2023 - Total gross premiums were US $342 million, and insurance penetration was 1.16 per cent of the GDP in 2023, representing insurance density at US $21 per person

The Cambodian government and industry stakeholders are actively working to improve these and set ambitious targets to increase penetration to 5.5% and density to US $135 per capita by 2030. The full detailed annual report from the IRC for 2024 is still due and is usually out at the end of the first quarter.

On February 5 2025, the IRC and the Department of Enterprises and Insurance Supervision (SOEI) from Laos’s Ministry of Finance also signed a memorandum of understanding to promote insurance cooperation.

Impacts of the National Social Security Fund (NSSF)

Consumer behaviour has also been impacted and individuals may also be making budget cuts and relying more on the expanding social services rather than spending on the rising costs of private health care - which has been increasing annually.

While some media blame external factors, the growth of NSSF for medical coverage and the rising costs of health insurance in the region must also be considered for the slow growth - at least for medical coverage.

For Cambodians, the NSSF has helped to some degree with medical coverage - but the NSSF also covers eligible foreigners in Cambodia and can be accessed via an app.

_20250205_154932.jpg)

The government should be credited for rolling out the services which will continue to expand in 2025 as part of the implementation of the “Roadmap for Universal Health Coverage in Cambodia 2024-2035” - which is the state’s strategic plan aimed at ensuring universal healthcare access for all Cambodian citizens. The target is to provide NSSF coverage to 80 per cent of the population by 2035.

Under the Social Security Law enacted in 2019, all Cambodian companies are required to register their employees for NSSF health services.

In 2024, the National Social Security Fund (NSSF) fund’s healthcare services were used just under 8 million times at a cost of approximately US $162.55 million.

The Ministry of Labour and Vocational Training - which looks after the NSSF - reported that by mid-January 2025:

- There were a total of 2,713,694 members (more than half were women - 1,503,345).

- Just under half a million are employed in the Cambodian public sector.

- 1.5 million are covered by private companies under labour law provisions.

- Half a million (511,337) are self-employed.

- 158,265 are dependents of NSSF members.