Cambodian Consumer Report 2024 - We Unpack The Latest On Consumers Sentiments

For the second consecutive year, Confluences in partnership with Standard Insights, has released its annual Consumer Report for the Cambodian market which covers a range of insights into Cambodian consumer preferences and perspectives.

So are Cambodian consumers in a positive mindset economically and financially, and what are the current paint points and concerns?

(All images are from the Consumer Report Cambodia)

Confluences CEO Soreasmey Ke Bin said in the report, “Global uncertainties, such as geopolitical tensions, impact consumer sentiments and behaviours. Our report reflects this by presenting the strengths and challenges faced by Cambodian consumers, highlighting the

mix of optimism about the economy and concerns influenced by these global conditions.

This year's report, meticulously analysed by Confluences and Standard Insights, offers valuable insights into Cambodian consumer behaviours and preferences. It starts with an overview and then dives into a more detailed sector-specific analysis.”

What Is New - Cambodian Consumer Report 2024

In 2024, the Consumer Report has expanded also to include coverage of consumer budget priorities and future work trends.

Confluences Business Development Manager Dara N. Vann told B2B Cambodia, "The Cambodian consumer report is not just data; it's a compass for readers and investors guiding them through the opportunities in Cambodia, providing crucial insights into market trends, consumer behaviours, and untapped opportunities that can redefine your strategic approach and drive success in one of Asia's most promising markets."

Confluence said at the time of releasing the free report, “The report delves into Cambodian consumers' attitudes, spending habits, and economic views, shedding light on their environmental awareness and personal goals. Key areas like budgeting, travel preferences, and streaming habits are explored to understand what motivates Cambodian consumers today.”

The research survey (online study) on the consumer landscape in Cambodia was conducted in March 2024 including the responses of just over 500 respondents (the number was in excess of 1,000 in 2023). The report examines “essential areas such as budgeting habits, travel preferences, and streaming habits, to better understand what motivates Cambodian consumers today.”

You can read more about our analysis of the 2023 Consumer Report here.

Consumers On Cambodia’s Future - Focus On Finance and The Economic Recovery

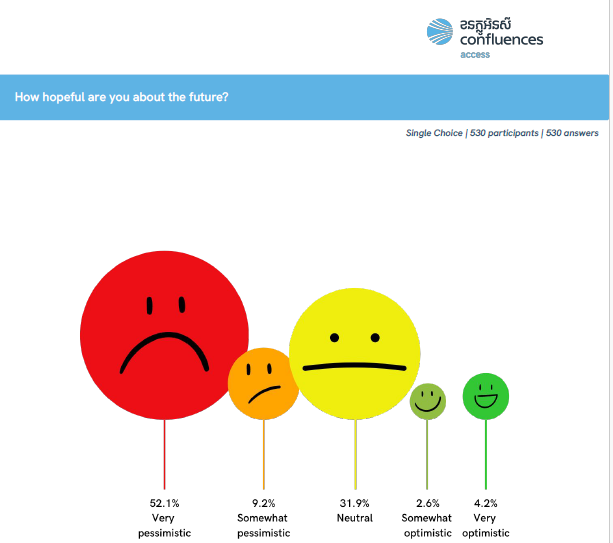

The Cambodian market consists of 60% of Gen Z (between the ages of 12-27 in 2024) who are generally considered young and tech-savvy, and their views on Cambodia reflect that there is “predominant pessimism towards the future among respondents” with the age groups of 25-34 and 18-24 showing the highest levels of pessimism.

However economy-wise Confluences Business Development Manager Dara N. Van adds that more than 60 per cent expressed confidence in the direction of the economy, while nearly 40 per cent were ‘very confident’). “There is more optimism in areas which are starting to see the benefits of investment outside of the traditional hubs,” she added.

- Respondents under 24 years of age were more optimistic about the economic outlook, while older groups were unsure.

- The 2023 report indicated that nearly 70 per cent of Cambodians expressed a positive attitude, while 91 per cent were hopeful about their future - the latest date suggests a decline in the positive outlook.

Cambodian’s Financial Goals

- The leading financial priority across all demographics in Cambodia is paying off debt with more than a third indicating so.

- Less than 5 per cent had an interest in stocks or funds.

- A third are seeking to reduce unnecessary expenses.

- The top planned purchases are vehicles, electronics, and real estate - while general consumer interests remained varied.

- Education was still an important target, especially for younger age groups.

Future of Work - Job Security and Advancement Are Key

There is a concern over job security and advancing careers in particular while balancing financial returns and work-life balance are in the minds of most respondents.

The report states that “Job Security, Competitive Salary, and Opportunities for Advancement are deemed the most important factors across all age groups, genders, and locations.”

- Work-life balance was considered necessary and extremely important by most respondents (more so for 35-44 and 25-34 age groups and women find it 'extremely important.')

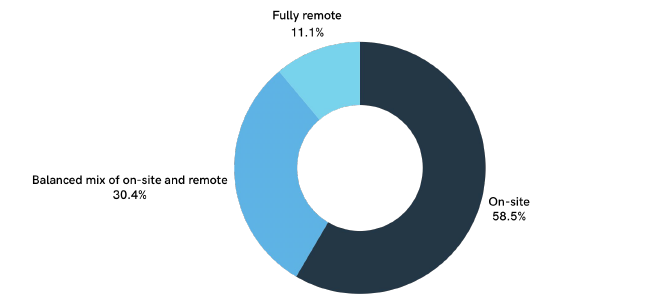

- On-site is preferred by most Cambodians, while a mix of remote work and on-site increases with decreasing age groups.

- The impacts of AI (Artificial Intelligence) raised concerns about job security across all age groups, genders, and locations.

- Fewer than half expressed a desire to use AI in the future with younger age groups more inclined to do so.

Travel Plans Take a Hit For Cambodian Consumers

Much like how Cambodia has seen lower levels of international tourism compared to pre-COVID, nearly half of all respondents in Cambodia suggested they have no travel plans as they tighten purse strings and there is an anxious outlook on the financial climate.

Some of this sentiment has rolled over from 2023, where the main concerns included the rising cost of travel and the complexities of navigating regulations.

- Individuals aged 18-24 are most interested in travelling.

- Males showed less inclination than females to travel in the coming year.

- 45 per cent were still planning 1-5 trips (it was not indicated if this statistic was for domestic or international or combined) but the report added that a majority do plan to travel within Cambodia.

- The most popular regional destinations are Thailand, Vietnam, Malaysia and Singapore.

- Popular international destinations were Japan, China, South Korea, and France.

Consumers On Cambodian Retail Spending

On dining in particular, fewer respondents were dining at or ordering from fast-food restaurants, but younger age groups indicated more diverse responses regarding fast food consumption.

Across the range of retail and expenditures, there were strong indications that respondents wanted to reduce spending on dining, high-end retail, speciality foods, as well as leisure

Activities but the data overall shows a willingness to reduce expenses on a range of sectors.

On the flip side, educational services, health and wellness and home improvements showed the strongest growth areas for where consumers want to increase spending.

On health and wellness, Cambodians aged 18-24 and 35-44 were most enthusiastic about health and fitness, while those under 18 and aged 55-64 showed less interest. Nearly half of all respondents indicated they were involved in physical activities frequently or very frequently and only ten per cent said never.

Social Media Impacts On Cambodia & Trustworthy News Sources

The debate continues to rage globally on the impacts of social media, with accusations of mental health damage, while in the US and Europe, it has become politicised due to the bans or restrictions on Chinese-owned TikTok.

- The Cambodian Consumer Report 2024 indicated mixed views from the younger age groups while those aged 35-44 were more negative.

- Males generally have more positive perceptions about the impact of social media compared to females.

- Nearly one-fifth indicated social media had a “very negative” impact, a quarter said it had a neutral impact and another quarter suggested it is “very positive”.

- Nearly half use social media as a news source.

Online websites were the top choice for news and information (with just over 55 per cent), followed by social media and TV, with younger generations preferring online sources, and older generations using a mix.

- A third trust new media (online) more, while 42 per cent still trust traditional media more.

- From a streaming perspective, YouTube was by far the most popular (also it is free), ahead of Netflix and other paid-for streaming services.

Sustainability

Environmental concerns seem to be more front and centre in 2024 as is the desire to achieve a greater level of sustainable living which the respondents recognised as necessary among the younger generations, while the 55-64 age group considered it "Not important at all."

- Respondents valued this as "Important" or "Extremely Important."

- Females and males suggested they prioritise sustainable living

- The importance of Sustainability was consistent with particular emphasis in areas such as Kampong Speu and Takeo.