Cambodia Business in 2025 and What to Expect in 2026

As we enter 2026, we reflect back on some of the main developments and highlights from what was a challenging year for the business community in Cambodia. Businesses faced various geopolitical shocks and structural imbalances, while continuing to adjust and stabilise.

While the short-term pressures are certainly harsh, Cambodia’s overall long-term growth outlook remains positive, supported by higher foreign direct investment (FDI), new infrastructure, expanded air connectivity, and a capital market that remained stable during periods of uncertainty.

A Year of Shocks, But Not Collapse

The real estate sector continued to struggle with oversupply and weak demand, problems rooted in the pandemic and compounded by tight liquidity. Concerns over U.S. tariffs eased later in the year, although the initial announcement disrupted export-oriented industries. Border conflicts also temporarily disrupted business operations and trade flows, adding pressure to the recovery.

Major institutions, including the International Monetary Fund (IMF), the World Bank and Asian Development Bank (ADB), have lowered Cambodia’s growth forecasts for 2025 and 2026, citing weakening external demand and domestic challenges.

The IMF expects growth to slow to 4.8 per cent in 2025, and further to 4.0 per cent in 2026, reflecting export volatility and softer tourism activity. Similarly, the World Bank projects growth of 4.0 per cent for 2025 and 4.5 per cent for 2026. On the other hand, the ADB projects a slightly more positive growth rate of 4.9 per cent for 2025, and 5.0 per cent for 2026.

“Cambodia’s economy remained robust in 2025, despite global volatility and border conflict,” Dr. Darin Duch, Economist and Assistant Professor at the American University of Phnom Penh (AUPP), told B2B Asia News. “A projected growth of around 5.2 per cent (by the Cambodian government) was underpinned by exports, which rebounded, tourism recovery, construction, foreign direct investment and domestic consumption. Contributing factors included robust macroeconomic management and sound fiscal policy.”

U.S. Tariffs and Cambodia-Thailand Border Conflict

The first major shock of 2025 came in February, when the United States announced a 49 per cent tariff on Cambodian goods, placing Cambodia among the most affected countries. After several rounds of negotiations, the tariff was reduced to 19 per cent, easing pressure on exporters.

The reduction helped protect jobs for nearly one million workers, particularly in the garment, footwear, and travel goods sectors. With the US accounting for around 38 per cent of Cambodia’s total exports, the lower tariff helped preserve Cambodia’s competitiveness.

In 2024, Cambodia exported approximately USD 12.6 billion worth of goods to the U.S. With the revised tariff lower than that faced by some regional peers, the new rate may also support Cambodia’s position in global supply chains.

The second major shock of the year came in May, when tensions across the Cambodia–Thailand border reignited. This led to the closure of land border crossings in June, and escalated further into direct armed conflict in July. Following a brief period of a shaky ceasefire, a longer 20-day period of armed clashes took place in December, only ending after a new ceasefire agreement was signed on December 27.

In addition to the massive toll the conflict has had on the livelihoods of people living along the border—with hundreds of thousands displaced in Cambodia alone—trade and supply chains were also significantly disrupted following the border closure. However, Cambodia has been quick to adapt, increasing trade volumes with Vietnam and importing more products from other ASEAN countries like Malaysia to replace goods that were traditionally sourced from Thailand.

Capital Markets: Stability and Milestones

Despite geopolitical tensions, the Cambodia Securities Exchange (CSX) remained stable. The exchange reported that trading activity and investor confidence were largely unaffected during periods of border conflict.

2025 was also an important year for Cambodia’s bond market:

- ACLEDA Bank raised USD 200 million, the largest bond issuance to date.

- SchneiTech Dynamic issued USD 50 million in bonds.

- Daun Penh Agrico prepared an upcoming USD 49 million bond listing.

On the equity side, the CSX welcomed Picasso City Garden to its Growth Board, showing continued interest in capital-market financing.

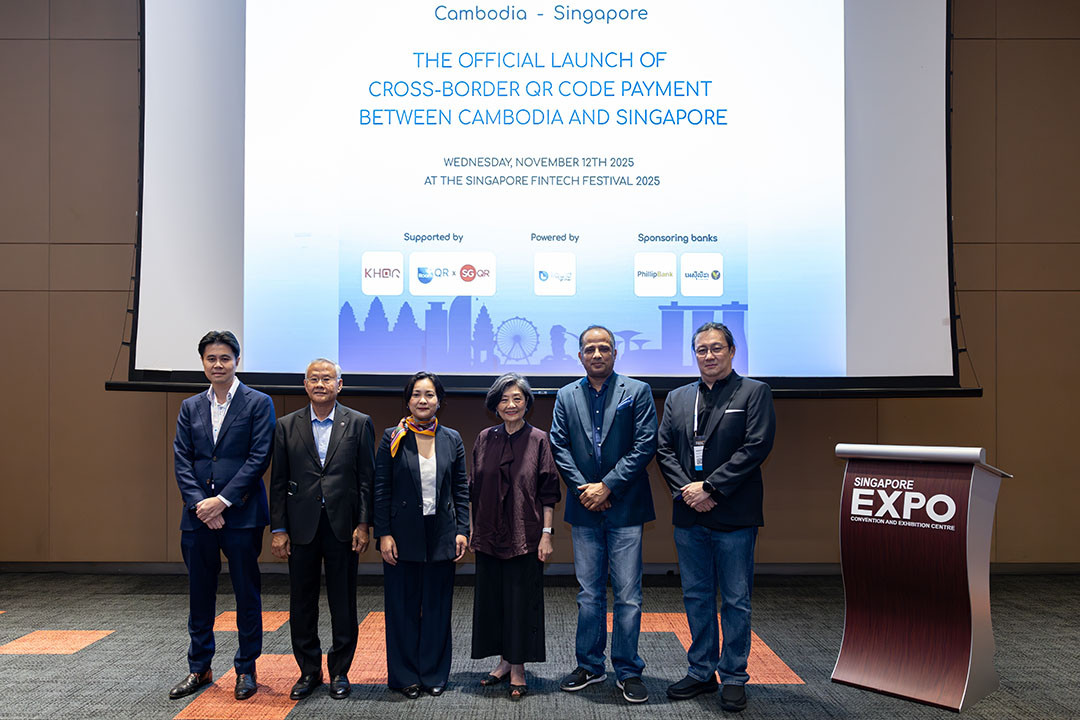

Advancements in Cross-Border Payment Agreements

In 2025, Cambodia made progress in regional financial integration. The country launched cross-border QR code payments with Singapore and expanded Phase II cross-border payments with Laos.

The National Bank of Cambodia (NBC) and TenPay Global also signed a Memorandum of Understanding (MOU) to establish a cooperation framework to jointly promote interoperability between Cambodia's Bakong system (KHQR) and China's Weixin Pay mobile payment network.

Furthermore, ACLEDA Bank and NPCI International Payments Limited (NIPL)—the international arm of the National Payments Corporation of India (NPCI)—officially signed an agreement on December 4 to enable UPI & KHQR Acceptance in India and Cambodia. The first phase of this agreement (India QR UPI scans KHQR) is projected to launch in Semester 2 of 2026.

These developments support Cambodia’s move towards a cash-lite economy and improve efficiency for tourism, trade, and small businesses.

Infrastructure, Aviation, and Investment

A major milestone in 2025 was the launch of Techo International Airport, strengthening Cambodia’s long-term logistics and tourism capacity.

Air connectivity also further expanded:

- India’s IndiGo introduced new routes to Siem Reap in November.

- Etihad Airways launched flights from Abu Dhabi to Phnom Penh in November.

- Turkish Airlines began flights from Istanbul to Phnom Penh in December.

On the investment front, the Council for the Development of Cambodia (CDC) approved USD 9.5 billion in investment capital across more than 600 projects in the first 11 months of 2025, an increase of 60 per cent year-on-year.

Another notable development was the launch of BYD’s assembly plant in Cambodia, which began operations in 2025. Cambodia also received exclusive rights from General Motors (GM) to assemble Chevrolet vehicles in the coming years.

Tourism: Mixed Performance

Tourism performance in 2025 was mixed. According to the Ministry of Tourism, Cambodia received 4.37 million international visitors in the first nine months of the year, a 8.8 per cent year-on-year decline.

Thailand remained the largest source market with 978,826 visitors (down 35.9 per cent), followed by Vietnam with 906,398 visitors (down 6.9 per cent). In contrast, arrivals from China increased 46.3 per cent to 889,089, partly offsetting declines from neighbouring countries.

_20250908_114407_20260101_121200.jpg)

What to Expect in 2026

Looking ahead, 2026 is expected to be a year of gradual transition rather than rapid growth.

- 5G coverage is expected to expand in major cities and provinces.

- The real estate sector will continue facing oversupply and weak demand, making consolidation likely.

- Capital Gains Tax will be implemented in January 2026

“When I look to 2026, I am optimistic that the future is bright. Cambodia’s emphasis on infrastructure, digital economy, human capital and diversification may improve productivity and competitiveness,” said Dr. Darin Duch.

“I hope that the major expectation by 2026 is growth of better quality—higher value-added exports, strengthened SMEs and deepened integration in regional and global supply chains while preserving price stability and fiscal sustainability.

“War shocks, for example, can raise production costs and impact inflation if not properly handled. But Cambodia is relatively less exposed compared to bigger economies. It is the diversified nature of our export markets, robust financial system, more foreign direct investment, and good calibration of monetary and fiscal policy that mitigates these external shocks,” he concluded.

While risks remain, Cambodia enters 2026 with stronger institutions, a more developed capital market, and improving connectivity, providing a foundation for steadier growth ahead.