ABA Bank Reimagines Online Banking with Launch of ABA Business for Cambodia

Cambodia Investment Review speaks with Bekzod Ruzmetov, Head of ABA Business and Data Analytics Division, ABA Bank.

CIR: What motivated ABA Bank to rebuild its online banking platform recently, and how did the needs of both small enterprises and large corporations shape the final product?

Answer:

We rebuilt our platform – now called ABA Business – to make business banking easier, safer, and ready for the future. We wanted a system that works for all types of businesses.

We listened to our Relationship Managers, reviewed customer feedback, and looked at trends in the market. As a result, ABA Business is more than just a website – it’s a complete platform designed to help businesses run better.

Here’s how it works for different users:

- For small businesses:

Think of a family-run shop where each family member has a different role. ABA Business lets them each have their own login with clear responsibilities. It’s safe, organised, and simple to use. - For larger companies:

Bigger firms often need approvals at different levels. For example, a payment over a certain amount can require the CEO’s sign-off. Our platform makes these controls easy to set up, keeping things transparent and secure.

In short, ABA Business grows with your business. Whether you’re just starting out or running a large company, the system fits your needs.

CIR: Can you explain how features like Virtual Accounts and Host-to-Host integration help large clients manage complex payments and accounting? How do they work with systems like SAP?

Answer:

Sure. Virtual Accounts and Host-to-Host (H2H) are tools that help large businesses handle many payments and reports more easily.

- Virtual Accounts help companies track where money is coming from.

For example, if a business runs a network of petrol stations, it can use separate virtual accounts for:- QR payments for fuel

- Card payments at POS terminals

- Mini-mart sales at each station

This makes it easy to track income from each source and location. Reports are clear and updated in real time.

- Host-to-Host Integration connects a company’s ERP system (like SAP) directly to ABA.

This means:- No need to upload payment files by hand

- No double data entry

- Fewer mistakes and faster transactions

- Automated workflows for payroll, vendor payments, and collections

Together, these tools make business operations more accurate and efficient while saving time and improving cash flow visibility.

CIR: How important are features like batch payments, payroll, and tax payments for your clients? What are the results so far?

Answer:

These features are very important – especially for businesses with many staff, suppliers, or bills to pay.

Right now, more than 60 per cent of all transactions on ABA Business are done in batches. That shows how valuable this tool is.

Without batch payments, companies would spend hours doing payments one by one. Now, they can process salaries, taxes, utilities, and supplier payments all at once – in just a few clicks.

Our payroll service also protects privacy and fits businesses of any size. We’re seeing faster processing, fewer mistakes, and better use of time. Finance teams can now focus on bigger tasks instead of repeating the same work every month.

CIR: Security is key in banking. How does ABA protect data on ABA Business, especially with the new mobile app?

Answer:

Security is a top priority for us. Every new feature goes through strong internal tests and independent security checks.

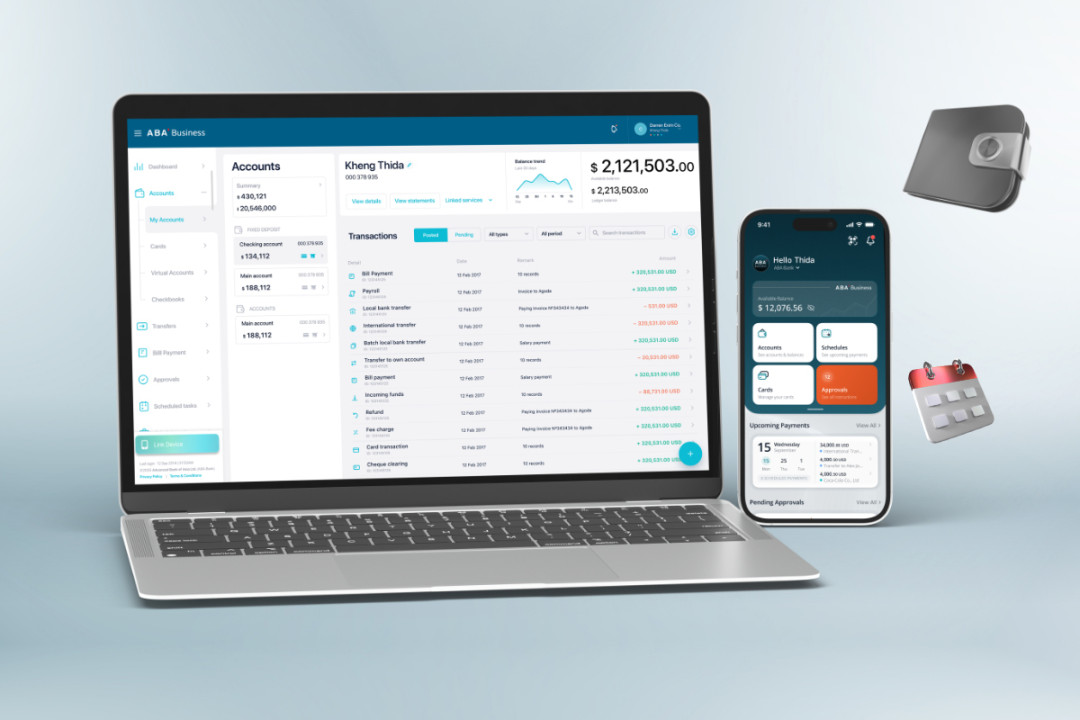

ABA Business works together with the ABA Business mobile app, which adds even more safety:

- Two-factor login

- End-to-end encryption

- Digital signatures for all transactions

- No sensitive data is stored on your phone

This way, both web and mobile users are fully protected.

CIR: As you complete the platform migration and launch the mobile companion app, what’s next for ABA Business?

Answer:

We’ve officially completed the move to ABA Business and retired our old security tool, DigiGuard. The ABA Business app now handles all approvals and login security.

Looking ahead, we’re focusing on three things:

- Making the platform work even better for startups, SMEs, and large companies.

- Adding new tools like advanced reports and cash flow analysis.

- Keeping everything safe with the highest security standards.

We’ll keep updating the app with new features that help businesses grow – like mobile approvals and real-time insights – all without compromising security.

CIR: For businesses interested in ABA Business 2.0, how can they get started? Who should they contact?

Answer:

It’s easy to get started. Just talk to your Relationship Manager, visit any ABA branch, or call our 24/7 Contact Center toll-free at 1 800 203 203. Our team will guide you through every step of the onboarding process.

This press release was supplied.