Analyse and Improve Financial Spending Habits With ABA Analytics – Vathana Ban, Senior Digital Product Owner at ABA Bank

B2B Cambodia interviewed Vathana Ban, Senior Digital Product Owner at ABA Bank, to discuss the bank's new Analytics feature built into the ABA Mobile app, designed to help customers track, analyse, and better manage their financial spending habits.

B2B Cambodia: What is ABA Mobile’s Analytics, and who is it useful for?

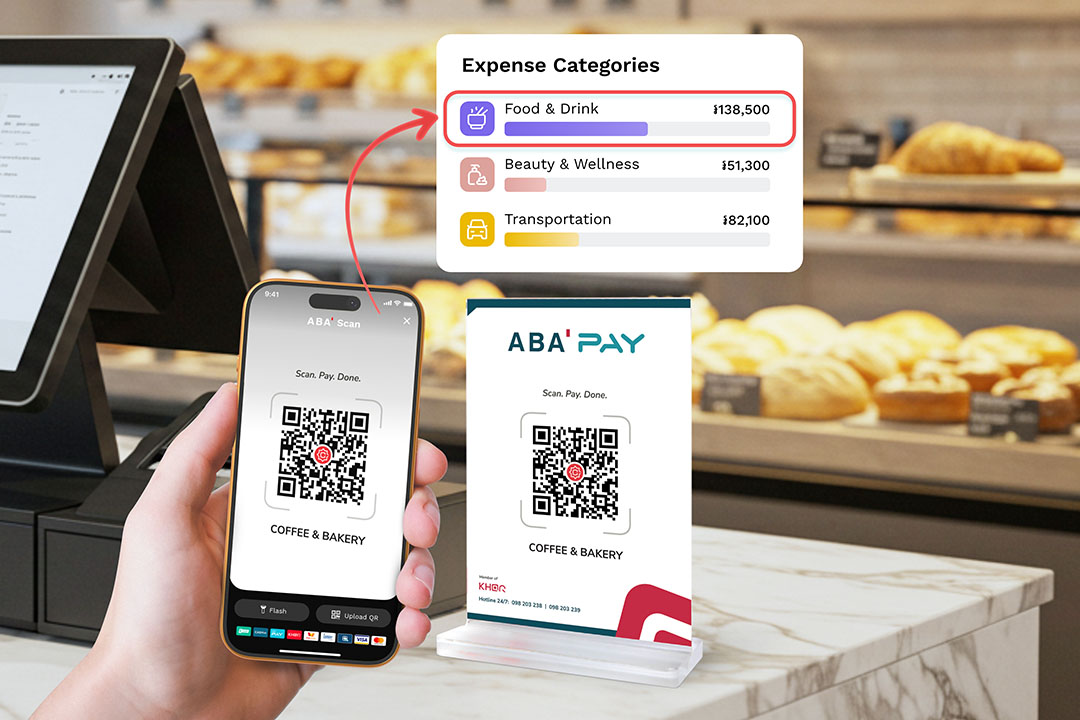

Vathana Ban: "Analytics in ABA Mobile is an innovative tool that helps ABA customers clearly understand how they spend and manage money. It automatically categorises expenses, shows visual summaries, and helps track income and savings.

"It is helpful for all Cambodians—students learning to manage pocket money, families planning household budgets, and small business owners monitoring daily expenses. It supports the broader goal of improving financial literacy and inclusion in Cambodia by making financial data accessible and easy to understand for everyone."

B2B Cambodia: Why did ABA decide to introduce this new feature?

Vathana Ban: "ABA introduced Analytics to help Cambodians gain better financial awareness and make informed money decisions. Many people struggle to manage their spending or plan their savings. Analytics addresses this by transforming raw transaction data into clear insights. It is our commitment to caring for our clients’ financial health and sustainability, ensuring that customers not only use digital banking conveniently but also improve their overall financial well-being. It also aligns with national efforts to promote financial inclusion and literacy across Cambodia."

B2B Cambodia: Many people find it hard to keep track of where their money goes. How does Analytics make this easier?

Vathana Ban: "Analytics automatically classifies every transaction—such as food, utilities, or transportation—without users having to record anything manually. It shows where money goes each month, with charts and comparisons that make spending habits easy to understand.

"The only condition to make this work is to use cashless payments through ABA Mobile or ABA cards, either locally or internationally. This approach makes it convenient, secure, and effortless for customers to track their expenses automatically, promoting a smooth transition toward a cashless and transparent economy."

B2B Cambodia: Can you share an example scenario of how the feature supports budgeting or saving goals?

Vathana Ban: "For example, a user can set a limit on monthly entertainment or dining expenses. If their spending approaches that limit, ABA Mobile notifies them instantly. It encourages conscious financial behavior and supports personal saving goals, such as saving for education, family needs, or the future. Over time, users learn to spend wisely and save regularly, reinforcing the national goal of improving financial discipline among citizens."

B2B Cambodia: Since the feature processes sensitive financial data, how does ABA ensure customer privacy and data security?

Vathana Ban: "Security and privacy are ABA’s top priorities. All data stays within the bank’s secure environment and is encrypted according to international and Cambodian banking security regulations. No financial data is shared with external parties. Our system fully complies with Cambodian regulatory standards on data protection and supports safe digital financial practices—an essential part of building trust in Cambodia’s robust and evolving financial sector."

B2B Cambodia: How can ABA Bank customers access the Analytics feature?

Vathana Ban: "Every ABA Mobile user can access Analytics directly in the app—simply tap on the “Analytics” button in the main menu or dashboard of your ABA Mobile and start exploring spending insights.

“The feature works automatically for transactions in both Khmer riel and US dollars, helping customers better understand and manage money in their preferred currency.”

B2B Cambodia: Why is it important for people to develop conscious financial practices?

Vathana Ban: "Conscious spending and saving habits are key to long-term financial stability. By helping customers see and manage their finances, ABA supports the national financial literacy strategy and promotes responsible money management.

"The goal is to empower Cambodians to take control of their money, save more in riel, and make better financial decisions that strengthen both individual well-being and our national economy."

B2B Cambodia: Have you seen any behavioral changes in users – for example, more savings, better control of spending?

Vathana Ban: "Indeed! Many users now regularly review their Analytics, adjust their budgets, and start saving more systematically. We observe growing awareness of responsible money management, especially among young professionals and students who are new to financial planning. These behavioral shifts contribute to a stronger culture of saving and smarter use of financial services."

B2B Cambodia: Do you see Analytics becoming even smarter in the future?

Vathana Ban: "Yes. Future versions will include personalised insights and financial recommendations based on spending habits, savings goals, and lifestyle. For example, users might receive suggestions on how to save more in riel or manage recurring payments better. Over time, ABA Mobile Analytics will evolve into a personal financial assistant that helps users plan, save, and spend more effectively, supporting both individual prosperity and Cambodia’s vision of a fully digital, financially inclusive society."