Cambodia's Major Industries

Cambodia’s Biggest Industries

Read on to learn about the progress of Cambodia’s key industries, the outlook for the future, and the impact of Special Economic Zones.

What GDP Growth Are Cambodian Key Industries Experiencing?

Cambodia has been experiencing robust economic growth since 1998 with an average annual GDP growth rate of around 8 per cent until the global pandemic.

This economic growth has been driven mainly by the expansion of Cambodia's key industries of tourism, agriculture, garment manufacturing, and construction. These are all hoped to achieve the government’s vision of turning Cambodia into a middle-income country by 2030 and a high-income country by 2050.

During the COVID-19 global pandemic, Cambodian economic growth slowed down to 3.1 per cent in 2020, and according to the World Bank's Economic Update, Cambodia's real economic growth rate for 2022 was 5.2%. Post-pandemic levels have risen above 5 per cent in 2023 - the country's GDP growth is forecast to maintain around 6 per cent in 2024 and reach 6.5 per cent in the medium term from 2025-2027, according to new government data.

The Pentagonal Strategy – Phase 1, which is being implemented by the new government which took its seat in 2023, outlines the intention to focus on implementing institutional reform and introducing new measures to address current issues that businesses and investors face in Cambodia.

Cambodia's Textile & Garment Manufacturing Industry

How Has The Cambodian Garment Sector Improved?

Significant progress has been made in improving the welfare of garment workers in Cambodia through the implementation of the International Labor Organization's (ILO) "Better Factories Cambodia" social compliance program as well as implementing various government reforms.

A notable achievement is the consistent annual increase in the minimum wage for garment workers. The minimum wage was increased in 2023 to USD $200, and for 2024 has been set at USD $204.

While the labour and technology efficiencies are lower in Cambodia than in established garment markets such as Vietnam and China, the labour pool is young, readily available and still more affordable. However, specialised training must be factored into predicted operational costs.

Where Do Most Cambodian Factories Operate?

According to former Prime Minister Hun Sen’s speech in 2023, Cambodia's total factories in the garment sector increased to 1,326, employing 840,000 workers.

Investors have been opening factories in areas such as the traditional epicentres located in outer Phnom Penh, but also along the Thai or Vietnamese borders.

New infrastructure projects mean the country is increasingly becoming better connected internally and to international markets.

Special Economic Zones in Cambodia, especially those located close to ports of export, offer advantages in setting up cost-effective garment production factories.

How Is Cambodia's Textile/Garment Manufacturing Sector Performing Post COVID-19?

The growth of Cambodia's garment sector has been a significant success story for the country's economic development. Evidently, before the pandemic, the garment industry accounted for 74 per cent of Cambodia's merchandise exports, and in 2022, the garment sector contributed 57 per cent of Cambodia's exports.

In 2023, Cambodia's exports of garment, footwear, and travel goods amounted to USD $11.12 billion, a 12% decrease from the previous year's total of USD $12.68 billion.

- Apparel and Textiles: Approximately USD $8.02 billion, down 11.43%.

- Footwear: Contributed about USD $1.36 billion, marking a significant drop of over 21%.

- Travel Goods: Totaled around USD $1.63 billion, which represents an 8% decrease

How Did EBA Removal Impact Cambodia’s Garment Industry?

On August 12, 2020, the European Commission decided to partially withdraw Cambodia's preferential access to the EU market under the European Union's Everything But Arms (EBA) trade scheme, which affected selected garment and footwear products, all travel goods, and sugar exports.

Under the EBA, Cambodia was granted full duty-free and quota-free access to the EU market for all products except arms and ammunition, making it Cambodia's largest trading partner.

Generalised Scheme of Preferences (GSP)

After the partial EBA withdrawal in 2020, the United Kingdom offered Cambodia trade privileges on exports and was eligible for tariff-free exports under the United Kingdom Generalised Scheme of Preferences (GSP).

Despite the removal of the EBA trade scheme, Cambodia's trade with the EU did not decline.

- Export trade was valued at USD $3.229 billion in 2021 to the UK.

- In 2022, Cambodian exports to the EU reached a value of USD $4.045 billion and decreased to USD $3.66 billion in 2023.

Read: What Does The UK Developing Countries Trading Scheme Mean for Cambodia?

Cambodia’s Agriculture Industry

How Is The Agriculture Sector In Cambodia Performing?

The agricultural sector in Cambodia continues to play a pivotal role in the nation's economy and societal structure. Despite a modest projected growth rate of 1.1% for 2023, agriculture remains a cornerstone of the Cambodian economy, engaging over half of the country's workforce. This is particularly noteworthy given the burgeoning diversification into other industrial sectors.

As the backbone of Cambodia's export economy, the sector boasts a diverse range of agricultural commodities such as rice, bananas, mangoes, cassava, cashew nuts, corn, palm oil, pepper, and tobacco. These products find their way across the globe, contributing substantially to the nation's export revenues.

Organic farming, although not widespread, is carving a niche in international markets, with organic rice, pepper, and moringa increasingly sought after in the US and European markets. Cambodian farmers and processors who meet international organic standards are beginning to reap the benefits of higher global prices for organic products.

- Agriculture contributed 22.2 per cent to Cambodia’s gross domestic product in 2022.

- According to the Cambodian Minister of Agriculture, Forestry, and Fisheries, the Kingdom exported 8.6 million tons of agricultural products worth USD $5 billion in 2022.

- In 2023, Cambodia's agricultural sector generated approximately USD $4.3 billion in revenue from the export of agricultural products, with a total export volume of around 8.4 million tonnes.

Rice Sector In Cambodia

Rice is deeply ingrained in the cultural and historical tapestry of Cambodia, with its cultivation being a cornerstone of the national economy. Cambodian rice yields, whilst traditionally less than those of more industrialised nations, are nonetheless substantial, averaging around 3.1 metric tonnes per hectare.

The Cambodia Rice Federation (CRF) is the authoritative body releasing annual insights into the nation's rice production.

- In 2022, Cambodia's rice exports generated US $1.255 billion. Milled rice, sent forth by 61 agricultural cooperatives to 59 countries, contributed US $414.29 million

- Paddy rice exports to Vietnam amounted to 3,477,886 tonnes, valued at US $841.09 million.

Over 80 per cent of these exports were destined for Mainland China, Hong Kong, Macao, and the European Union. Specifically, China (inclusive of Hong Kong & Macao) received 288,830 tonnes, the EU countries took in 221,504 tonnes, ASEAN members imported 63,733 tonnes, and other regions (spanning Africa, the USA, Australia, Russia, Ukraine, and various island territories) accounted for 61,937 tonnes.

Diversity marks the types of rice Cambodia exports, including aromatic, fragrant, white, parboiled, organic, and glutinous varieties. Each type caters to distinct international tastes and preferences, reflecting the versatility of Cambodian rice cultivation.

Read More - 7th Cambodia Rice Forum 2024 - What Was Announced?

Rubber Production In Cambodia

Rubber cultivation has a long history in Cambodia, dating back to French colonial times in the mid-1920s amid the rubber boom, and today still remains an important crop for the Kingdom.

The sector is also seeing an increasing number of domestic farmers, as well as foreign investors who use land concessions to build large-scale rubber plantations.

Cambodia exports rubber to China, Vietnam, Malaysia, Singapore, India, and the European Union among other countries.

- Cambodia earned USD $541.66 million from the export of rubber and rubber articles in 2022.

- In the first half of 2023, Cambodia earned USD $324 million.

Cassava Production

Cassava is amongst the main crops for Cambodia’s smallholder farmers and is an alternative to growing rice. Cassava is often used to produce animal feed and ethanol.

Between 2005 and 2013, Cambodia more than doubled its cassava growing area, and by 2019 cassava plantations covered 400,000 hectares. According to UNDP Cambodia, in 2021 Cambodia was the fourth largest cassava producer in Asia and the tenth largest globally, with over 12 million tons of fresh cassava root harvested.

According to the Ministry of Agriculture, Forestry and Fisheries:

- In 2022, Cambodia exported 3.230 million tonnes of cassava in 2022.

- Over the course of 2023, Cambodia exported 1.2 million tonnes of dried cassava chips, 1.9 million tonnes of fresh cassava, over 36,000 tonnes of cassava flour, and more than 74,000 tonnes of cassava waste.

- Cambodia's markets for cassava are Thailand, Vietnam, China, the US, Italy, the Netherlands, Canada, Malaysia, India and Singapore.

Nonetheless, as the second-largest agricultural crop in Cambodia after rice, cassava has the potential to contribute significantly to social and economic gains. In 2019, then Cambodian Commerce Ministry Secretary of State Mao Thora stated that the government's long-term vision is to become the world's most reliable producer and supplier of cassava.

Cambodia also released its National Cassava Policy (2020-2025) aims to position itself as a reliable supplier of cassava-based products for global markets.

Cashews In Cambodia

Cambodia introduced the National Cashew Policy 2022-2027 with the aim of improving the quality of its cashew production, along with competitive production output, by driving industrialisation and increasing the exports of finished, processed products instead of raw cashews.

The Cambodian government predicted a 25 per cent growth in the cashew sector by 2027 and 50 per cent by 2032.

According to a report from the Cashew Nut Association of Cambodia (CAC):

- Cambodia exported a total of 670,000 tonnes of cashew nuts in 2022 and the exports to the international market reached a value of USD $1.077 billion.

- In 2023, Cambodia exported 656,000 tonnes of cashew nuts, generating approximately USD $837 million in revenue

- Vietnam emerged as the primary export destination, importing 660,000 tonnes of cashew nuts from Cambodia.

Construction Industry in Cambodia

Cambodia's construction industry has been experiencing a significant boom and a staggering number of construction projects have been approved in Cambodia over the years. These have been a mix of residential, commercial, retail and infrastructure developments.

Cambodia's economy has experienced growth underpinned by the continued growth due to the country's positive performance in the construction and property sector but post-pandemic this sector has also been impacted. These include realistic property pricing as well as ensuring quality developments and appreciating the property buyer’s portfolio has changed.

The biggest investors in Cambodia's construction and real estate sector have traditionally been China, South Korea, and Japan.

According to the Ministry of Land Management, Urban Planning and Construction (MLMUC)

- Between 2008 and 2018, Cambodia approved 43,136 construction projects which amounted to more than USD $43.3 billion in investment capital.

- In 2019, the sector saw a total investment of USD $9.35 billion.

- This had grown to USD $ 11.2 billion in 2022 and is projected to achieve an AAGR of more than 6% during 2024-2027.

Phnom Penh & Sihanoukville

The demand for increased office space, serviced apartments, condominiums, and commercial buildings in Phnom Penh and Sihanoukville, from 2017-2020 in particular, contributed to the sector's growth.

While all sectors of the real estate industry experienced an influx of developments, this trend was particularly evident in residential real estate, especially in bustling urban cities like Phnom Penh.

In Phnom Penh:

- The total cumulative supply of serviced apartments is expected to reach around 9,000 units by 2026.

- At the end of 2020, the supply of condominium units was 21,935.

- By 2028, the total supply of condo units is projected to reach 83,023 units spread across 185 developments!

- By 2026, the total supply of borey units is estimated to reach 98,392 across 47 housing developments.

- By mid-2023, the total supply of hotel rooms in Phnom Penh was 14,624 keys, with 7,684 rooms expected to be added by 2028.

Sihanoukville faced significant challenges in its construction sector following the 2019 ban on online gambling and the pandemic. This led to the abandonment of nearly 400 construction projects by foreign investors but a new Sihanoukville master plan roadmap was introduced in 2023.

Tourism In Cambodia

Southeast Asia remains one of the fastest-growing tourism markets in the world, with Cambodia benefiting in the past from foreign visitors' "side trips" to Thailand, Vietnam, and other regional hotspots.

However the tourism sector is a key economic driver, and the government, the Ministry of Tourism, as well as the private sector, have all been improving the image of the Kingdom, diversifying the range of activities beyond its main attraction of Angkor Wat, and investing in the infrastructure, skills and eco-friendly options to appeal to a more diverse range of tourists.

As a result, the tourism industry in Cambodia has continued to grow and plays a significant role in employment:

- Cambodia directly employed 630,000 workers in 2019 (60 per cent of them being women)

- According to the World Travel and Tourism Council (WTTC), Cambodia directly or indirectly employed around 1.2 million people in 2023.

China has represented the largest number of foreign tourist visitors to Cambodia, and before the pandemic affected the global travel industry, helped drive international visitors to 6.61 million, with 11.3 million domestic tourists in 2019 - which was a record year.

It is hoped that tourists will gradually lengthen their stay in the Kingdom and visit other provinces such as Sihanoukville, Kampot, Kep, Mondulkiri, and Ratanakiri as they begin to attract tourists away from the temples at Siem Reap and the capital of Phnom Penh.

New Cambodian Ports And Airports

New airports, sea ports, and highways are all helping to encourage tourism. Direct airline routes as well as the relatively easy and affordable visa procedures for visitors have also helped to attract tourism to Cambodia.

The new Siem Reap International Angkor Airport opened in October 2023, with a capacity to handle around 7 million passengers annually, while the new Phnom Penh Techo International Airport is under construction and is scheduled to accommodate 30 million passengers annually and is expected to be completed by 2024 and start operations in 2025..

There are also several other airports under development as well as seaports which will allow for domestic and regional travel. The Funan Techo Canal is the biggest project announced and broke ground in 2024.

Post-Pandemic Tourism Recovery and Goals

The Cambodian Tourism Ministry has set a goal to attract at least 11 million foreign tourists by 2025 and 25 million by 2030.

By 2022, the Kingdom welcomed a notable increase in international visitors, reaching 2.2 million individuals, and in 2023, the Ministry of Tourism announced Cambodia welcomed a total of 5.45 million foreign tourists. The MoT is hopeful that in 2024, Cambodia could receive 7 million international tourists.

Some key updates in the tourism sector include:

Other Notable Industries In Cambodia

Manufacturing Assemblies In Cambodia

Clothing, textiles, and shoes still make up almost three-quarters of Cambodia's total exports, but the share of "other" manufactured items is expected to rise. The relatively low cost of labour in Cambodia makes it an attractive location for the labour-intensive stages of light manufacturing production tasks, including wire harnessing, producing parts for digital information appliances, chassis and auto body components, bicycle manufacture, and even gemstone polishing.

Increasingly, global companies are outsourcing these parts of the production process and Cambodia has been one of the beneficiaries, especially in its special economic zones (SEZs). However, most components & parts as well as raw materials are sourced from neighbouring countries such as Thailand, Vietnam, China, and Malaysia.

Cambodia's light manufacturing assembly sector, primarily but not exclusively located in SEZs, covers principally labour-intensive operations, including bicycle manufacturing, electronics and electronic manufacturing and assembly, and a mix of other light manufacturing products.

In 2017, Cambodia became the largest bicycle supplier to the European Union (EU) and it has remained one of the top exporters of bicycles. There are a number of bicycle manufacturers in Cambodia, including companies from Taiwan and the USA (Trek Bicycle, Ken International, Atlantic Cycle, Smart Tech, Worldtec Cycles).

Read More - Cambodia's Manufacturing Sector: Opportunities And Challenges In 2024

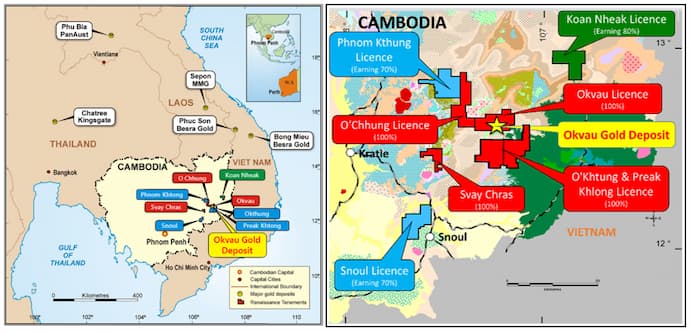

Mining And Natural Resource Exploration In Cambodia

Several large international mining companies are currently prospecting in Cambodia, and some have been successfully mining.

There is a belief there could be huge potential for the production of a number of minerals, including gold, copper, other base metals, bauxite, iron ore, and coal, as well as oil and gas, both on and offshore (although the latter has hit several obstacles over recent years),

Gold Mining Cambodia

According to Open Development Cambodia, there were more than 300 mining concessions listed for their operation throughout Cambodia in 2022.

For gold mining, several dozen gold exploration licences have been granted over the years but by 2023, only a total of six companies held active gold exploration licences. These licences cover areas in the provinces of Mondulkiri, Ratanakiri, Battambang, and Preah Vihear.

Between 2021 and 2023 Cambodia produced nearly nine tonnes of semi-refined gold bars (1,040 gold bars).

- Mesco Gold Cambodia acquired the rights to develop and mine the Phum Syarung prospect from the Canadian-listed exploration firm Angkor Gold Corporation in 2013, but since the pandemic, has had little progress

- The first commercial gold pour occurred in June 2021.

- By 2023, Cambodia achieved a revenue exceeding USD $15 million from gold production (the extraction of over 5.3 tonnes of ore bars, which are semi-finished products typically smelted at the mine and hold around 90 per cent purity.

- Australian-owned Renaissance Minerals (Cambodia) Ltd, based in Mondulkiri, has contributed the largest share of state revenues.

Oil And Gas Cambodia

Oil does also exist off the coast of Cambodia and in July 2019, Cambodia adopted its first legislation governing the extraction of oil from onshore and offshore fields, the Petroleum and Petroleum Products ("Petroleum Law").

Companies to investigate offshore deposits have been the Japanese Government Oil Company and the Vietnamese Government Oil Company.

However, it was KrisEnergy of Singapore who attempted to develop the Apsara oil field which it had purchased in 2014. By 2020, Cambodia became an oil producer and generated great excitement but the company quickly faced problems in 2021.

In October 2022, Angkor Resources, a Toronto-listed company, announced that its energy subsidiary, EnerCam Resources Corp. (Cambodia) Co., had obtained a licence for exploration, development, and production onshore in Cambodia.

In 2023, former Prime Minister Hun Sen called for a study on the country's untapped oil reserves offshore following the demise of KrisEnergy. Since then, Kuwait, a well-known oil producer, has expressed interest in the development of Cambodia's oil and gas sector.