Visa Announces Several Partnerships In Cambodia To Drive Ongoing Digitalisation Ambitions

One of the world’s leading digital payments service providers, Visa, has extended its resources and digital tools by signing MoUs with the Techo Startup Center and the Cambodian Ministry of Tourism, while also confirming it would continue its cooperation with the NBC (National Bank of Cambodia) aimed at strengthening the security of financial transactions - these are all part of the national agenda of growing secure financial digitalisation and boosting digital business.

Visa And Techo Startup Center Partnership

At the end of August 2024, Visa, which is a world leader in digital payments, signed a Memorandum of Understanding (MOU) with Techo Startup Center (TSC).

TSC is a government organisation created to foster startups and promote digital business in Cambodia today and this collaboration is aligned with the government’s Cambodia Digital Economy and Society Policy Framework 2021-2035.

The agreement covers best practices and knowledge sharing on digital-first strategies, workshops utilising Visa's expertise, and sharing Visa's resources on innovative technologies.

H.E. Dr. Nguonly Taing, Executive Director of TSC, said: “This partnership with Visa is another step forward in empowering Cambodian startups and businesses with the knowledge, resources, and tools they need to thrive in the digital age. Visa’s expertise in digital payments and its commitment to knowledge sharing will be invaluable to TSC in linking these support and resources to our Cambodian entrepreneurs as they navigate the ever-evolving landscape. We are confident that this collaboration will unlock Cambodia's full potential as a digital innovation hub.”

Visa’s Country Manager for Cambodia, Ivana Tranchini, said following the agreement being signed:

I’m so proud the Visa team can be part of this truly collaborative initiative to ignite the fintech startup ecosystem in the Kingdom! We’ll be looking for the next cohort of creative minds to help us and our partners find ways to better support the SMB community through financial technology.

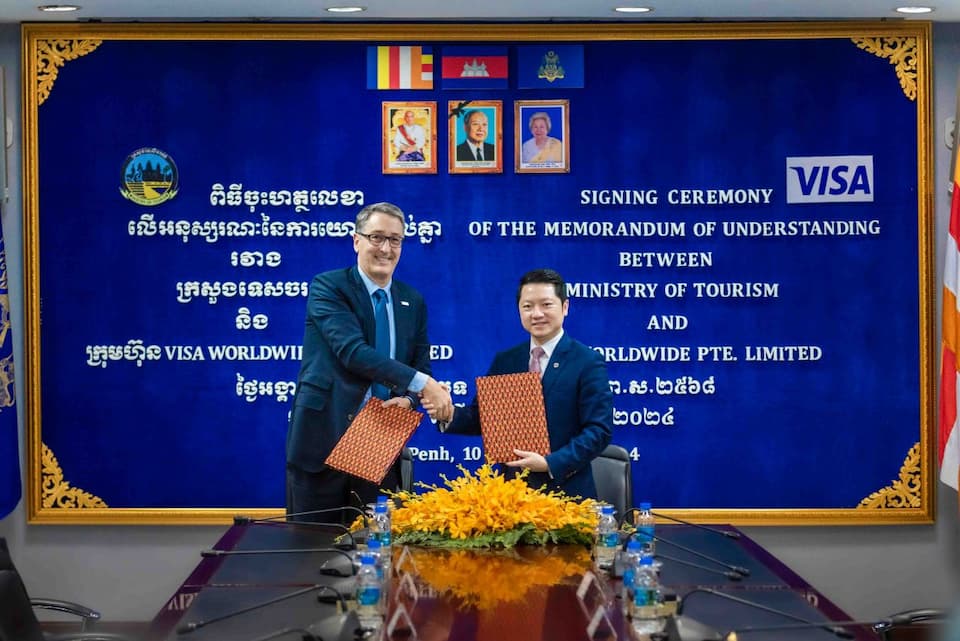

Visa Signs MoU With Cambodia Ministry of Tourism To Promote Digital Payment Solutions

The Visa and MoT partnership was announced in September and it is hoped the partnership will further boost tourism and digital payment solutions with the global payments provider supplying data insights using Visa Destination Insights.

This application is based on verified VisaNet transaction data and allows for real-time tracking of travel behaviours and trends and will support the ministry’s ambitions in cultivating a data and digital-first tourism strategy.

Sok Soken (Cambodian Minister of Tourism) and Arturo Planell (Visa’s Group Country Manager for Southeast Asia and Senior Vice President) signed the MoU in Phnom Penh. The MoT said in a statement online that the MoU focuses on key areas of cooperation, including sharing of tourism data and insights, marketing support, education and capacity building, digital transformation, particularly on digital payments in the tourism sector.

Planell explained, “The Ministry’s leadership has been fundamental to tourism recovery in the country, and it’s an honour for Visa to help accelerate that effort. Prime Minister Hun Manet’s recent announcement on revamping the Cambodia Tourism Board also encourages collaboration between the public and private sectors to enhance Cambodia’s tourism promotion strategies.”

It is believed that 60 per cent of tourist transactions in Cambodia are made via credit cards, and the introduction of the recently launched Bakong Tourists app, will probably grow this further once credit cards can be linked to the local payments app. The Bakong Tourists App can also be used in countries with which Cambodia connects cross-border payments, currently including Thailand, Vietnam and Laos.

The MoU focuses on data and insight sharing of tourism, marketing support, education and capacity building, in addition to digital transformation.

It was not made clear what changes would actually be made to further integrate Visa’s payment systems or how it would be better than the Bakong app. Visa already is widely accepted in Cambodia and they have partnerships with most banks in the Kingdom and said following the soft launch of the Bakong Tourists app that they are looking forward to being a top-up option very soon.

Ivana Tranchini (Visa’s Country Manager for Cambodia) said online, I am so excited for our Visa team to work more closely with the Ministry of Tourism, Kingdom of Cambodia and the broader tourism community to help tell this story to more travellers around the world. Through leveraging our data, insights and technology, as well as marketing channels and expertise, we look forward to supporting the growth of this critical sector of the economy.

Visa Destination Insights in Cambodia

However, utilising the firm's data will be beneficial to paint a clearer picture of transactions and tracking growth areas. Visa stated online, “This collaboration will leverage Visa's data-driven insights, marketing expertise, and facilitate financial and digital literacy for small businesses and merchants. Amplifying the impact of data analytics, Visa Destination Insights will play a crucial role in tracking travel behaviours and trends, enabling a more precise tourism strategy.”

Soken added:

This collaboration will enable us to integrate world-class digital payment systems and leverage Visa’s comprehensive data capabilities to offer a seamless and advanced experience for tourists, while also empowering local businesses to adopt modern payment solutions. This, in turn, will foster greater economic participation and ensure that the benefits of tourism are widely distributed across our society.

- Tourism contributed USD $1.14 billion in revenue and accounted for 12.4% of total employment in Cambodia in 2022.

- An estimated 6.6 million tourists are expected in 2024.

- Foreign tourists in H1 2024 spent an estimated USD $1.7 billion in Cambodia.

- Visa hopes to drive faster growth to support the ‘Cambodia-China People-to-People Exchange Year’ and the ‘First Cambodia-India Tourism Year 2024’.

National Bank of Cambodia (NBC) and Visa To Continue Collaboration On Payment Security

The multinational payment card services company also agreed to continue cooperation on strengthening the security of financial transactions after Arturo Planell and Tranchini met with Chea Serey, Governor of NBC.

The meeting concluded with agreed cooperation to expand financial and digital skills as well as strengthen transaction security in Cambodia.

NBC said, “Mr. Arturo applauded the advancement of payment systems developed by the National Bank of Cambodia, especially the Bakong and the recently launched Bakong Tourists App. He also expressed readiness for supporting the new project to participate in attracting international tourists to Cambodia and promoting payments in riel.”

The NBC Governor also welcomed the support and the possibility of using payment data for the analysis of tourists’ spending behaviours which can be a solid base of tourism strategy preparation.

- Via the Bakong app In H1 2024, there were 75 million riel transactions made to the value of 65 trillion riels, and 99 million US transactions valued at over USD $38 billion.

- The total volume of digital financial transactions in 2023 exceeded USD $492 billion.

There was mutual agreement on the significance of expanding cooperation in further promoting financial and digital literacy as well as strengthening the security of payments in the context of technology advancements.