CBRE Market Insights Q3 2024 - Property Market is Flat But Optimism Over Economic Growth

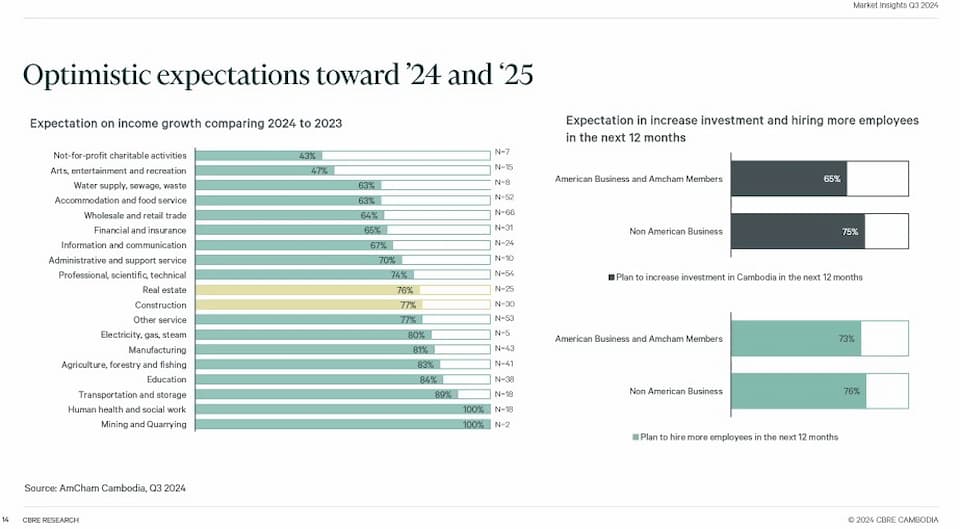

The CBRE Market Insights Q3 2024 report findings were presented via an online webinar on Thursday 17th October to assess the Cambodian real estate market. Truth be told, there were no real surprises in the report as the market continues to see stabilisation and moderate growth in some areas, but the overall outlook for the future indicates a patient albeit positive outlook as the Kingdom sees expected strong GDP growth.

CBRE Cambodia Managing Director Kinkesa Kim and Channdara Latt (manager of Research and Consulting) presented the overall economic outlook and broke down their analysis of the Office, Retail, Hospitality and Residential property sectors before answering selected questions posed by the online attendees.

If anything, the latter showed greater insight into some of the larger concerns in the market and the hesitancy of investors regarding what the best timing and opportunities there are in the local property market.

Cambodian Economic Outlook 2024-2025

Kinkesa Kim highlighted some of the key economic data and trends, much of it was already known if you follow the quarterly economic reports and media, but there were some nuggets that provided food for thought.

The most positive outlook is still hinged on the GDP growth of the Kingdom, which is anticipated to be approximately 5.8 per cent in 2024 and grow by potentially 6 per cent in 2025. In the ASEAN region, Cambodia is currently tracked as having the 3rd strongest GDP growth in 2024 (behind Vietnam and India) but it's the only economy expected to grow stronger in 2025.

Tourism remains a key driver, and yes, although year-on-year (Y-o-Y) compared to 2023 it is stronger - the data still lags behind 2019 figures (currently at 4.3 million tourist arrivals).

From a property point of view, the US $2.19 billion invested in the first 8 months of 2024 is down (Y-o-Y).

- Office - Occupancy rates are slightly up but prime rent remains flat (at around $27 sqm)

- Retail - Occupancy rates are down but prime rent remains flat (at around $22.1 sqm)

- Condominium - The supply is up with 970 units launched thus far in 2024 and the price sqm is down ($2,714 sqm high-end sales price).

- Landed Property - The supply is up with 250 units launched thus far in 2024 and the price of sqm is up for single villas ($1,177 sqm)

There is optimism as leading central banks internationally are cutting interest rates, notably in the EU and the US, while in China there have been new stimulus packages announced.

Other aspects that were highlighted were the renewed activities in Sihanoukville since incentives were announced for the incomplete buildings according to Kinkesa, with 140 projects now approved for incentives.

Combined with increased policy activity and regulations in Cambodian real estate from licensing, the launch of the digital platform for land registration and public services, the tax rates updates, and exemptions from capital gains tax delayed to the end of 2025 are all seen as forward-thinking initiatives.

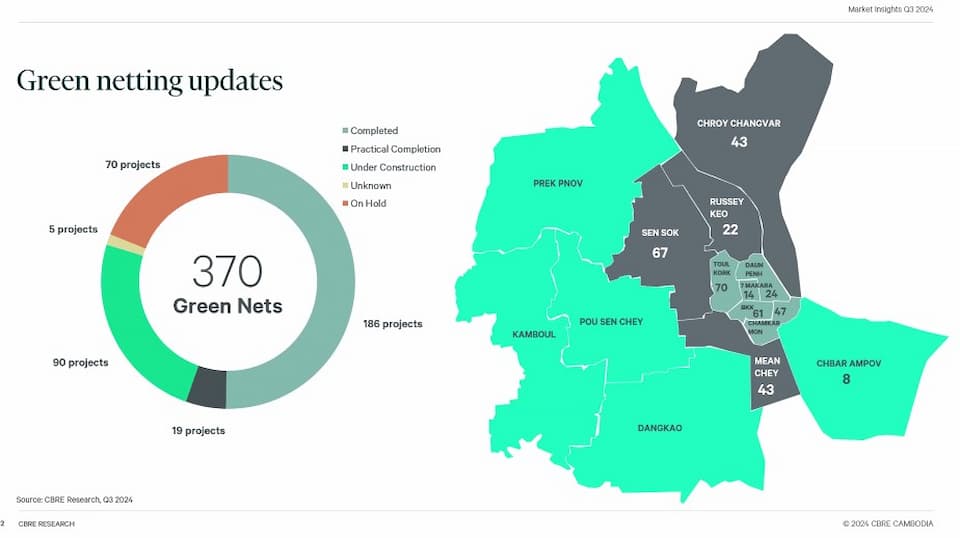

Construction investment has been on the decline annually since 2020 but CBRE says it's a healthy correction for the market, and that new projects (green netting projects) are concentrated in the residential sector followed by the commercial sector.

Property Sectors - Cambodia Q3 2024

Cambodia Retail Sector

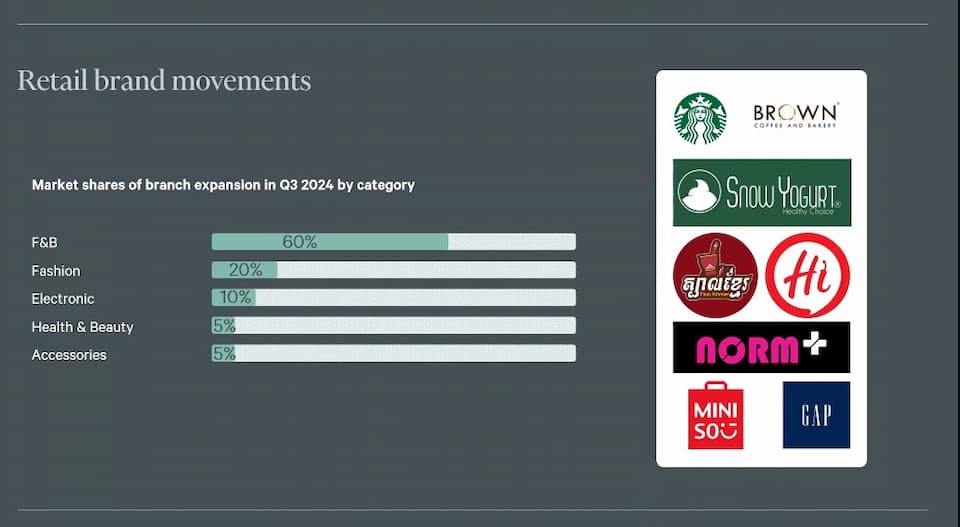

The Cambodian retail sector is expected to double compared to 2023 and there have been adjustments in the supply added in 2024 (769,000 sqm) and 2025 (862.000 sqm).

CBRE research indicated that there has been a slow absorption rate with occupancy dropping from 63 per cent in 2023 to 58 per cent in 2024. in addition, the rental adjustments have seen price drops in some segments such as podium and prime retail - with all segments seeing declines since 2020 but some are flat compared to 2023. F&B is the biggest component of retail.

In terms of trends, there has been greater flexibility from landlords in pricing and tenant mix and smaller retail projects are choosing specific target markets instead of competing with mass-market shopping malls said Kinkesa. Landlords used to be pickier with the brands but are now more flexible and there have been signs of bigger local brand expansions.

Cambodia Office Sector

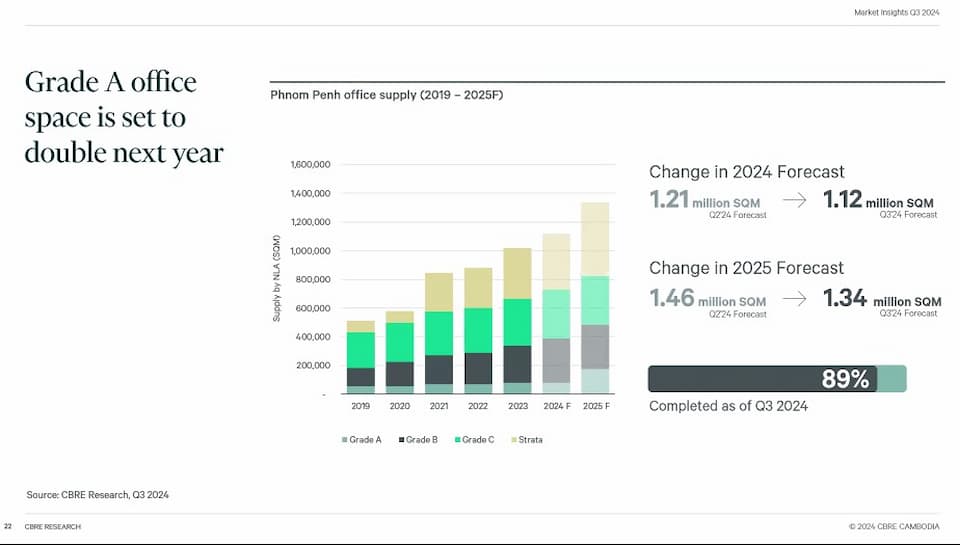

There has been a drop in supply and the forecast was reduced in the office sector in Cambodia with additional supply expected to be 1.12 million sqm in 2024 and 1.34 million sqm in 2025. There have been no new strata offices launched in 2 years in Cambodia.

Grade A offices have seen moderate growth, while overall occupancy growth is moderate to flat and overall there are suppressed prices - only grade B offices in the Phnom Penh CBD increased slightly.

In the region, it was noted that cost factors were the biggest concerns followed by location and employee experience to renew leases.

This sector has also seen more flexibility from the landlords who are offering concessions, and better maintenance, as well as being more open to rate negotiations.

Cambodia Hospitality Sector

In 2024, there will be no new 5-star hotels launched in Cambodia, with a total of 9,800 keys in 4-syar hotels in the Cambodian capital and 4,200 keys in 3-star hotels. (We did ask how the ratings were assessed but no answer was provided at the time).

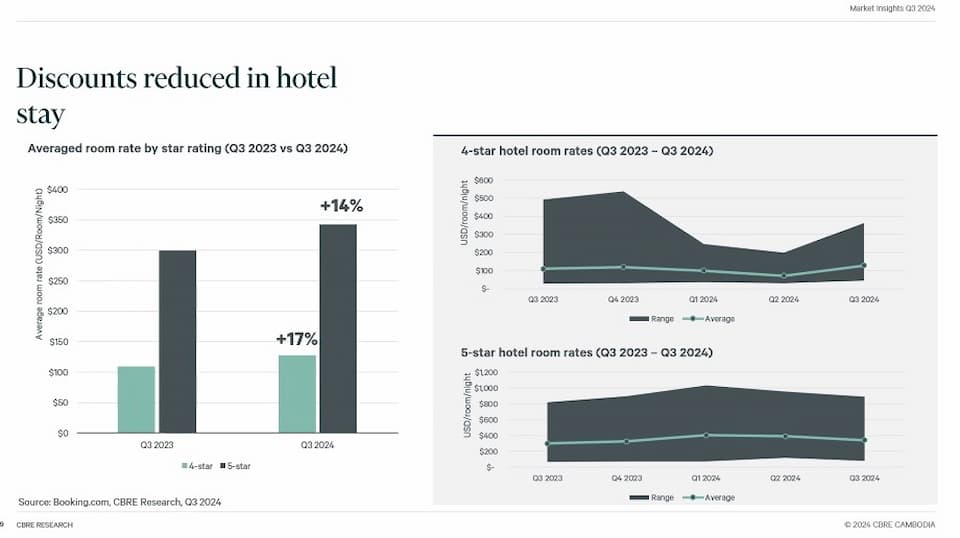

The average room rate pricing increased in Phnom Penh for 5 and 4-star bookings and the pricing between Ho Chi Minh City, Bangkok and Phnom Penh at the top end are all similar.

Of concern is that more hotel chains are considering offloading portfolios in favour of liquidation for cash, said Channdara Latt of CBRE. One additional interesting note was that there has been an increase in ‘condotels’ influencing the market - with condos' operating day stays competing with hotels.

Cambodia Residential Sector

The growth of condo project completion in the Cambodian residential property market is slower in 2024 and there have been no “big launches in 2 years.” Although supply is slowing, Latt said this is a positive as demand will take up excess supply in the market.

2024 has also seen the slowest condo launches since 2019, and these have dropped every year since the pandemic by ten per cent and are at the lowest since 2014.

For landed property, the growth is also down and is seeing the same output in 2024 as in 2019. There have been minor adjustments on pricing - but not much movement or new supply.

Regionally, there has been a surge in demand in the residential sector but these have been attracting purpose-built student housing and specialized projects, for example.

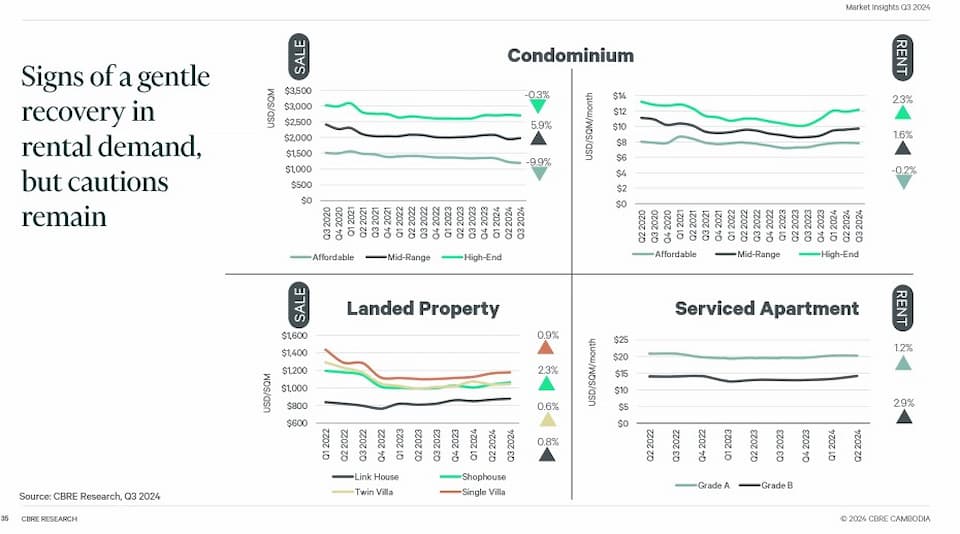

Pricing-wise there has been a drop off in the high-end condos and a small increase in mid-range condos in Phnom Penh, while the rental market has experienced a slight uptick for all categories except the affordable range. Serviced apartment rents are also slightly up in 2024 Y-o-Y.

In the ensuing Q&A session online, CBRE said they are seeing an increase in the leasing market but they don't have actual occupancy data for the condo market.

The same advice we have heard from other property experts in Cambodia was reinforced, that location is still key and true to the property market in Cambodia or anywhere - the project offering, price, and developer profile are key considerations.