CBRE Cambodia Real Estate Mid-Year Review 2024

CBRE Cambodia recently hosted its ‘Phnom Penh Mid-Year Review 2024’ and launched the real estate report covering the first six months by presenting the latest developments in the current Cambodian real estate market.

The property firm also released their report in 2023 and again provided coverage across the same categories: office, retail, condominiums, landed properties as well as industrial and logistics.

During the event held in Phnom Penh in July 2024, the audience heard presentations from CBRE’s Kinkesa Kim (Managing Director) and Chandara Latt (Manager). This was followed by a panel discussion featuring Youdy Bun (Founding Partner of Bun & Associates), and Ramzi Sharif (Chief Risk Officer of Maybank Cambodia Plc.)

This article is based on the recent report and input from the event’s speakers.

Cambodia Real Estate Market Overview H1 2024

CBRE said before the event, “As Cambodia's capital continues to evolve as a key regional hub, this exclusive gathering will delve into comprehensive insights and analyses of Phnom Penh's development landscape, economic resilience, and transformative urban initiatives.”

They reported that Cambodia's construction sector saw a potential revival despite a sluggish performance in Q1 2024. According to the Ministry of Land Management, Urban Planning and Construction (MLMUPC), there were 830 construction projects approved in Q1 2024, while In 2022 and 2023, there were 4,275 and 3,207 projects respectively.

For the first half (H1) of 2024:

- Cambodia's office occupancy rate was 61.8 per cent, and the retail occupancy rate was 58.7 per cent.

- There was a new supply of 2,200 condominium units launched.

- The industrial and logistics real estate sector saw 120 hectares of new launches.

In terms of movements towards construction and energy sustainability, the number of Leadership in Energy and Environmental Design (LEED) Certified Projects for the region showed that Cambodia had only 28 such projects, compared to 306 in Singapore, 589 in Vietnam, and 603 in Thailand, according to data from the U.S. Green Building Council.

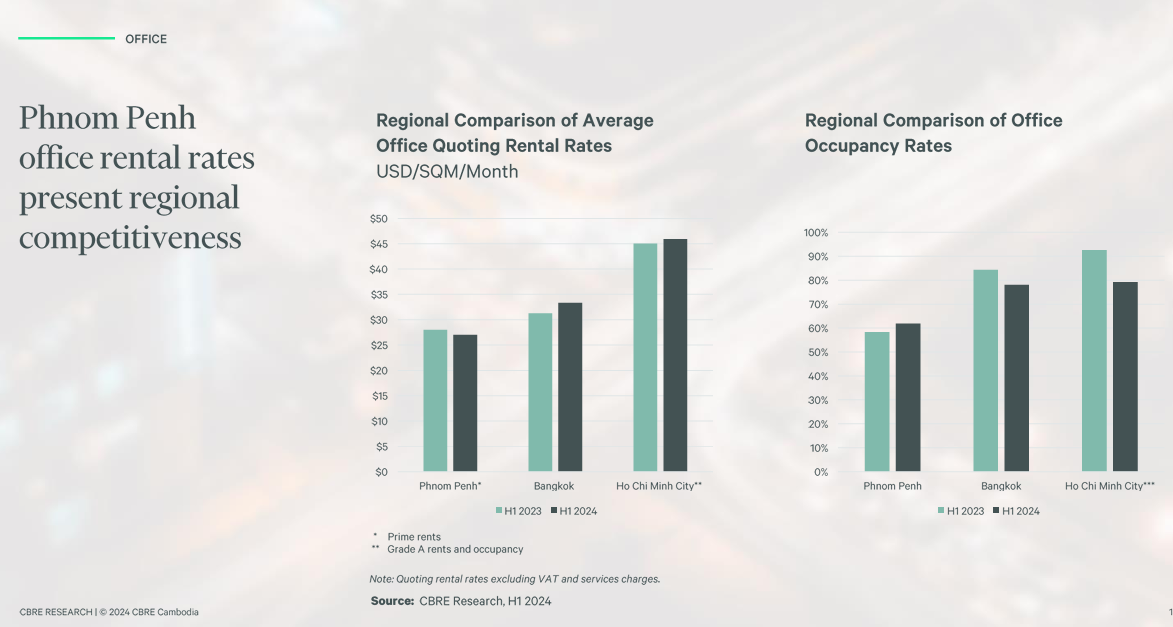

Office Rental Rates & Occupancy In Phnom Penh, Cambodia - Steady Growth In H1 2024

According to CBRE’s research, Cambodia's rental rates and office occupancy rate compared favourably to Vietnam and Thailand. Office rental occupancy in Cambodia was 61.8 per cent, while in Bangkok it was nearly 80 per cent and in Ho Chi Minh it was 80 per cent. For reference, in the CBRE 2023 mid-year report, rental occupancy in the Cambodian capital was 58.3 per cent.

CBRE added that the supply of office space for rent continues to grow in Cambodia, with some pre-lease commitments and just over a third (35 per cent) of the total supply is expected to be Strata-titled by the end of 2024.

Comparing rental rates excluding Value Added Tax (VAT) and service charges, Cambodia's rental cost per square meter (sqm) decreased for the first half of 2024 compared to the same period in 2023, with the current price range between USD $25-30/sqm. In contrast, Bangkok and Ho Chi Minh City rental prices increased compared to H1 2023; Bangkok's price range exceeds USD $30-35/sqm, while Ho Chi Minh City's average price was above USD $45.

This indicates that the Cambodian office market is experiencing steady growth, with increasing supply and occupancy rates, although still lagging behind the higher occupancy levels seen in other regional cities.

The office supply in Cambodia is expected to increase by 198,000 square metres in 2024, with 31 per cent of this new supply already completed in the first half of the year.

Recent office projects in Cambodia include the completed Versailles Square, Maline Office Park, the upcoming Chief Tower, and the General Department of Taxation ‘Tax Tower’ project.

Lower Cost In Phnom Penh’s Office Rental Rates In 2024

The mid-year review explained that the rental rates are approaching the bottom line and expected to hover. Grade A and Grade B office rental prices were above USD $20/sqm, while Grade B (NCBD) and Grade C (CBD & NCBD) were around USD $15/sqm or less. In H1 2023, Grade A office rental prices were USD $26.5/sqm.

Growth rate half-over-half (H-o-H) for office rental in :

- Grade A office price remains flat in H1 2024

- Grade B (CBD) was down 4.7 per cent

- Grade B (NCBD) was up 6 per cent

- Grade C (CBD) was up 1.4 per cent

- Grade C (NCBD) was down by 3.2 per cent

Phnom Penh’s Retail Real Estate - Challenges Remain In H1 2024

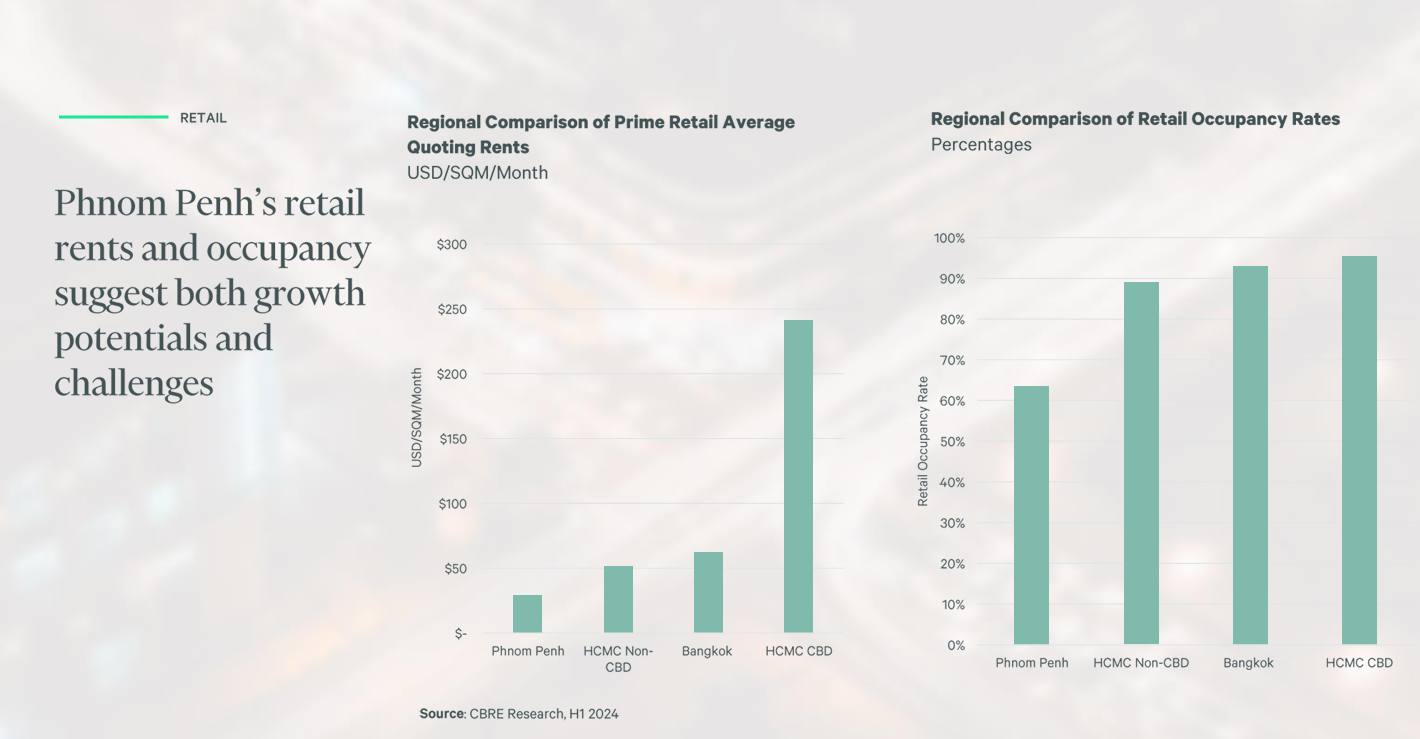

Phnom Penh's retail rents and occupancy rates suggest both growth potential and challenges, as they both remain lower compared to major cities in Vietnam and Thailand.

Regarding retail supply and occupancy, the CBRE report showed that the delayed openings persisted due to sluggish take-up. For H1 2024, the average occupancy rate for retail real estate was 58.7 percent (compared to 68.5 per cent in H1 2023), and 45 percent of the current supply is shopping malls in Phnom Penh. Meanwhile, the food and beverage (F&B) sector continued to see new brand entries and expansions.

Compared to major regional cities regarding occupancy rates, Phnom Penh's retail real estate occupancy was slightly above 60 per cent, whereas Ho Chi Minh City's Non-CBD was nearly 90 per cent, and Bangkok and Ho Chi Minh City's CBD both exceeded 90 per cent.

In terms of rental rates per square metre, Phnom Penh was approximately USD $25, while Ho Chi Minh City (Non-CBD) was USD $50, Bangkok was above USD $50, and Ho Chi Minh City's CBD was approaching nearly USD $250.

This data suggests that while Phnom Penh's retail sector remains more affordable compared to some regional cities, it faces challenges in occupancy rates, potentially indicating room for growth and development in the Cambodian retail market.

U Mall was the most recently completed retail project in Phnom Penh and there are a few upcoming projects such as the 60M Community Mall, The Peak, and GDT Tower (Retail).

Condominium Real Estate In Phnom Penh - 14,000 Units Expected To Be Added By The End Of 2024

Cambodia's condominium market has seen a slowdown in new launches in H1 2024, with 2,200 units launched during H1 2024, ranging from affordable to mid-range projects including Times Square 7, Capital Center City, and L Tower TPP. There were no high-end condominium launches during this period.

Of the existing under development projects, there were more completions, and the condominium supply increased during the first six months of 2024, with 2,400 units completed, or 18 per cent of the total 14,000 units expected by the end of 2024. Two recently completed projects are Royal Platinum and TV Tower One, while City View Residence and Vue Aston are upcoming.

CBRE Cambodia mid-year 2024 research showed that Cambodia’s condominium price half-over-half (H-o-H) for the affordable and mid-range types were down respectively by 9.9 and 5.9 per cent, while high-end condominium prices were up 0.3 per cent.

The report emphasised that the opportunities lie amid the challenges as Phnom Penh city offers the lowest sale price (USD $2,500/sqm) for condominiums and offers the highest rental yield (5.3 per cent) over other cities in Asia such as Bangkok, Hong Kong, Ho Chi Minh, Manila, and Singapore.

Landed Property Market In Cambodia

During the first half 2024, new landed property launches experienced a slowdown, while the completions from the pipeline continue. CBRE Cambodia’s review indicated there were 29 landed property projects completed in H1 2024 and affordable types made up 49 per cent, followed by mid-range (44 per cent) and high-end (7 per cent).

In their research outlook, it was also mentioned that Cambodian landed property developers are reluctant to launch new projects, and instead chose to extend the existing ones.

Industrial and Logistics Real Estate

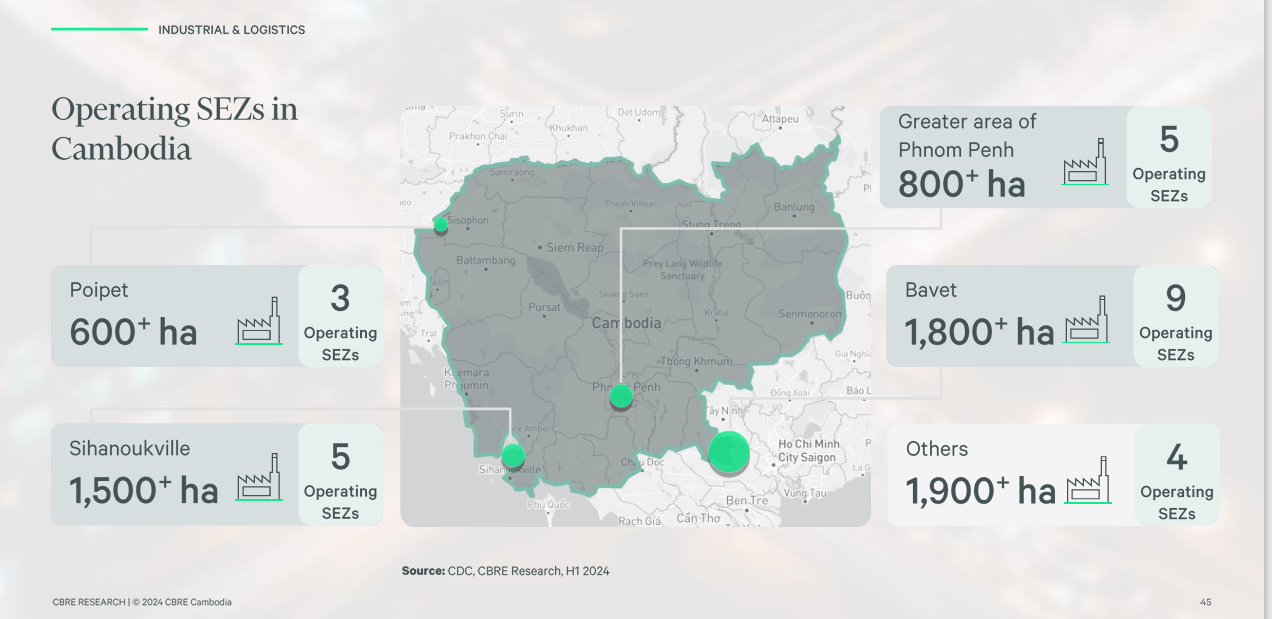

In 2021, it was reported that Cambodia had 54 Special Economic Zones (SEZs). However, according to the new CBRE Cambodia report for H1 2024, there are currently only 26 operating SEZs in four major cities:

- Bavet City, bordering Vietnam, has 9 operating SEZs.

- The greater area of Phnom Penh and Sihanoukville each have 5 operating SEZs.

- Poipet, at the Thai border, has 3 operating SEZs, with 4 additional SEZs in other locations.

According to CBRE Cambodia, from 2019 to H1 2024, the average 50-year land lease increased by 12.1 per cent from USD $54.4 to USD $61 per sqm and ready-built -factories within SEZ rental was down by 6.2 per cent from USD $3.2 to USD $3 per sqm.

Prospect Of Cambodia’s Real Estate Recovery

Manufacturing is the main driver in the commercial property sector while the production and exports of apparel (textiles, garments and footwear) remains in the top spot.

The Cambodian government has also been promoting the industrial sector to boost investment and sector growth but more needs to be done in ease of doing business and trade competitiveness.

During the CBRE panel, it was mentioned that there is still uncertainty on when Cambodia's real estate sector will recover, and more loans are being rejected for certain real estate borrowing. However, as the sector tends to be cyclical, panellists suggested there are reasons to be positive about the sector.

_20240718_164254.jpg)

Chandara stated that the recovery of Cambodia's real estate sector depends on the growth of the country's key industries, such as trade (including imports and exports), retail, tourism, and other core productive sectors. He believes that once these sectors start growing again, their positive impact will be felt in the real estate market within six months to a year.

Ramzi emphasised that real estate in Cambodia will take more time to recover, and during this time, the banks will also need to pivot and adjust to market conditions.

He also added that Cambodia's economy should be further diversified and that the sectors in Cambodia need to grow, as they cannot be so concentrated anymore and the Kingdom can not just be relying on tourism, or garments & textiles alone - there needs to be a focus on a broader agenda.