Can Cambodia Hit Its EV 2050 Targets?

Although Tesla has been the darling of the EV (Electric Vehicle) market for some years, the American Elon Musk-founded firm is seeing increased pressure from the Chinese EV market, which is seeing greater penetration into Europe, the US, and emerging markets due to their lower price points and improved quality as well as enhanced fuel efficiency.

With Cambodia's close economic relationship with China, can the Kingdom expect to see more Chinese EV brands enter the market and are the government's EV goals achievable?

According to the Cambodian Ministry of Public Works and Transport, 604 new EVs were registered in the Kingdom in 2024, this is compared to just 5 registered EVs in 2020.

Some of the most popular electric vehicle brands available in Cambodia include VinFast, Tesla, BYD, Hongqi, Levdeo, Letin, Foton, and Wuling. These brands have established showrooms and retail outlets in the country, showcasing a variety of electric vehicles to meet the growing demand for EVs.

Hongqi New Energy, a sub-brand under Hongqi, announced that its new Hongqi EH7 electric sedan will be launched on March 20th, 2024 in China but this is just one of dozens of models boasting improved specifications at lower price tags that are expected to hit the market in 2024.

BYD now leads in the region for EV sales and accounts for more than 25 per cent of sales in the Southeast Asian market. China’s EV sales growth is anticipated to be 25 per cent in 2024 which is impressive albeit lower than the 35 per cent in 2023, and a combined total of approximately 185 new EV models are set to go on sale in 2024.

Cambodian EV Registrations

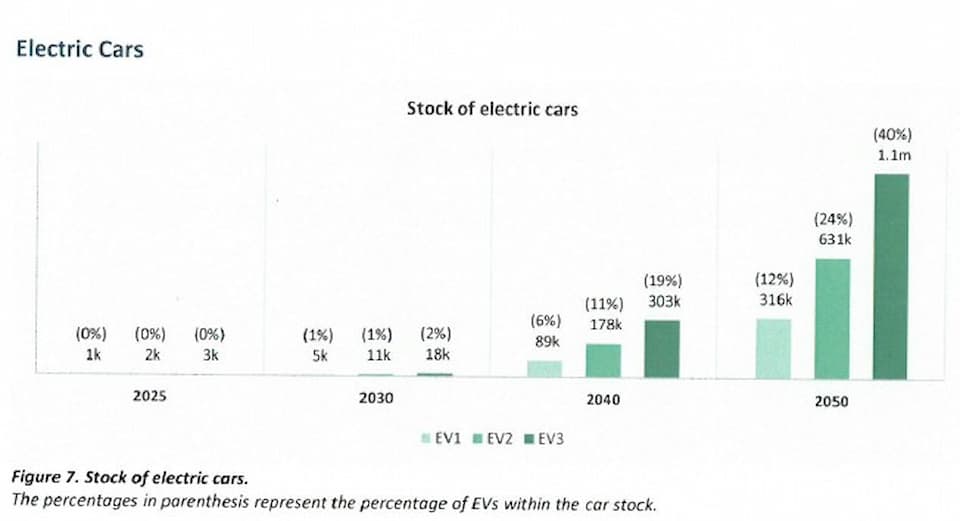

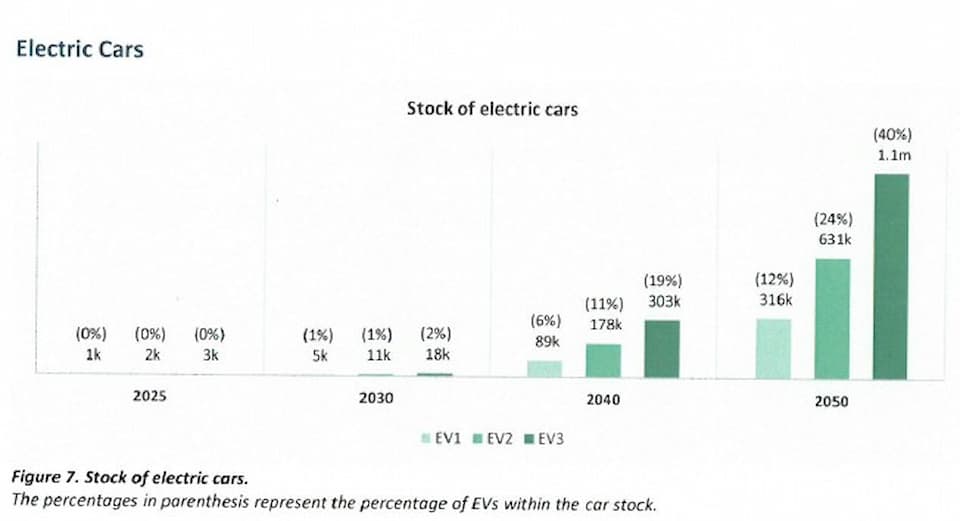

There seems to be a healthy demand for Electric Vehicles in Cambodia - most Cambodians (94.41%) indicated in the Standard Insights 2023 Consumer Report that the future of automobiles lies in electric vehicles (EVs). The Cambodian government also set a target of having 40 per cent of EV cars and 70 per cent of electric motorbikes by 2050 as part of its goals to reduce carbon emissions.

Although the total below is just over 1,300 EV vehicles, and based on reports from the Ministry of Public Works and Transport, they have also separately indicated that there were 1,489 EVs in the country (including 683 four-wheeler EVs and 410 three-wheeler EVs) as of December 2023.

Cambodian EV registrations per year:

- 2020: 5

- 2021: 63

- 2022: 663

- 2023: 604

The Cambodian government's strategic policy is to transform Cambodia into a regional and global production hub for automotive and electronic components. As a result, they reduced import duties on EVs since 2021 to about 50 per cent lower than taxes on traditional internal combustion engine vehicles.

However, there were 652,163 new licensed vehicles in Cambodia in 2023, and there are a total of 7.56 million registered vehicles in Cambodia in 2024 (including 6.14 million motorcycles) - so there is a long way to go to try and reach the EV goals over the next 16 years.

Based on the 2050 targets (and using only current 2024 vehicle registration numbers), Cambodia would need to see an additional 2,800,000 EVs by 2050 which doesn't seem realistic (this equates to sales of over 190,000 EVs per year by 2050)!

Cambodian EV Developments

- 2021 - Cambodia reduced import duties on electric vehicles in 2021 to about 50% lower than taxes on traditional internal combustion engine vehicles

- 2021 - Tesla opened its first dealership in Cambodia.

- May 2023: An electric mobility manufacturing factory started operations in Kandal.

- December 2023: AION Cambodia's new Y Plus car was launched.

- February 2024: BYD Cambodia and Harmony Auto launched EV showrooms in the City Mall and the Chip Mong Mall 271 in Phnom Penh.

EV Taxi Services In Cambodia

In February 2022, the first few hundred electric three-wheeler tuk-tuks from ONiON T1 were assembled in the Kingdom by ONiON Mobility – which was established by Singapore-headquartered MVL.

In Q4 2023, VinFast, a Vietnamese EV manufacturer part of Vingroup, outlined its intention to expand across Southeast Asia, and had planned to enter the Cambodian market - however, public backlash meant Cambodian Prime Minister Hun Manet did not approve Vingroup’s operation in Cambodia, addressing the public’s apprehensions.

EV Charging Stations Network Infrastructure - Cambodia

One of the biggest obstacles to EV adoption globally has been the distance the EV vehicles can cover and the availability of EV charging stations. The comparatively small size of Cambodia means the establishment of a suitable network should be feasible, but this is also countered by the relatively high costs of electricity in the Kingdom.

One of the biggest obstacles to EV adoption globally has been the distance the EV vehicles can cover and the availability of EV charging stations. The comparatively small size of Cambodia means the establishment of a suitable network should be feasible, but this is also countered by the relatively high costs of electricity in the Kingdom.

The Ministry of Public Works and Transport (MPWT) has encouraged Cambodian fuel station operators to install EV charging stations at selected locations as well as develop licensing requirements for firms wanting to establish independent charging stations in Cambodia.

According to the UNDP, the Cambodian Roadmap for the Development of an EV Charging Stations Network goals are:

- To assess the need for charging stations in coherence with the EV market projections

- Set priorities for infrastructure development

- Identify the regulatory framework with recommended actions

- Assess financial and capacity-building needs.

By the start of 2024, there were only EV charging stations available at 18 locations across the whole of Cambodia. Rohan Patel, senior public policy and business development executive at Tesla, said in an online social media post; "Southeast Asia will undoubtedly be a major place of growth over the coming years in battery storage and electric vehicle adoption."

Charge+ Cambodia launched operations in the Kingdom in Q3 2023 and has ambitious plans to install 4,000 charging points across Cambodia by 2030. The Singaporean company is also offering its services in other regional countries – they plan to connect 5,000 kilometres across five ASEAN countries by using Charge+ charging stations and apps. This charging network would be the longest in ASEAN, and one of the longest globally.

This EV Cambodia Strategy (EVCS) document suggests that one EV charging station is generally required for every 10 EVs - currently, the ratio in Cambodia is 1:83.

The EVCS roadmap indicated that between 10,000-33,000 charging stations will be required nationally by 2050 - which the document suggests will require an investment of USD $160-575 million. This is indeed a substantial investment to fulfil the expansion to accommodate Cambodia's commitments.

Furthermore, EV battery disposal facilities and a means of recycling would also need to be established to keep up with the targets and EV growth. However, this is true globally and within Southeast Asia - the region requires a projected USD $2.8 trillion in infrastructure investments by 2030 to fuel economic growth and China could align its BRI (Belt & Road Initiative) to include EV infrastructure which would help make the region a top destination for Chinese EVs.

The demand is there - in Q2 2023, the total EV sales in Southeast Asia experienced year-on-year growth of 894 per cent, which was the highest globally. The Diplomat reported that Vietnam, the Philippines, and Indonesia, have set ambitious targets and policies to be a manufacturing hub for EVs over the next decade.

The Cambodian government has also encouraged investments in EV assembling plants. Simultaneously, the Chinese EV manufacturers are looking for other destinations to produce their cars and with Southeast Asia governments enticing their expansion with tax incentives and subsidies, this is something Cambodia can also offer via its Special Economic Zones.