The real estate market in Cambodia has experienced significant challenges in recent years, particularly in the post-COVID context. This period of uncertainty has been marked by slower activity, price corrections, and a broad market reset across most sectors. However, signs of stability are beginning to emerge in certain areas of the market.

Taking a deep dive into the ins and outs of Cambodia’s condominium market specifically, Realestate.com.kh (REAKH) has published a comprehensive Investment & Market Analysis report looking at the dynamics, trends, and opportunities the market offers, separate from the broader real estate landscape.

According to REAKH, the insights in the report are grounded in real transactional data and on-the-ground market activity, offering a strong and credible foundation to assess market movements, buyer behavior, and emerging trends.

“Buyers today are more careful and better informed. They have a clearer sense of what’s available, what’s truly in demand, and what to avoid,” Sotha Vatey, Sales Director at REAKH, is quoted saying in the report. She explains that the market’s underperformance has made buyers more cautious about committing to a condominium project.

As a result, leading developers have been pushed to respond with smarter product offerings, better designs, and more flexible payment plans, with the focus shifted to making property ownership in Cambodia more accessible. For example, some now offer longer terms – with up to 50 per cent of payment due only at completion – easing buyer risk during construction, and helping build confidence, while others have adjusted their pricing models to appeal to a broader pool of buyers, targeting both local customers and overseas investors seeking affordable opportunities.

Overall, the emphasis on livability and lifestyle has also increased, with developers expanding their amenities beyond the standard pool and gym, and beginning to incorporate co-working spaces, libraries, gardens, cafés, restaurants, and more.

“It’s no longer just about offering a place to live – it’s about delivering a complete, engaging living experience that captures the buyer’s imagination and sets new standards for urban living,” said Vatey.

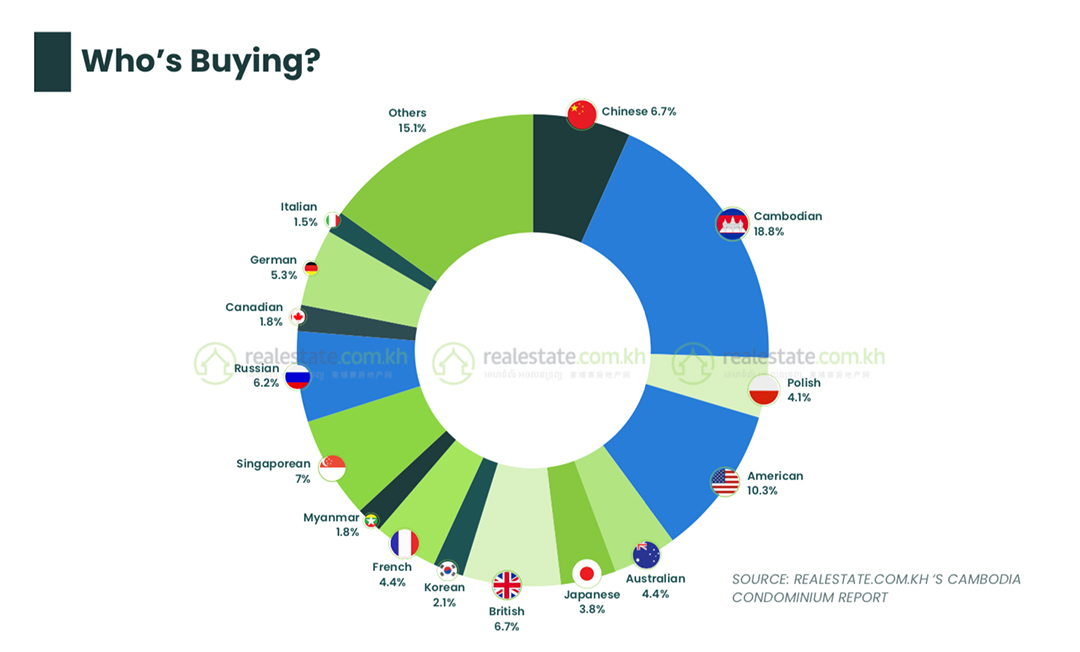

Who’s Buying Condominiums in Cambodia?

REAKH state that the Cambodian condo market has historically been driven by foreign investment, and this trend continues to be true based on the latest data collected.

The largest groups of international buyers hail from:

- The United States (10.3 per cent)

- Singapore (7 per cent)

- The United Kingdom (6.7 per cent)

- China (6.7 per cent)

At the same time, there has been growing local participation observed, with Cambodian buyers now making up 18.2 per cent of the market. This suggests an increase in buyer confidence for the condo segment, which REAKH say is likely driven by rising incomes, urbanisation, and shifting lifestyle preferences.

What Types of Condo Units Do Buyers Prefer in Cambodia?

One-bedroom units seem to dominate buyer preference, making up 61 per cent of the total unit mix in Phnom Penh, due to their affordability, ease of rental, and strong appeal to singles and couples.

This is followed by:

- Two-bedroom units (20.5 per cent)

- Studio rooms (10.1 per cent)

- Three-bedroom units (8.4 per cent)

The report notes that there is a noticeable lack of supply of centrally located three-bedroom units for rent, which presents a growing opportunity as demand rises among expat families.

Watch Part 2 of O'Sullivan's interview on REAKH's condominium report:

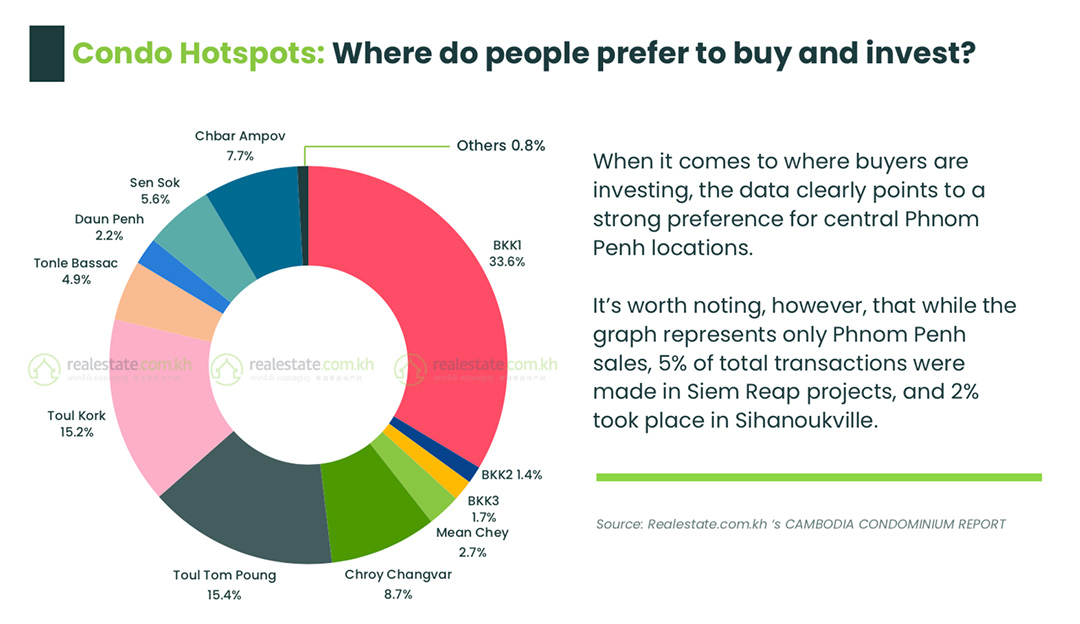

Condo Hotspots: Where Are People Buying and Investing?

A strong preference for central Phnom Penh locations is evident in the data, with Boeung Keng Kang 1 (BKK1) appearing to be the most popular, making up 33.6 per cent of the total unit mix in Phnom Penh.

Other popular neighbourhoods include:

- Tuol Tom Poung (15.4 per cent)

- Toul Kork (15.2 per cen)

- Chroy Changvar (8.7 per cent)

- Chbar Ambov (7.7 per cent)

- Sen Sok (5.6 per cent)

The report notes that while most of this data is Phnom Penh-centric, 5 per cent of total transactions recorded by REAKH were made in Siem Reap, and 2 per cent in Sihanoukville.

For more detailed insights on Cambodia’s condominium market, including a breakdown of the condo rental market, read the full Realestate.com.kh report at the following: LINK.